Authored by Ven Ram, Bloomberg cross-asset strategist,

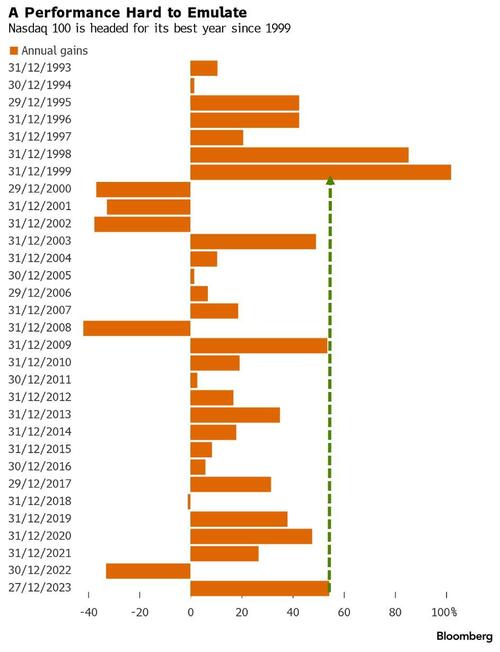

The Nasdaq has been the gift that’s kept giving this year, but stiff valuations pose headwinds in 2024 even though the Fed is set to cut rates.

Techonology stocks haven’t had this good a year since the days of the dotcom bubble, with the Nasdaq 100 having surged more than 54%.

However, there is something to be said about stocks that are trading at an earnings yield of just about 3%.

While traders are understandably enthusiastic about the potential of artificial intelligence, there may soon come a point where they become more circumspect and less enamored about their growth potential.

By my calculations, the basket is now trading more than 30% above its value estimated as long-duration bonds.

So far, traders haven’t been unduly perturbed by those valuations, but higher and higher levels from here will get harder and harder to cling on to.

Authored by Ven Ram, Bloomberg cross-asset strategist,

The Nasdaq has been the gift that’s kept giving this year, but stiff valuations pose headwinds in 2024 even though the Fed is set to cut rates.

Techonology stocks haven’t had this good a year since the days of the dotcom bubble, with the Nasdaq 100 having surged more than 54%.

However, there is something to be said about stocks that are trading at an earnings yield of just about 3%.

While traders are understandably enthusiastic about the potential of artificial intelligence, there may soon come a point where they become more circumspect and less enamored about their growth potential.

By my calculations, the basket is now trading more than 30% above its value estimated as long-duration bonds.

So far, traders haven’t been unduly perturbed by those valuations, but higher and higher levels from here will get harder and harder to cling on to.

Loading…