Authored by Paul Frijters, Gigi Foster, and Michael Baker via The Brownstone Institute,

We know that the modern West has developed a jaw-dropping degree of totalitarianism, wherein the bureaucracies of the state and the corporate sector coordinate together to cripple humans outside their power networks and media channels. But what are the mechanics of this coordination?

To understand one of the games they play, consider the rise of measures and standards associated with DEI (Diversity, Equity, and Inclusion) and ESG (Environmental, Social, and Governance) – both occupants of a highly abstract thought dimension and the latter an especially incomprehensible word salad.

ESG as a phrase was coined in a 2006 United Nations report, gradually gaining adoption by private companies like BlackRock via the production of annual ESG reports. Governments then started supporting these voluntary efforts, and eventually began making them mandatory. Since early 2023, corporations in the EU have been compelled to report on ESG. Many US companies with subsidiaries in the EU must observe both US and European rules, and those in the Asia-Pacific region too are starting to follow the ESG reporting pantomime.

In brief, ESG originated at the level of the international and intellectual stratosphere and then grew, unchecked by tedious real-world constraints like scarcity and tradeoffs, as a kind of malignant joint venture between large government bureaucracies and large corporations.

This JV is a serious industry, offering lucrative money-making opportunities for consulting companies, fund managers, and assorted professionals who ‘help’ companies comply. Bahar Gidwani, co-founder of a company called CSRHub, a compiler and provider of ESG company ratings, estimates that the collection of ESG data alone is already costing companies $20 billion worldwide.

It is an expanding industry too, since the reporting requirements keep increasing: according to recent reports, the head of the US Securities and Exchange Commission estimates that the cost of ESG reporting by the companies it oversees could quadruple to $8.4 billion this year, primarily due to the introduction of more ESG requirements. And that’s just in the US.

Large reporting costs are easier for large companies to bear, which offers a clue to why they’re interested: this sort of burden, particularly when made compulsory by the state, helps them dominate their smaller competitors.

DEI is the younger brother of ESG. At present, DEI reporting is not yet compulsory, but about 16% of the biggest US firms have open DEI reports, and the DEI fad is growing, perhaps eventually to eclipse ESG. Just as with ESG, DEI originates from the grandiose world of fluffy abstractions, big corporations, and governments. Despite efforts to make it appear otherwise, it is not grassroots at all.

The Benign-Sounding Aims of ESG

ESG measures and reports are supposedly about gauging whether the activities of corporations are ‘sustainable,’ and especially whether companies are reducing their carbon footprints. DEI is about whether a company’s employment practices promote gender and race ‘equality,’ provide ‘safe spaces,’ and rely on global supply chains that adhere to ‘fair’ practices. Most reasonable people would agree that many of these stated goals sound worthwhile in principle. What is being advocated sounds caring and does not, on the face of it, appear to be destructive in any way.

Yet, talk is always cheap. How do these pretty ideas get operationalised when they confront the harsh reality of measurement?

Let us delve into a leading example from a company report.

Grab Holdings from Singapore

Many Asian companies are ensnared in the ESG compliance system because they are listed on Western financial exchanges. One such company is the Singapore-based ‘superapp’ Grab Holdings, listed on the Nasdaq. Its customers mainly interact with Grab Holdings via a mobile phone app, where they can buy many different services (food delivery, e-commerce, ride-hailing, financial services, etc.), hence the term ‘superapp.’

Grab is unprofitable but very visible. For the first half of 2023, it lost $398 million, on top of the $1.74 billion it lost in 2022. However, it operates in businesses — particularly food delivery and ride-hailing — with serious environmental and human impacts across a vast region encompassing 400 cities and towns in eight Southeast Asian countries. To anyone living where Grab operates, its fast-moving, green-helmeted motorcycle riders are as familiar as yellow taxis are to New Yorkers or red double-decker buses are to Londoners.

Grab’s business model is inherently not great for the safety of its drivers and the public. Grab uses routing and other technology to match riders with deliveries and to minimise both wait time for drivers and delivery times to customers. Scheduling is highly efficient because of the technology, which is to say that drivers are on tight schedules with razor-thin commissions.

To make a buck, the drivers for Grab (and its competitors) have to be brave and aggressive on the road. Some are real daredevils – the Evel Knievels of Southeast Asia – as we have personally witnessed. Not only that, but there is stiff competition in each of the markets in which Grab operates. Grab itself says that 72% of its five million drivers do double duty, performing both food deliveries and ride-hailing services. This makes the company a more efficient service provider across both cut-throat businesses and gives drivers the opportunity to earn more money.

Despite the fact that it doesn’t make a profit — at least not yet — Grab splashed out to produce an ESG report that in its last iteration (2022) was 74 pages long and almost as heroic as its drivers.

The introductory pages are taken up with the usual marketing talk, replete with large photos of company motorbike drivers grinning from ear to ear because, well, they are just so grateful to be part of such a great organisation. The uniforms in the photos are smart and clean, in contrast to the reality which is that the drivers’ green uniforms are almost always greasy and grubby and the drivers often look, understandably, stressed and morose.

Deeper into the ESG report, Grab gives us 5 pages on how admirably it is performing regarding road safety, 8 pages on greenhouse gas emissions, 1 on air quality, 4 on food packaging waste and 8 on inclusiveness.

Pantomime One: Road Safety

The part of the report on road safety is of special interest, since Southeast Asia’s roads have a deservedly deadly reputation for motorcyclists, and much of the mayhem is provided by the delivery drivers themselves. For example, one study in Malaysia reported that 70% of food delivery motorcyclists drivers broke traffic rules during delivery, and the kinds of violations covered the waterfront: illegal stopping, running red lights, talking on the phone while riding, riding in the wrong direction, and making illegal U-turns. The statistics on crashes involving these drivers make for grim reading.

Other studies based on rider surveys tell an even grimmer story. A 2021 survey of food delivery drivers in Thailand found that 66% of the more than 1,000 respondents had been in one to four accidents while working, with 28% reporting more than five. This squares with reputation: in countries like Thailand, where enforcement of traffic laws is the exception rather than rule, dangerous driving by two-wheelers is famously awful.

So it is with some surprise that one reads in Grab’s ESG report that there is only just under one accident for every million rides involving a Grab delivery driver. That is an incidence at least one hundred times lower than the incidence implied in self-reports. One may assume that many accidents involving delivery drivers are not reported to the company, particularly those involving no or minor injuries, or where the driver is concerned that he will lose his job.

This latter concern is not trivial, since Grab claims that it has a zero-tolerance policy toward violators of the company’s Code of Conduct, which includes failure to follow road rules. This means the count of accidents per ride is a shaky number at best. The report doesn’t really say where the company gets this number from, so it could well be made up out of thin air, though presumably whoever wrote it down had some rationale in mind. One might imagine something like “Sounds low, and dumb Westerners will believe it.”

Pantomime Two: Grab’s Strategy for Saving the Planet

After dispensing with the road safety issue, Grab’s ESG report moves on to how the company is saving the planet. The company’s greenhouse gas emissions rose during the course of the year because of ‘normalization’ after covid, but the report’s author disingenuously sidesteps the problem by saying that most of the emissions were made from vehicles that were owned by the ‘driver-partners’ rather than the company itself. So, with direct blame for GHG emissions dodged, the company’s priority is stated as to ‘support our driver-partners in transitioning to low emission vehicles and encouraging zero-emission modes of transport.’

It really isn’t clear how that fluffy ‘transition’ might come about, since conventional motorcycles are a cheap and convenient form of transport in Southeast Asia, easily outcompeting other available options for the coal-face work required by Grab’s business model. The report says it will encourage cycling, walking, and EVs. The first two are obviously out of the question in most instances for food delivery, and as for the third, for the overwhelming majority of two-wheeler drivers, upgrading to an EV is a pipe dream (or pipe nightmare, depending on how much they know about EV recharging, weight, and maintenance issues).

One of the beauties of Grab being a platform that connects eateries with drivers without actually operating restaurants itself is that – as with GHG emissions – food packaging waste isn’t really Grab’s direct responsibility. It is the responsibility of the restaurants and food manufacturers, like the owners of the factories that make all those nasty little sachets of ketchup, soy sauce, and other condiments.

Brilliant! With this sleight of hand squarely in frame, this part of the ESG report then writes itself as an exercise in hand-wringing, admitting with furrowed brow that food packaging waste is a serious problem, and stating that the company’s goal is ‘Zero packaging waste in Nature by 2040.’ Exactly what this means and how it is to be accomplished is shrouded in mystery, but to anyone whose beach holidays have ever been marred by the ugly sight of plastic litter on the shoreline, it sounds awfully good.

Pantomime Three: Equity, Diversity, and Inclusion

Most of this section of the report consists of descriptive marketing: saying all the right things and showcasing the occasional shining example, without getting into too much detail. The main statistics given are that 43% of Grab’s employees are women and 34% of those in ‘leadership positions’ are women. Well, maybe that could be true if one counts the few thousand direct employees, including a lot of secretaries, but omits the five million ‘driver-partners’ who are overwhelmingly male. The report also says that female employees earn 98% of what men do, which presumably means that the odd male secretary is treated just as badly as his female colleagues.

This section of the report showcases other inventive labeling. We are told the company has ‘Inclusion Champions,’ collectively a group of employees who ‘contribute to inclusion through crowdsourcing of ideas and on-ground feedback for better inclusion initiatives. They also help to identify and coach fellow Grab employees towards more inclusive behaviour, and will co-drive projects that help drive inclusion.’ Who knows what that really means? One might guess that ‘crowdsourcing ideas’ is the new term for having a suggestion box, and that pretty much every email sent by HR can be contrived to be a form of ‘inclusive’ coaching.

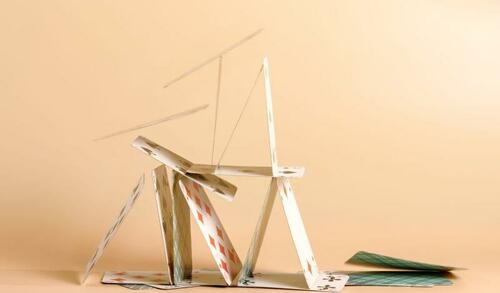

Grab’s report thus seems like it addresses ESG- and DEI-related issues, but no real-world mechanism ties them to actual outcomes, and there is no realistic external verification. Even seemingly simple things, like counting how much fuel a company buys directly for its processes and thereby estimating the size of its ‘carbon footprint,’ are like child’s play to game, as demonstrated by Grab’s masterly reporting: simply forcing workers and subsidiaries to buy their own fuel (compensated via higher wages or other things) will make the footprint of the company itself seem dramatically lower, while requiring nothing substantial to change. It’s all an elaborate show.

Who’s Asking for This Crap?

Though specious, unverifiable, and mostly made up, ESG reporting is a way to formally present a company’s ‘ESG performance.’ This performance can theoretically be ‘scored’ by some third party, and thereby compared with that of other companies. If ESG is valued highly by consumers, then companies that get high scores should attract a disproportionate amount of investment, meaning that their cost of capital will be lower than companies who don’t score so well – the magic through which a bullshit report is turned into a business opportunity.

This also makes delicious fodder for fund managers, who can bundle firms’ stock into ‘ESG funds’ or ‘sustainable funds’ or whatever, and charge investors fat fees for the privilege of investing in them. Fund managers also have another motivation to egg on more ESG reporting: their funds are designed not to green the world or make it a nicer place, but rather to highlight which companies will adapt best and thrive the most in a world where ‘progress’ toward ESG goals (for example, ‘net zero’) is actually being made.

How big is this market? According to Morningstar, by the end of the third quarter of 2023, global ‘sustainable’ funds numbered more than 7,600, of which nearly 75% were in Europe and 10% in the US. These funds had assets of $2.7 trillion. However, global inflows into these funds have been falling sharply since the first quarter of 2022. While they have still been attracting more inflows than non-sustainability funds in Europe, this is not true in the US. Amid waning interest in the US, fewer and fewer new ESG funds are being launched, and in 3Q2023 there were more ESG fund exits than new arrivals.

During the first two years of covid, American ESG stocks outperformed conventional stocks by a wide margin. This is not surprising since technology companies did rather well out of lockdowns, and they also have high ESG scores because of their lower carbon footprints than miscreant ‘old economy’ companies. Still, since the start of 2022, ESG stocks have fallen back and now are only just edging the market. Indicatively, in the seven quarters ending September 30, 2023, the S&P ESG Index was down 7.3%, while the S&P 500 was down 9.4%.

Importantly, many ESG fund investors themselves are government-type entities, like public pension funds, where the distance between investment decision and personal consequence is about as big as it gets. So often the ultimate payers for this circus are the general population whose pensions are, unbeknown to themselves, being used for virtue-signaling by public fund managers.

Who Wins and Who Loses?

Learning how to write up and cheat with these performance reports requires a lot of resources, but once a company antes up, the game becomes easy to play. ESG reporting is just one example of the broader reality that compliance with external bureaucracies requires largely a one-off fixed cost, and in this case the cost is often large enough to bankrupt a small firm. This means that, just as bizarre covid-era rules were a gift of competitive advantage to big companies, ESG and DEI reporting is a mechanism through which big companies can pressurise and even get rid entirely of smaller ones.

This, we think, is the reason why bullshit reporting is not getting pushback from the largest companies that don’t already have natural monopolies: plainly, it suits their purposes. They are big enough to absorb the cost without a major effect on the bottom line, and they are getting in return a stronger position in their markets. They naturally support the big bureaucracies that make these reports compulsory. Big consulting companies, and the aforementioned fund managers, also love the idea of compulsory reporting because it creates business for them.

On this very issue, Michael Shellenberger opined recently on Tucker Carlson’s channel that big traditional energy companies were led by cowards who had been “bullied into submission:” that the ESG movement had “used political activism and the pension funds to put pressure on the oil and gas industries to basically sell out their main product.” He called the ESG movement an “anti-human death cult” and asserted that “it’s finally becoming obvious to people that it’s a scam.”

On the lattermost point, we hope he’s right.

Yet, the scam is still spreading, as there are plenty more unproductive people eager to climb aboard. The push for companies to jump on the ESG reporting bandwagon is not confined to the West. Regulators in Asia are also pushing — harder in some countries, like Singapore, than in others — to make ESG reporting mandatory rather than optional. Sensing a huge opportunity to divert valuable resources their way, a posse of consulting firms are also coming after companies to advise them on how they can bridge the ESG gap with the more advanced West. Companies in Asia are starting to fall in line and dutifully churn out their ESG reports, breathing more life into the scam.

Will This Eventually Crash and Burn?

Hard-nosed managers of big firms understand that bullshit reporting requirements can be a source of competitive advantage, causing financial distress for their smaller competitors. What is in the whole charade for the state bureaucracy and the corporate bureaucracy is that it makes them seem virtuous while creating a huge fog of mystery about what they are actually doing, thereby providing both jobs and cover.

Like the woke movement, ESG and DEI are at heart parasitical developments, originating from a decaying West, championed by the useless and the clueless, and benefiting the shrewd and the corrupt.

Such malignancies weaken our society and should be discarded at the earliest opportunity. Much like Elon Musk showed the door to 80% of Twitter staff with no loss of functionality, and just as we have advocated previously that 80% of employment in ‘health’ professions is useless, so too do we think that firing all professionals whose primary business involves ESG and DEI can be done without any loss of functionality. We don’t think this will happen anytime soon.

If it were to happen, what would one do with all those unproductive workers who have been dining on the ESG/DEI word-salad gravy trains for months or years? Paying them to paint rocks for a while would at least get them out of the way. Better still, taking a cue from what the Ontario College of Psychologists has suggested recently for Jordan Peterson, these people could be taken into the field to help communities struggling with actual problems, involving actual trade-offs, as part of a reeducation and retraining program aimed at making them useful to their societies once again.

Authored by Paul Frijters, Gigi Foster, and Michael Baker via The Brownstone Institute,

We know that the modern West has developed a jaw-dropping degree of totalitarianism, wherein the bureaucracies of the state and the corporate sector coordinate together to cripple humans outside their power networks and media channels. But what are the mechanics of this coordination?

To understand one of the games they play, consider the rise of measures and standards associated with DEI (Diversity, Equity, and Inclusion) and ESG (Environmental, Social, and Governance) – both occupants of a highly abstract thought dimension and the latter an especially incomprehensible word salad.

ESG as a phrase was coined in a 2006 United Nations report, gradually gaining adoption by private companies like BlackRock via the production of annual ESG reports. Governments then started supporting these voluntary efforts, and eventually began making them mandatory. Since early 2023, corporations in the EU have been compelled to report on ESG. Many US companies with subsidiaries in the EU must observe both US and European rules, and those in the Asia-Pacific region too are starting to follow the ESG reporting pantomime.

In brief, ESG originated at the level of the international and intellectual stratosphere and then grew, unchecked by tedious real-world constraints like scarcity and tradeoffs, as a kind of malignant joint venture between large government bureaucracies and large corporations.

This JV is a serious industry, offering lucrative money-making opportunities for consulting companies, fund managers, and assorted professionals who ‘help’ companies comply. Bahar Gidwani, co-founder of a company called CSRHub, a compiler and provider of ESG company ratings, estimates that the collection of ESG data alone is already costing companies $20 billion worldwide.

It is an expanding industry too, since the reporting requirements keep increasing: according to recent reports, the head of the US Securities and Exchange Commission estimates that the cost of ESG reporting by the companies it oversees could quadruple to $8.4 billion this year, primarily due to the introduction of more ESG requirements. And that’s just in the US.

Large reporting costs are easier for large companies to bear, which offers a clue to why they’re interested: this sort of burden, particularly when made compulsory by the state, helps them dominate their smaller competitors.

DEI is the younger brother of ESG. At present, DEI reporting is not yet compulsory, but about 16% of the biggest US firms have open DEI reports, and the DEI fad is growing, perhaps eventually to eclipse ESG. Just as with ESG, DEI originates from the grandiose world of fluffy abstractions, big corporations, and governments. Despite efforts to make it appear otherwise, it is not grassroots at all.

The Benign-Sounding Aims of ESG

ESG measures and reports are supposedly about gauging whether the activities of corporations are ‘sustainable,’ and especially whether companies are reducing their carbon footprints. DEI is about whether a company’s employment practices promote gender and race ‘equality,’ provide ‘safe spaces,’ and rely on global supply chains that adhere to ‘fair’ practices. Most reasonable people would agree that many of these stated goals sound worthwhile in principle. What is being advocated sounds caring and does not, on the face of it, appear to be destructive in any way.

Yet, talk is always cheap. How do these pretty ideas get operationalised when they confront the harsh reality of measurement?

Let us delve into a leading example from a company report.

Grab Holdings from Singapore

Many Asian companies are ensnared in the ESG compliance system because they are listed on Western financial exchanges. One such company is the Singapore-based ‘superapp’ Grab Holdings, listed on the Nasdaq. Its customers mainly interact with Grab Holdings via a mobile phone app, where they can buy many different services (food delivery, e-commerce, ride-hailing, financial services, etc.), hence the term ‘superapp.’

Grab is unprofitable but very visible. For the first half of 2023, it lost $398 million, on top of the $1.74 billion it lost in 2022. However, it operates in businesses — particularly food delivery and ride-hailing — with serious environmental and human impacts across a vast region encompassing 400 cities and towns in eight Southeast Asian countries. To anyone living where Grab operates, its fast-moving, green-helmeted motorcycle riders are as familiar as yellow taxis are to New Yorkers or red double-decker buses are to Londoners.

Grab’s business model is inherently not great for the safety of its drivers and the public. Grab uses routing and other technology to match riders with deliveries and to minimise both wait time for drivers and delivery times to customers. Scheduling is highly efficient because of the technology, which is to say that drivers are on tight schedules with razor-thin commissions.

To make a buck, the drivers for Grab (and its competitors) have to be brave and aggressive on the road. Some are real daredevils – the Evel Knievels of Southeast Asia – as we have personally witnessed. Not only that, but there is stiff competition in each of the markets in which Grab operates. Grab itself says that 72% of its five million drivers do double duty, performing both food deliveries and ride-hailing services. This makes the company a more efficient service provider across both cut-throat businesses and gives drivers the opportunity to earn more money.

Despite the fact that it doesn’t make a profit — at least not yet — Grab splashed out to produce an ESG report that in its last iteration (2022) was 74 pages long and almost as heroic as its drivers.

The introductory pages are taken up with the usual marketing talk, replete with large photos of company motorbike drivers grinning from ear to ear because, well, they are just so grateful to be part of such a great organisation. The uniforms in the photos are smart and clean, in contrast to the reality which is that the drivers’ green uniforms are almost always greasy and grubby and the drivers often look, understandably, stressed and morose.

Deeper into the ESG report, Grab gives us 5 pages on how admirably it is performing regarding road safety, 8 pages on greenhouse gas emissions, 1 on air quality, 4 on food packaging waste and 8 on inclusiveness.

Pantomime One: Road Safety

The part of the report on road safety is of special interest, since Southeast Asia’s roads have a deservedly deadly reputation for motorcyclists, and much of the mayhem is provided by the delivery drivers themselves. For example, one study in Malaysia reported that 70% of food delivery motorcyclists drivers broke traffic rules during delivery, and the kinds of violations covered the waterfront: illegal stopping, running red lights, talking on the phone while riding, riding in the wrong direction, and making illegal U-turns. The statistics on crashes involving these drivers make for grim reading.

Other studies based on rider surveys tell an even grimmer story. A 2021 survey of food delivery drivers in Thailand found that 66% of the more than 1,000 respondents had been in one to four accidents while working, with 28% reporting more than five. This squares with reputation: in countries like Thailand, where enforcement of traffic laws is the exception rather than rule, dangerous driving by two-wheelers is famously awful.

So it is with some surprise that one reads in Grab’s ESG report that there is only just under one accident for every million rides involving a Grab delivery driver. That is an incidence at least one hundred times lower than the incidence implied in self-reports. One may assume that many accidents involving delivery drivers are not reported to the company, particularly those involving no or minor injuries, or where the driver is concerned that he will lose his job.

This latter concern is not trivial, since Grab claims that it has a zero-tolerance policy toward violators of the company’s Code of Conduct, which includes failure to follow road rules. This means the count of accidents per ride is a shaky number at best. The report doesn’t really say where the company gets this number from, so it could well be made up out of thin air, though presumably whoever wrote it down had some rationale in mind. One might imagine something like “Sounds low, and dumb Westerners will believe it.”

Pantomime Two: Grab’s Strategy for Saving the Planet

After dispensing with the road safety issue, Grab’s ESG report moves on to how the company is saving the planet. The company’s greenhouse gas emissions rose during the course of the year because of ‘normalization’ after covid, but the report’s author disingenuously sidesteps the problem by saying that most of the emissions were made from vehicles that were owned by the ‘driver-partners’ rather than the company itself. So, with direct blame for GHG emissions dodged, the company’s priority is stated as to ‘support our driver-partners in transitioning to low emission vehicles and encouraging zero-emission modes of transport.’

It really isn’t clear how that fluffy ‘transition’ might come about, since conventional motorcycles are a cheap and convenient form of transport in Southeast Asia, easily outcompeting other available options for the coal-face work required by Grab’s business model. The report says it will encourage cycling, walking, and EVs. The first two are obviously out of the question in most instances for food delivery, and as for the third, for the overwhelming majority of two-wheeler drivers, upgrading to an EV is a pipe dream (or pipe nightmare, depending on how much they know about EV recharging, weight, and maintenance issues).

One of the beauties of Grab being a platform that connects eateries with drivers without actually operating restaurants itself is that – as with GHG emissions – food packaging waste isn’t really Grab’s direct responsibility. It is the responsibility of the restaurants and food manufacturers, like the owners of the factories that make all those nasty little sachets of ketchup, soy sauce, and other condiments.

Brilliant! With this sleight of hand squarely in frame, this part of the ESG report then writes itself as an exercise in hand-wringing, admitting with furrowed brow that food packaging waste is a serious problem, and stating that the company’s goal is ‘Zero packaging waste in Nature by 2040.’ Exactly what this means and how it is to be accomplished is shrouded in mystery, but to anyone whose beach holidays have ever been marred by the ugly sight of plastic litter on the shoreline, it sounds awfully good.

Pantomime Three: Equity, Diversity, and Inclusion

Most of this section of the report consists of descriptive marketing: saying all the right things and showcasing the occasional shining example, without getting into too much detail. The main statistics given are that 43% of Grab’s employees are women and 34% of those in ‘leadership positions’ are women. Well, maybe that could be true if one counts the few thousand direct employees, including a lot of secretaries, but omits the five million ‘driver-partners’ who are overwhelmingly male. The report also says that female employees earn 98% of what men do, which presumably means that the odd male secretary is treated just as badly as his female colleagues.

This section of the report showcases other inventive labeling. We are told the company has ‘Inclusion Champions,’ collectively a group of employees who ‘contribute to inclusion through crowdsourcing of ideas and on-ground feedback for better inclusion initiatives. They also help to identify and coach fellow Grab employees towards more inclusive behaviour, and will co-drive projects that help drive inclusion.’ Who knows what that really means? One might guess that ‘crowdsourcing ideas’ is the new term for having a suggestion box, and that pretty much every email sent by HR can be contrived to be a form of ‘inclusive’ coaching.

Grab’s report thus seems like it addresses ESG- and DEI-related issues, but no real-world mechanism ties them to actual outcomes, and there is no realistic external verification. Even seemingly simple things, like counting how much fuel a company buys directly for its processes and thereby estimating the size of its ‘carbon footprint,’ are like child’s play to game, as demonstrated by Grab’s masterly reporting: simply forcing workers and subsidiaries to buy their own fuel (compensated via higher wages or other things) will make the footprint of the company itself seem dramatically lower, while requiring nothing substantial to change. It’s all an elaborate show.

Who’s Asking for This Crap?

Though specious, unverifiable, and mostly made up, ESG reporting is a way to formally present a company’s ‘ESG performance.’ This performance can theoretically be ‘scored’ by some third party, and thereby compared with that of other companies. If ESG is valued highly by consumers, then companies that get high scores should attract a disproportionate amount of investment, meaning that their cost of capital will be lower than companies who don’t score so well – the magic through which a bullshit report is turned into a business opportunity.

This also makes delicious fodder for fund managers, who can bundle firms’ stock into ‘ESG funds’ or ‘sustainable funds’ or whatever, and charge investors fat fees for the privilege of investing in them. Fund managers also have another motivation to egg on more ESG reporting: their funds are designed not to green the world or make it a nicer place, but rather to highlight which companies will adapt best and thrive the most in a world where ‘progress’ toward ESG goals (for example, ‘net zero’) is actually being made.

How big is this market? According to Morningstar, by the end of the third quarter of 2023, global ‘sustainable’ funds numbered more than 7,600, of which nearly 75% were in Europe and 10% in the US. These funds had assets of $2.7 trillion. However, global inflows into these funds have been falling sharply since the first quarter of 2022. While they have still been attracting more inflows than non-sustainability funds in Europe, this is not true in the US. Amid waning interest in the US, fewer and fewer new ESG funds are being launched, and in 3Q2023 there were more ESG fund exits than new arrivals.

During the first two years of covid, American ESG stocks outperformed conventional stocks by a wide margin. This is not surprising since technology companies did rather well out of lockdowns, and they also have high ESG scores because of their lower carbon footprints than miscreant ‘old economy’ companies. Still, since the start of 2022, ESG stocks have fallen back and now are only just edging the market. Indicatively, in the seven quarters ending September 30, 2023, the S&P ESG Index was down 7.3%, while the S&P 500 was down 9.4%.

Importantly, many ESG fund investors themselves are government-type entities, like public pension funds, where the distance between investment decision and personal consequence is about as big as it gets. So often the ultimate payers for this circus are the general population whose pensions are, unbeknown to themselves, being used for virtue-signaling by public fund managers.

Who Wins and Who Loses?

Learning how to write up and cheat with these performance reports requires a lot of resources, but once a company antes up, the game becomes easy to play. ESG reporting is just one example of the broader reality that compliance with external bureaucracies requires largely a one-off fixed cost, and in this case the cost is often large enough to bankrupt a small firm. This means that, just as bizarre covid-era rules were a gift of competitive advantage to big companies, ESG and DEI reporting is a mechanism through which big companies can pressurise and even get rid entirely of smaller ones.

This, we think, is the reason why bullshit reporting is not getting pushback from the largest companies that don’t already have natural monopolies: plainly, it suits their purposes. They are big enough to absorb the cost without a major effect on the bottom line, and they are getting in return a stronger position in their markets. They naturally support the big bureaucracies that make these reports compulsory. Big consulting companies, and the aforementioned fund managers, also love the idea of compulsory reporting because it creates business for them.

On this very issue, Michael Shellenberger opined recently on Tucker Carlson’s channel that big traditional energy companies were led by cowards who had been “bullied into submission:” that the ESG movement had “used political activism and the pension funds to put pressure on the oil and gas industries to basically sell out their main product.” He called the ESG movement an “anti-human death cult” and asserted that “it’s finally becoming obvious to people that it’s a scam.”

On the lattermost point, we hope he’s right.

Yet, the scam is still spreading, as there are plenty more unproductive people eager to climb aboard. The push for companies to jump on the ESG reporting bandwagon is not confined to the West. Regulators in Asia are also pushing — harder in some countries, like Singapore, than in others — to make ESG reporting mandatory rather than optional. Sensing a huge opportunity to divert valuable resources their way, a posse of consulting firms are also coming after companies to advise them on how they can bridge the ESG gap with the more advanced West. Companies in Asia are starting to fall in line and dutifully churn out their ESG reports, breathing more life into the scam.

Will This Eventually Crash and Burn?

Hard-nosed managers of big firms understand that bullshit reporting requirements can be a source of competitive advantage, causing financial distress for their smaller competitors. What is in the whole charade for the state bureaucracy and the corporate bureaucracy is that it makes them seem virtuous while creating a huge fog of mystery about what they are actually doing, thereby providing both jobs and cover.

Like the woke movement, ESG and DEI are at heart parasitical developments, originating from a decaying West, championed by the useless and the clueless, and benefiting the shrewd and the corrupt.

Such malignancies weaken our society and should be discarded at the earliest opportunity. Much like Elon Musk showed the door to 80% of Twitter staff with no loss of functionality, and just as we have advocated previously that 80% of employment in ‘health’ professions is useless, so too do we think that firing all professionals whose primary business involves ESG and DEI can be done without any loss of functionality. We don’t think this will happen anytime soon.

If it were to happen, what would one do with all those unproductive workers who have been dining on the ESG/DEI word-salad gravy trains for months or years? Paying them to paint rocks for a while would at least get them out of the way. Better still, taking a cue from what the Ontario College of Psychologists has suggested recently for Jordan Peterson, these people could be taken into the field to help communities struggling with actual problems, involving actual trade-offs, as part of a reeducation and retraining program aimed at making them useful to their societies once again.

Loading…