Authored by Gary Alexander via The Epoch Times,

On the winter solstice, the shortest day of the year, the Dow Jones Industrial Average closed at a record high (37,404), the S&P 500 neared an all-time high, and the Russell 2000 soared nearly 25 percent in under two months, so it’s natural to see spreading euphoria in such a grossly overbought market. Wall Street’s favorite trophy wife, Rosy Scenario, is once again showing her smiling face when it comes to predictions for the coming year. Alas, we always seem to mirror the recent past when projecting the year to come.

This is reflected in sentiment surveys. The Bears were roaring in October, but they are now hibernating. The Investors Intelligence Bull/Bear Ratio (BBR) is now over 3-to-1, while the AAII ratio is 2.66-to-1. Discounting the neutrals, bears accounted for only 18.1 percent in the Bull/Bear poll and 19.3 percent on the AAII ballot. That’s not extreme by historical standards, but it does show a plurality of Pollyannas out there.

Our favorite economist, Ed Yardeni, is clearly in the “Roaring 20s,” camp, as am I, but I’m also on record as saying that a lot depends on the 2024 election. After all, Calvin Coolidge won the 1924 election, and the Roaring 20s really began in 2025. There would have been no “Roar” without Cal and his pro-business administration, including Secretary of the Treasury Andrew Mellon. That is not the case with the current administration. We need a change. I have said that my main fear is that 2024 will turn out to be so good that we’ll forget to “vote for a change” next November, so that the same policies limiting growth will remain in effect for the next four years, restricting the long-term bull market and any Roar in these ‘20s.

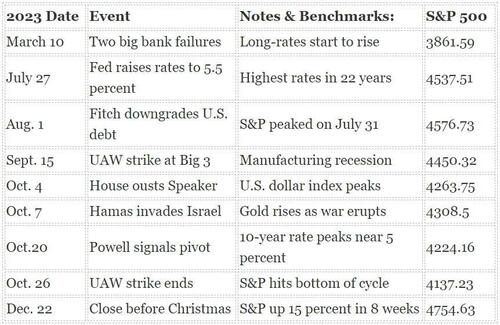

Also, we can look at all the positives in line for 2024 and forget that the Trickster will unveil several surprises. After all, we had several shocks in 2023 that interrupted an otherwise positive year—starting with the banking crisis in March, then the credit downgrade in July and the invasion of Israel in October.

The Biggest Market Shocks and Surprises of 2023

(Source: Yahoo! Finance; Bespoke Investment Group)

With the firm knowledge that we don’t know the future, let’s rehearse Ed Yardeni’s dozen bullish points:

Ed Yardeni’s Dozen (or More) Good Reasons for Expecting a Great 2024

(1) Interest rates are back to normal.

(2) Consumers have purchasing power.

(3) Households are wealthy and liquid.

Mr. Yardeni says, “The net worth of American households totaled a staggering record-high $151 trillion at the end of Q3-2023. A record $5.9 trillion is in money market mutual funds (MMMF) with a record $2.3 trillion in retail MMMFs. Commercial bank deposits in M2 totaled $17.3 trillion during the December 12 week. There are 86 million households who own their own homes, and 40 percent of them have no mortgages.”

That’s a ton of dry fuel to fund new market purchases in the coming year. The next six look solid, too:

(4) Demand for labor is strong. There are still 8.6 million job openings begging for willing workers.

(5) The onshoring boom is boosting capital spending and promising to end the manufacturing recession.

(6) Housing is set for a recovery due to the “plunge in mortgage interest rates since early November.”

(7) Corporate cash flow is at a record high—a record $3.4 trillion during the third quarter of 2023.

(8) Inflation is turning out to be transitory. The inflation of goods was back down to 0 percent in November.

(9) The High-Tech Revolution is boosting productivity in a trend Mr. Yardeni identified as starting in 2015.

The final reasons to be bullish are more defensive in nature, primarily arguing against the perma-bears:

(10) The Leading indicators are mostly misleading. The 10 leading economic indicators (LEI) have forecast a recession for a long time—a recession that has refused to arrive. One dominant example among the LEI is the “inverted yield curve,” which still prevails, due to the Fed fighting market rates—with their high short-term rates versus falling long-term rates. Mr. Yardeni argues that, “The LEI has misfired its recession signals because its composition is biased toward predicting the goods sector more than the services sector of the economy. There has been a rolling recession in the goods sector, but it has been more than offset by strength in services, nonresidential private and public construction, and high-tech capital spending.”

(11) The rest of the world’s challenges should remain contained. We already have two active wars, and we may see more, perhaps in Venezuela or China, but Mr. Yardeni argues that these threats are contained. “The wars between Russia and Ukraine, and between Israel and Gaza should remain contained regionally,“ he said. ”China’s economic woes reduce the chances that China will invade Taiwan. Nevertheless, these geopolitical hotspots will boost defense spending among the NATO members. The bursting of China’s property bubble should continue to weigh on global economic growth and commodity prices. China will remain a major source of global deflationary pressures. Europe is in a shallow recession and should recover next year as the European Central Bank lowers interest rates.”

(12) The Roaring 2020s will broaden the bull market, dodging a recession. The “soft landing” scenario is gaining traction as 2023’s AI-based rally broadens into several (virtually all) S&P sectors. Mr. Yardeni says, “We believe that reflects investors’ realization that the beneficiaries of the Roaring 2020s theme aren’t just the companies that make technology but also those that use it to boost their productivity.”

(13) How about all that government debt? This is my main concern. With the lowering of long-term interest rates, I’m afraid that gives Congress, the president, and most consumers and businesses a green light to keep running up more debt. Net interest paid on the federal debt reached a record high $716.7 billion in the 12 months ending Nov. 30. Mr. Yardeni argues that more federal spending will “stimulate onshore construction of manufacturing facilities” but I’ve always been skeptical of these “shovel-ready” federal boondoggles. Mr. Yardeni admits that too much federal debt could cause “an oversupply of Treasury bonds relative to demand, which could set off a debt crisis. And that certainly could trip up the Roaring 2020s scenario.” That remains my greatest concern—that all this anticipated good news will encourage more deficit spending and more voter apathy come next November, causing unsustainable future debt growth.

Enjoy a great growth year in 2024, but let’s not forget our responsibility to sustain that growth into 2025.

Authored by Gary Alexander via The Epoch Times,

On the winter solstice, the shortest day of the year, the Dow Jones Industrial Average closed at a record high (37,404), the S&P 500 neared an all-time high, and the Russell 2000 soared nearly 25 percent in under two months, so it’s natural to see spreading euphoria in such a grossly overbought market. Wall Street’s favorite trophy wife, Rosy Scenario, is once again showing her smiling face when it comes to predictions for the coming year. Alas, we always seem to mirror the recent past when projecting the year to come.

This is reflected in sentiment surveys. The Bears were roaring in October, but they are now hibernating. The Investors Intelligence Bull/Bear Ratio (BBR) is now over 3-to-1, while the AAII ratio is 2.66-to-1. Discounting the neutrals, bears accounted for only 18.1 percent in the Bull/Bear poll and 19.3 percent on the AAII ballot. That’s not extreme by historical standards, but it does show a plurality of Pollyannas out there.

Our favorite economist, Ed Yardeni, is clearly in the “Roaring 20s,” camp, as am I, but I’m also on record as saying that a lot depends on the 2024 election. After all, Calvin Coolidge won the 1924 election, and the Roaring 20s really began in 2025. There would have been no “Roar” without Cal and his pro-business administration, including Secretary of the Treasury Andrew Mellon. That is not the case with the current administration. We need a change. I have said that my main fear is that 2024 will turn out to be so good that we’ll forget to “vote for a change” next November, so that the same policies limiting growth will remain in effect for the next four years, restricting the long-term bull market and any Roar in these ‘20s.

Also, we can look at all the positives in line for 2024 and forget that the Trickster will unveil several surprises. After all, we had several shocks in 2023 that interrupted an otherwise positive year—starting with the banking crisis in March, then the credit downgrade in July and the invasion of Israel in October.

The Biggest Market Shocks and Surprises of 2023

(Source: Yahoo! Finance; Bespoke Investment Group)

With the firm knowledge that we don’t know the future, let’s rehearse Ed Yardeni’s dozen bullish points:

Ed Yardeni’s Dozen (or More) Good Reasons for Expecting a Great 2024

(1) Interest rates are back to normal.

(2) Consumers have purchasing power.

(3) Households are wealthy and liquid.

Mr. Yardeni says, “The net worth of American households totaled a staggering record-high $151 trillion at the end of Q3-2023. A record $5.9 trillion is in money market mutual funds (MMMF) with a record $2.3 trillion in retail MMMFs. Commercial bank deposits in M2 totaled $17.3 trillion during the December 12 week. There are 86 million households who own their own homes, and 40 percent of them have no mortgages.”

That’s a ton of dry fuel to fund new market purchases in the coming year. The next six look solid, too:

(4) Demand for labor is strong. There are still 8.6 million job openings begging for willing workers.

(5) The onshoring boom is boosting capital spending and promising to end the manufacturing recession.

(6) Housing is set for a recovery due to the “plunge in mortgage interest rates since early November.”

(7) Corporate cash flow is at a record high—a record $3.4 trillion during the third quarter of 2023.

(8) Inflation is turning out to be transitory. The inflation of goods was back down to 0 percent in November.

(9) The High-Tech Revolution is boosting productivity in a trend Mr. Yardeni identified as starting in 2015.

The final reasons to be bullish are more defensive in nature, primarily arguing against the perma-bears:

(10) The Leading indicators are mostly misleading. The 10 leading economic indicators (LEI) have forecast a recession for a long time—a recession that has refused to arrive. One dominant example among the LEI is the “inverted yield curve,” which still prevails, due to the Fed fighting market rates—with their high short-term rates versus falling long-term rates. Mr. Yardeni argues that, “The LEI has misfired its recession signals because its composition is biased toward predicting the goods sector more than the services sector of the economy. There has been a rolling recession in the goods sector, but it has been more than offset by strength in services, nonresidential private and public construction, and high-tech capital spending.”

(11) The rest of the world’s challenges should remain contained. We already have two active wars, and we may see more, perhaps in Venezuela or China, but Mr. Yardeni argues that these threats are contained. “The wars between Russia and Ukraine, and between Israel and Gaza should remain contained regionally,“ he said. ”China’s economic woes reduce the chances that China will invade Taiwan. Nevertheless, these geopolitical hotspots will boost defense spending among the NATO members. The bursting of China’s property bubble should continue to weigh on global economic growth and commodity prices. China will remain a major source of global deflationary pressures. Europe is in a shallow recession and should recover next year as the European Central Bank lowers interest rates.”

(12) The Roaring 2020s will broaden the bull market, dodging a recession. The “soft landing” scenario is gaining traction as 2023’s AI-based rally broadens into several (virtually all) S&P sectors. Mr. Yardeni says, “We believe that reflects investors’ realization that the beneficiaries of the Roaring 2020s theme aren’t just the companies that make technology but also those that use it to boost their productivity.”

(13) How about all that government debt? This is my main concern. With the lowering of long-term interest rates, I’m afraid that gives Congress, the president, and most consumers and businesses a green light to keep running up more debt. Net interest paid on the federal debt reached a record high $716.7 billion in the 12 months ending Nov. 30. Mr. Yardeni argues that more federal spending will “stimulate onshore construction of manufacturing facilities” but I’ve always been skeptical of these “shovel-ready” federal boondoggles. Mr. Yardeni admits that too much federal debt could cause “an oversupply of Treasury bonds relative to demand, which could set off a debt crisis. And that certainly could trip up the Roaring 2020s scenario.” That remains my greatest concern—that all this anticipated good news will encourage more deficit spending and more voter apathy come next November, causing unsustainable future debt growth.

Enjoy a great growth year in 2024, but let’s not forget our responsibility to sustain that growth into 2025.

Loading…