In the last five years, Tesla stock has exploded upwards more than 800%.

From a company that was perpetually on the verge of bankruptcy, Tesla has emerged as the EV manufacturer to beat in the automotive market.

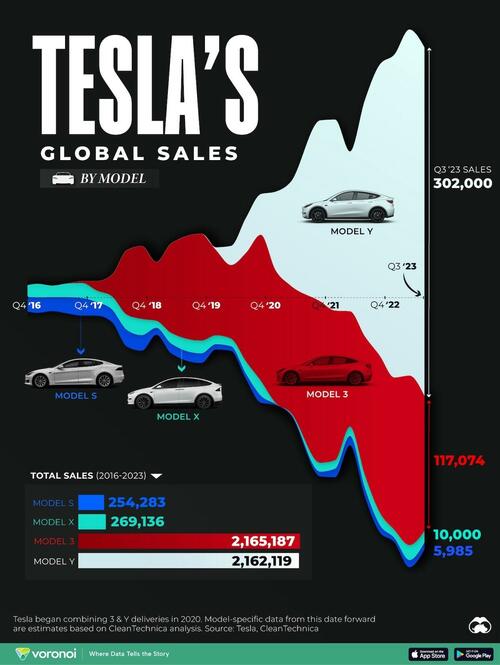

A huge part of the success comes from Tesla’s sales which jumped 30x in the same time period.

Visual Capitalist's Marcus Lu and Bhabna Banerkjee take a look at the numbers, as well as the sales share between the different Tesla models from 2016-2023 using data from CleanTechnica, an archive for news and data around clean technology.

Tesla’s Global Sales Sales Through the Years

From 2018 onwards, Tesla’s global sales began to skyrocket. Though quarter-on-quarter growth wasn’t always positive, dips were followed by more breakout numbers.

Here’s the model breakdown of Tesla’s global sales, from Q2 2016 to Q3 2023.

| Date | Tesla Model S | Tesla Model X | Tesla Model 3 | Tesla Model Y |

|---|---|---|---|---|

| Q2 2016 | 9,764 | 4,638 | N/A | N/A |

| Q3 2016 | 16,047 | 8,774 | N/A | N/A |

| Q4 2016 | 12,700 | 9,500 | N/A | N/A |

| Q1 2017 | 13,481 | 11,570 | N/A | N/A |

| Q2 2017 | 12,010 | 10,010 | N/A | N/A |

| Q3 2017 | 14,065 | 11,865 | 220 | N/A |

| Q4 2017 | 15,200 | 13,120 | 1,550 | N/A |

| Q1 2018 | 11,730 | 10,070 | 8,180 | N/A |

| Q2 2018 | 10,930 | 11,370 | 18,440 | N/A |

| Q3 2018 | 14,470 | 13,190 | 55,840 | N/A |

| Q4 2018 | 13,500 | 14,050 | 63,150 | N/A |

| Q1 2019 | 6,000 | 6,100 | 50,900 | N/A |

| Q2 2019 | 8,422 | 9,300 | 77,634 | N/A |

| Q3 2019 | 8,383 | 9,100 | 79,703 | N/A |

| Q4 2019 | 8,375 | 11,100 | 92,620 | N/A |

| Q1 2020 | 4,525 | 7,705 | 73,975 | 2,291 |

| Q2 2020 | 3,927 | 6,687 | 63,793 | 16,484 |

| Q3 2020 | 4,583 | 10,693 | 94,049 | 30,269 |

| Q4 2020 | 6,060 | 12,860 | 126,624 | 35,123 |

| Q1 2021 | 1,010 | 1,010 | 115,077 | 67,780 |

| Q2 2021 | 890 | 1,000 | 110,054 | 89,360 |

| Q3 2021 | 9,000 | 275 | 111,225 | 120,800 |

| Q4 2021 | 4,050 | 7,700 | 140,000 | 156,850 |

| Q1 2022 | 7,362 | 7,362 | 129,764 | 165,560 |

| Q2 2022 | 8,081 | 8,081 | 100,066 | 138,467 |

| Q3 2022 | 7,469 | 11,203 | 120,308 | 204,850 |

| Q4 2022 | 6,344 | 10,803 | 135,846 | 252,285 |

| Q1 2023 | 3,695 | 7,000 | 132,180 | 280,000 |

| Q2 2023 | 6,225 | 13,000 | 146,915 | 300,000 |

| Q3 2023 | 5,985 | 10,000 | 117,074 | 302,000 |

| Total | 254,283 | 269,136 | 2,165,187 | 2,162,119 |

Note: Beginning in 2020, Tesla’s reporting began to combine Model 3 & Y sales together. Model-specific data from this point is based on CleanTechnica’s estimates.

Aside from this steep rise, another key factor to note is how Tesla’s lineup has changed. The company began ramping production with the Model S and X, two luxury models that helped the brand build a prestigious image.

However since 2020 , the company has successfully transitioned to cheaper high volume models like the Model 3 and Y.

In fact, 2020 was also the first year Tesla turned a profit thanks in part to the Model Y.

The Model 3 and Y were also the world’s best-selling EVs in 2023.

Tesla’s presumed rival, Amazon and Ford-backed Rivian, is planning a similar approach. Its first models include the relatively expensive, full-size R1T and R1S. However the company has hinted at a 2024 reveal for its cheaper R2 model, with production starting in 2026.

In the last five years, Tesla stock has exploded upwards more than 800%.

From a company that was perpetually on the verge of bankruptcy, Tesla has emerged as the EV manufacturer to beat in the automotive market.

A huge part of the success comes from Tesla’s sales which jumped 30x in the same time period.

Visual Capitalist’s Marcus Lu and Bhabna Banerkjee take a look at the numbers, as well as the sales share between the different Tesla models from 2016-2023 using data from CleanTechnica, an archive for news and data around clean technology.

Tesla’s Global Sales Sales Through the Years

From 2018 onwards, Tesla’s global sales began to skyrocket. Though quarter-on-quarter growth wasn’t always positive, dips were followed by more breakout numbers.

Here’s the model breakdown of Tesla’s global sales, from Q2 2016 to Q3 2023.

| Date | Tesla Model S | Tesla Model X | Tesla Model 3 | Tesla Model Y |

|---|---|---|---|---|

| Q2 2016 | 9,764 | 4,638 | N/A | N/A |

| Q3 2016 | 16,047 | 8,774 | N/A | N/A |

| Q4 2016 | 12,700 | 9,500 | N/A | N/A |

| Q1 2017 | 13,481 | 11,570 | N/A | N/A |

| Q2 2017 | 12,010 | 10,010 | N/A | N/A |

| Q3 2017 | 14,065 | 11,865 | 220 | N/A |

| Q4 2017 | 15,200 | 13,120 | 1,550 | N/A |

| Q1 2018 | 11,730 | 10,070 | 8,180 | N/A |

| Q2 2018 | 10,930 | 11,370 | 18,440 | N/A |

| Q3 2018 | 14,470 | 13,190 | 55,840 | N/A |

| Q4 2018 | 13,500 | 14,050 | 63,150 | N/A |

| Q1 2019 | 6,000 | 6,100 | 50,900 | N/A |

| Q2 2019 | 8,422 | 9,300 | 77,634 | N/A |

| Q3 2019 | 8,383 | 9,100 | 79,703 | N/A |

| Q4 2019 | 8,375 | 11,100 | 92,620 | N/A |

| Q1 2020 | 4,525 | 7,705 | 73,975 | 2,291 |

| Q2 2020 | 3,927 | 6,687 | 63,793 | 16,484 |

| Q3 2020 | 4,583 | 10,693 | 94,049 | 30,269 |

| Q4 2020 | 6,060 | 12,860 | 126,624 | 35,123 |

| Q1 2021 | 1,010 | 1,010 | 115,077 | 67,780 |

| Q2 2021 | 890 | 1,000 | 110,054 | 89,360 |

| Q3 2021 | 9,000 | 275 | 111,225 | 120,800 |

| Q4 2021 | 4,050 | 7,700 | 140,000 | 156,850 |

| Q1 2022 | 7,362 | 7,362 | 129,764 | 165,560 |

| Q2 2022 | 8,081 | 8,081 | 100,066 | 138,467 |

| Q3 2022 | 7,469 | 11,203 | 120,308 | 204,850 |

| Q4 2022 | 6,344 | 10,803 | 135,846 | 252,285 |

| Q1 2023 | 3,695 | 7,000 | 132,180 | 280,000 |

| Q2 2023 | 6,225 | 13,000 | 146,915 | 300,000 |

| Q3 2023 | 5,985 | 10,000 | 117,074 | 302,000 |

| Total | 254,283 | 269,136 | 2,165,187 | 2,162,119 |

Note: Beginning in 2020, Tesla’s reporting began to combine Model 3 & Y sales together. Model-specific data from this point is based on CleanTechnica’s estimates.

Aside from this steep rise, another key factor to note is how Tesla’s lineup has changed. The company began ramping production with the Model S and X, two luxury models that helped the brand build a prestigious image.

However since 2020 , the company has successfully transitioned to cheaper high volume models like the Model 3 and Y.

In fact, 2020 was also the first year Tesla turned a profit thanks in part to the Model Y.

The Model 3 and Y were also the world’s best-selling EVs in 2023.

Tesla’s presumed rival, Amazon and Ford-backed Rivian, is planning a similar approach. Its first models include the relatively expensive, full-size R1T and R1S. However the company has hinted at a 2024 reveal for its cheaper R2 model, with production starting in 2026.

Loading…