Oil prices extended their recent gains, as traders weighed escalating violence in the Red Sea and tighter US inventories (following last night's API report showing a big crude draw, but product builds) against a fragile market demand backdrop.

As Bloomberg notes, crude has seesawed in a roughly $5 range for the past month as traders attempt to gauge the outlook for coming quarters.

Turmoil in the Middle East, a shutdown of Libya’s biggest oil field and production cuts by OPEC+ are buttressing prices, while demand forecasts such as Vitol’s are tempering them.

But any signs of tightness in the official inventory and production data could extend the current trend.

API

-

Crude -5.125mm (-600k exp)

-

Cushing -625k

-

Gasoline +4.896mm (+2.1mm exp)

-

Distillates +6.873mm (+1.00mm exp)

DOE

- Crude +1.2338mm (-600k exp)

-

Cushing -506k - first draw since Oct '23

-

Gasoline (+2.1mm exp)

-

Distillates (+1.00mm exp)

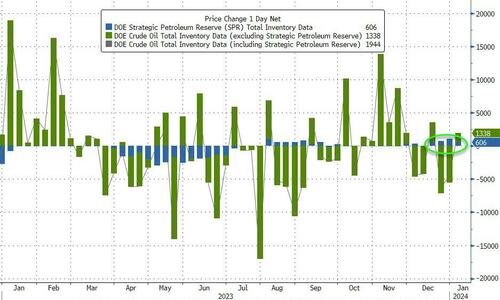

In a big shift from API's sizable crude draw, the official (adjusted) DOE data showed an unexpected 1.34mm barrel build in crude stocks. Cushing stocks did decline for the first time since October. And for the second week in a row, product builds were huge...

Source: Bloomberg

The Biden admin added 606k barrels to the SPR last week (the 4th weekly addition in a row)...

Source: Bloomberg

Cushing stocks rolled over from their highest level since July 2023..

Source: Bloomberg

US Crude production was flat, just off record highs....

Source: Bloomberg

WTI was hovering just above $73 ahead of the official print, and slid lower on the unexpected build...

On the bright side (for oil bulls), the US benchmark’s prompt spread, a critical barometer for supply and demand, has flipped to a bullish structure known as backwardation for the first time since November...

In the options market, some traders are betting that the worst of oil’s early-year malaise may be over, with contracts that would profit from a rally above $110 in June futures changing hands in large volumes yesterday.

Finally, the EIA said in its monthly report that it expects, global oil demand will exceed supply by 120,000 barrels a day in 2024 as output cuts by OPEC+ tighten the market. That modest supply deficit could push Brent futures to average $85 a barrel in March.

Recent days have also seen a surge in oil-tanker rates as one Asian shipper sparked a frenzy by hiring a slew of vessels. The move has tightened the availability of the world’s largest tankers and led to the biggest one-day gain in the cost of hauling oil from the US to China since November 2022. High freight rates can sometimes make it difficult to send cargoes over long distances.

Oil prices extended their recent gains, as traders weighed escalating violence in the Red Sea and tighter US inventories (following last night’s API report showing a big crude draw, but product builds) against a fragile market demand backdrop.

As Bloomberg notes, crude has seesawed in a roughly $5 range for the past month as traders attempt to gauge the outlook for coming quarters.

Turmoil in the Middle East, a shutdown of Libya’s biggest oil field and production cuts by OPEC+ are buttressing prices, while demand forecasts such as Vitol’s are tempering them.

But any signs of tightness in the official inventory and production data could extend the current trend.

API

-

Crude -5.125mm (-600k exp)

-

Cushing -625k

-

Gasoline +4.896mm (+2.1mm exp)

-

Distillates +6.873mm (+1.00mm exp)

DOE

In a big shift from API’s sizable crude draw, the official (adjusted) DOE data showed an unexpected 1.34mm barrel build in crude stocks. Cushing stocks did decline for the first time since October. And for the second week in a row, product builds were huge…

Source: Bloomberg

The Biden admin added 606k barrels to the SPR last week (the 4th weekly addition in a row)…

Source: Bloomberg

Cushing stocks rolled over from their highest level since July 2023..

Source: Bloomberg

US Crude production was flat, just off record highs….

Source: Bloomberg

WTI was hovering just above $73 ahead of the official print, and slid lower on the unexpected build…

On the bright side (for oil bulls), the US benchmark’s prompt spread, a critical barometer for supply and demand, has flipped to a bullish structure known as backwardation for the first time since November…

In the options market, some traders are betting that the worst of oil’s early-year malaise may be over, with contracts that would profit from a rally above $110 in June futures changing hands in large volumes yesterday.

Finally, the EIA said in its monthly report that it expects, global oil demand will exceed supply by 120,000 barrels a day in 2024 as output cuts by OPEC+ tighten the market. That modest supply deficit could push Brent futures to average $85 a barrel in March.

Recent days have also seen a surge in oil-tanker rates as one Asian shipper sparked a frenzy by hiring a slew of vessels. The move has tightened the availability of the world’s largest tankers and led to the biggest one-day gain in the cost of hauling oil from the US to China since November 2022. High freight rates can sometimes make it difficult to send cargoes over long distances.

Loading…