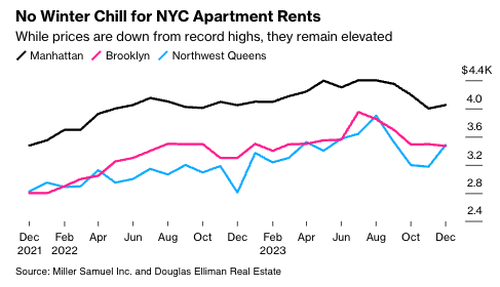

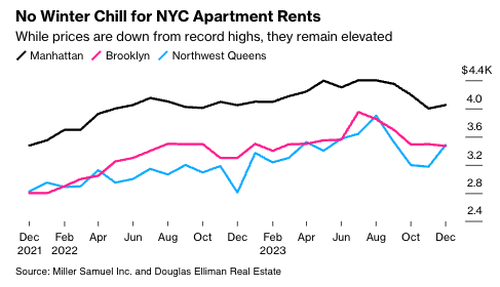

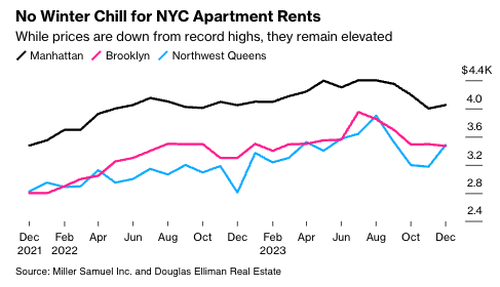

Manhattan's rental market showed no signs of easing, with prices climbing higher in December. This indicates that apartment hunters will face near-record-high rents into the spring season.

The median rent on new leases signed last month was $4,050, unchanged from a year before and up 1.3% from November, according to Bloomberg, citing new data from appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate. December's month-over-month increase was the first since July, in a period when rents generally trend lower.

Other data points also show apartment demand for the two months ending in 2023 was red hot, with deals soaring 14% from December 2022.

Although rents peaked at record highs last summer and the supply of apartments has increased, these welcoming signs have yet to push rents meaningfully down to offer apartment hunters relief.

Jonathan Miller, president of Miller Samuel, said this might be the best relief renters get.

"Even though they've come down from the summer peak, rents are still elevated. We're coming out of a frenzy period and transitioning into one of stability," Miller said, adding, "The era of very steep trajectories in rents is over."

The good news is that Manhattan's vacancy rate hit 3.42% last month, the highest level since July 2021. Also, listing inventory was up 33% from one year ago to 7,621 units. This might cap rental prices unless demand further accelerates.

Even though inventory is rising, Miller noted that the share of leases with bidding wars was still around 15%.

"We wouldn't be having bidding wars if supply was adequate," he said.

Miller added that no dramatic price decline is coming down the pipe, adding lower mortgage rates allow some renters to step into the homebuying ring this spring and that would take a little pressure off the leasing market.

So what happens to the rental market in New York City when progressives in City Hall provide a permanent housing solution to the 100,000 migrants?

Manhattan’s rental market showed no signs of easing, with prices climbing higher in December. This indicates that apartment hunters will face near-record-high rents into the spring season.

The median rent on new leases signed last month was $4,050, unchanged from a year before and up 1.3% from November, according to Bloomberg, citing new data from appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate. December’s month-over-month increase was the first since July, in a period when rents generally trend lower.

Other data points also show apartment demand for the two months ending in 2023 was red hot, with deals soaring 14% from December 2022.

Although rents peaked at record highs last summer and the supply of apartments has increased, these welcoming signs have yet to push rents meaningfully down to offer apartment hunters relief.

Jonathan Miller, president of Miller Samuel, said this might be the best relief renters get.

“Even though they’ve come down from the summer peak, rents are still elevated. We’re coming out of a frenzy period and transitioning into one of stability,” Miller said, adding, “The era of very steep trajectories in rents is over.”

The good news is that Manhattan’s vacancy rate hit 3.42% last month, the highest level since July 2021. Also, listing inventory was up 33% from one year ago to 7,621 units. This might cap rental prices unless demand further accelerates.

Even though inventory is rising, Miller noted that the share of leases with bidding wars was still around 15%.

“We wouldn’t be having bidding wars if supply was adequate,” he said.

Miller added that no dramatic price decline is coming down the pipe, adding lower mortgage rates allow some renters to step into the homebuying ring this spring and that would take a little pressure off the leasing market.

So what happens to the rental market in New York City when progressives in City Hall provide a permanent housing solution to the 100,000 migrants?

Loading…