Shares in Burberry Group Plc crashed as much as 15% in UK trading, hitting lows not seen since the early days of the Covid pandemic as the trenchcoat maker slashed its profit forecast. This is more evidence that the global luxury downturn will accelerate in the first half of 2024.

Burberry lowered its profit outlook by nearly £100 million ($128 million) in the biggest warning yet that the luxury bubble has gone bust. The company warned about slowing sales in its "key December trading period" as it slashed profit guidance for the full-year ending in March 2024.

The stock plunged as much as 15% in London, the steepest intraday decline since 2012.

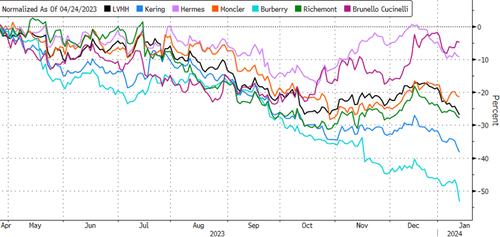

Burberry shares are the weakest out of all the luxury stocks we track.

Chief Executive Officer Jonathan Akeroyd said almost every region recorded falling sales last quarter. He indicated that 2024 could be a very challenging year for the industry.

Europe, the Middle East, India, and Africa recorded weaker sales. The Americas generated revenues of around 706 million pounds for the quarter ending Dec. 30, which is about 7% lower than the same period in 2022. Poor performances in those regions were slightly offset by a 3% rise in sales across the Asia Pacific region, driven by an 8% sales in China and a 9% increase in Japan.

The luxury goods market has stumbled since early 2023 as consumers, pressured by inflation and high interest rates, have reduced spending on big-ticket items.

We first asked this question in May 2023: Did Europe's Luxury Bubble Just Burst.

Ever since the luxury bubble has been unraveling:

- Luxury Turmoil: Diamond Prices Crash To Pre-COVID Levels; Used Rolex Prices Hit New Six-Month Low

- 'It Ain't Gucci': LVMH Shares Tumble As Luxury Bubble Unravels

- Richemont CEO Warns "Softening Demand Across All Categories" As Luxury Downturn Worsens

- Speculative Money Dumps Vintage Champagne Bottles As 'Bubble In Bubbly Pops'

Wall Street analysts this morning continue their gloomy outlook on the luxury space following Burberry's results:

Morgan Stanley analysts led by Grace Smalley say they expect estimates for Burberry's earnings for the coming years to be revised down

- The timeline for the company's long-term targets is becoming increasingly pushed out

- "While we had expected a weak trading and guidance update from Burberry, this is worse than our expectations," they wrote

Jefferies analysts led by James Grzinic say Burberry's profit warning "hints at a tough demand context worsening into December"

- The industry-wide slowdown doesn't, however, answer questions about the incremental demand or lack of demand coming for products designed by Burberry's Chief Creative Officer Daniel Lee.

Bernstein analysts call Burberry's trading update disappointing

- "Self-help is difficult in the best of times, and close to impossible when the market is tough," analysts led by Luca Solca said

- "Burberry's disappointing update during the crucial fourth calendar quarter of last year is the nth demonstration of this tenet"

RBC says Burberry needs to deliver "sustainable earnings growth which in the past has ultimately proved inconsistent"

- "We view Burberry's mid-term revenue (£4bn) and margin (20%) targets as optimistic at this stage," say analysts led by Piral Dadhania

And we'll end with Bank of America analysts led by Ashley Wallace, who warned one day before Burberry's results: it was "still too early to buy the luxury pullback."

Shares in Burberry Group Plc crashed as much as 15% in UK trading, hitting lows not seen since the early days of the Covid pandemic as the trenchcoat maker slashed its profit forecast. This is more evidence that the global luxury downturn will accelerate in the first half of 2024.

Burberry lowered its profit outlook by nearly £100 million ($128 million) in the biggest warning yet that the luxury bubble has gone bust. The company warned about slowing sales in its “key December trading period” as it slashed profit guidance for the full-year ending in March 2024.

The stock plunged as much as 15% in London, the steepest intraday decline since 2012.

Burberry shares are the weakest out of all the luxury stocks we track.

Chief Executive Officer Jonathan Akeroyd said almost every region recorded falling sales last quarter. He indicated that 2024 could be a very challenging year for the industry.

Europe, the Middle East, India, and Africa recorded weaker sales. The Americas generated revenues of around 706 million pounds for the quarter ending Dec. 30, which is about 7% lower than the same period in 2022. Poor performances in those regions were slightly offset by a 3% rise in sales across the Asia Pacific region, driven by an 8% sales in China and a 9% increase in Japan.

The luxury goods market has stumbled since early 2023 as consumers, pressured by inflation and high interest rates, have reduced spending on big-ticket items.

We first asked this question in May 2023: Did Europe’s Luxury Bubble Just Burst.

Ever since the luxury bubble has been unraveling:

Wall Street analysts this morning continue their gloomy outlook on the luxury space following Burberry’s results:

Morgan Stanley analysts led by Grace Smalley say they expect estimates for Burberry’s earnings for the coming years to be revised down

- The timeline for the company’s long-term targets is becoming increasingly pushed out

- “While we had expected a weak trading and guidance update from Burberry, this is worse than our expectations,” they wrote

Jefferies analysts led by James Grzinic say Burberry’s profit warning “hints at a tough demand context worsening into December”

- The industry-wide slowdown doesn’t, however, answer questions about the incremental demand or lack of demand coming for products designed by Burberry’s Chief Creative Officer Daniel Lee.

Bernstein analysts call Burberry’s trading update disappointing

- “Self-help is difficult in the best of times, and close to impossible when the market is tough,” analysts led by Luca Solca said

- “Burberry’s disappointing update during the crucial fourth calendar quarter of last year is the nth demonstration of this tenet”

RBC says Burberry needs to deliver “sustainable earnings growth which in the past has ultimately proved inconsistent”

- “We view Burberry’s mid-term revenue (£4bn) and margin (20%) targets as optimistic at this stage,” say analysts led by Piral Dadhania

And we’ll end with Bank of America analysts led by Ashley Wallace, who warned one day before Burberry’s results: it was “still too early to buy the luxury pullback.”

Loading…