With traders transfixed by today's bond rout (as a reminder tumbling yields was the most consensus trade of 2024, one which we said a month ago would blow up spectacularly), some were expecting today's 20Y reopening auction to be solid due to the generous concession thanks to the 5bps rout in the long-end. It wasn't.

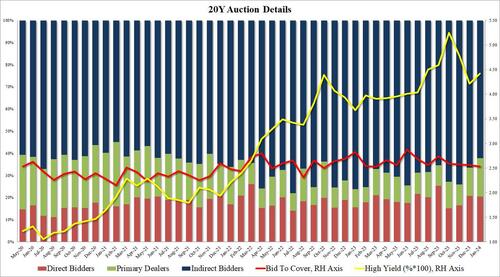

The auction stopped at a high yield of 4.423%, up from 4.213% in December, and tailing the When Issued 4.415 by 0.8bps (the second consecutive tail).

The bid to cover dropped to 2.53 from 2.56, the lowest btc since March 2023, and well below the recent average of 2.62.

The internals were even uglier: Indirects were awarded 62.2%, down from 66.4$ and the lowest since November 2021. And with Directs taking down 20.5%, or modestly above the 19.9% recent average, Dealers were left holding 17.3% of the auction, the highest since Nov 2021.

In short: after a brief hiatus, the long-end has remember that it is staring at a staggering $1.8 trillion in coupon supply this year, almost double from the $1 trillion in 2023, and that - absent a recession - yields will continue shooting up for the foreseeable future.

With traders transfixed by today’s bond rout (as a reminder tumbling yields was the most consensus trade of 2024, one which we said a month ago would blow up spectacularly), some were expecting today’s 20Y reopening auction to be solid due to the generous concession thanks to the 5bps rout in the long-end. It wasn’t.

The auction stopped at a high yield of 4.423%, up from 4.213% in December, and tailing the When Issued 4.415 by 0.8bps (the second consecutive tail).

The bid to cover dropped to 2.53 from 2.56, the lowest btc since March 2023, and well below the recent average of 2.62.

The internals were even uglier: Indirects were awarded 62.2%, down from 66.4$ and the lowest since November 2021. And with Directs taking down 20.5%, or modestly above the 19.9% recent average, Dealers were left holding 17.3% of the auction, the highest since Nov 2021.

In short: after a brief hiatus, the long-end has remember that it is staring at a staggering $1.8 trillion in coupon supply this year, almost double from the $1 trillion in 2023, and that – absent a recession – yields will continue shooting up for the foreseeable future.

Loading…