With central bankers into their blackout windows ahead of the meetings, today was quiet on the macro side with US Leading Indicators the only stand-out, "continuing to signal underlying weakness in the US economy" as they said.

Most notably, they concluded:

"Overall, we expect GDP growth to turn negative in Q2 and Q3 of 2024 but begin to recover late in the year."

And that helped pull rate-cut timing hopes lower, with the odds of a March rate-cut down to just 40% (from practically 100% at their peak in December). Rate-cut expectations for 2024 also declined modestly...

Source: Bloomberg

And after last week's carnage, Treasuries were bid today with the belly outperforming...

Source: Bloomberg

But, in the face of weak economic data and a bid for bonds, oil rallied notably too - as the reality of Houtthi attacks continues to sink in - with WTI breaking above $75 (out of the YTD range) - back near one-month highs...

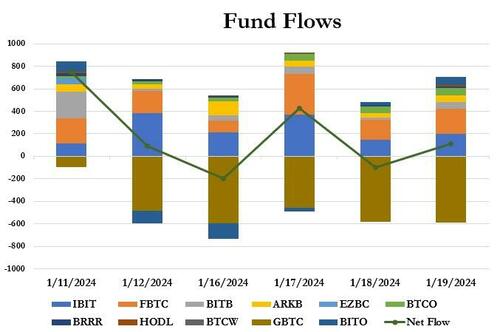

Bitcoin was clubbed like a baby seal, smashing down below $40k. Bitcoin found support at $39,500 and bounced off two-month lows...

Source: Bloomberg

Headlines about FTX selling (over the past couple of days, and apparently having finished), sparked some FUD - but its actually positive since as we tweeted earlier, this means the new ETF inflows are not simply recycled from GBTC...

Even in death, FTX estate continues to cause havoc in bitcoin, in this case it has sold more than $1 billion in GBTC. Which means inflows into new ETFs are not recycled GBTC exposure but actual new money.https://t.co/uRM0SUG4AA

— zerohedge (@zerohedge) January 22, 2024

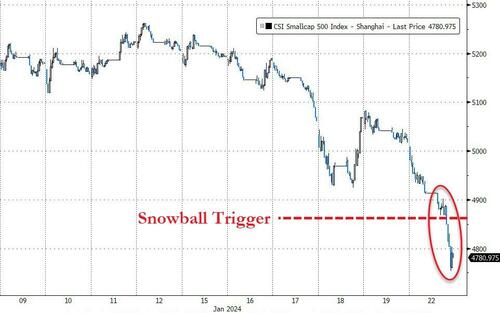

After China's equity market collapse accelerated overnight...

Source: Bloomberg

US equities were mixed with Small Caps soaring on a big squeeze at the open but everything faded back during the day with the rest of the majors clinging on to positive gains. The last hour saw another big reversal smashing Small Caps up 2% on the day (up 3 straight days and the best day since mid-December)... with Nasdaq barely holding green.

The Dow and S&P 500 closed at new record highs...

Interestingly, the last hour melt-up was more driven by heavy put-covering flows (as calls actually saw negative delta)

'Most Shorted' stocks were ripped higher at the open - up 7% from Friday's lows to today's highs - but that momentum failed fast...

Source: Bloomberg

Magnificent 7 stocks extended gains at the open but selling pressure hit soon after, leaving them barely green on the day...

Source: Bloomberg

While the cap-weighted S&P 500 has continued to climb in the first three weeks of January, the equal-weighted index has dropped...

Source: Bloomberg

... as US treasury yields have backed up to 4.15%...

Source: Bloomberg

In other words, the year-to-date rally has been propelled by a handful of large-cap stocks whose momentum has rendered them largely immune - for now - to more prosaic concerns.

But for the majority of stocks in the index, bond yields still matter.

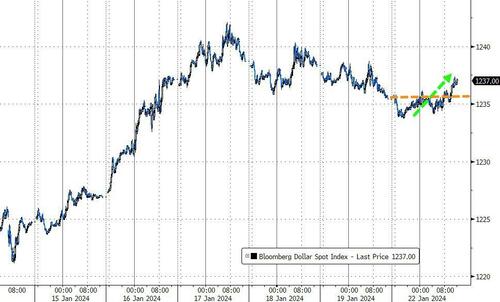

The dollar rallied relatively modestly on the day after opening weaker...

Source: Bloomberg

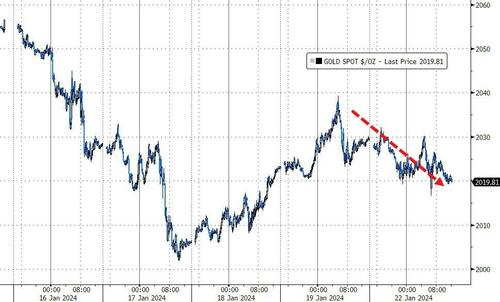

Spot Gold prices closed lower..

Source: Bloomberg

Finally, while LEI is screaming recession here, the lagged impact of the massive loosening of financial conditions seen in Q4 could be about to hit and lift macro data back rapidly stronger...

Source: Bloomberg

This is a problem - a re-emergence of economic 'animal spirits' is not what The Fed wants to see when they are still trying to tamp down inflation.

Simply put, the reflexive cycle of stronger stocks (on expectations of easier policy) driving financial conditions dramatically looser (doing The Fed's job for it), remove the need for actual rate-cuts from The Fed... and remove the pillar that is supporting the buying-panic in stocks... and around we go.

Be careful what you wish for...

With central bankers into their blackout windows ahead of the meetings, today was quiet on the macro side with US Leading Indicators the only stand-out, “continuing to signal underlying weakness in the US economy” as they said.

Most notably, they concluded:

“Overall, we expect GDP growth to turn negative in Q2 and Q3 of 2024 but begin to recover late in the year.”

And that helped pull rate-cut timing hopes lower, with the odds of a March rate-cut down to just 40% (from practically 100% at their peak in December). Rate-cut expectations for 2024 also declined modestly…

Source: Bloomberg

And after last week’s carnage, Treasuries were bid today with the belly outperforming…

Source: Bloomberg

But, in the face of weak economic data and a bid for bonds, oil rallied notably too – as the reality of Houtthi attacks continues to sink in – with WTI breaking above $75 (out of the YTD range) – back near one-month highs…

Bitcoin was clubbed like a baby seal, smashing down below $40k. Bitcoin found support at $39,500 and bounced off two-month lows…

Source: Bloomberg

Headlines about FTX selling (over the past couple of days, and apparently having finished), sparked some FUD – but its actually positive since as we tweeted earlier, this means the new ETF inflows are not simply recycled from GBTC…

Even in death, FTX estate continues to cause havoc in bitcoin, in this case it has sold more than $1 billion in GBTC. Which means inflows into new ETFs are not recycled GBTC exposure but actual new money.https://t.co/uRM0SUG4AA

— zerohedge (@zerohedge) January 22, 2024

After China’s equity market collapse accelerated overnight…

Source: Bloomberg

US equities were mixed with Small Caps soaring on a big squeeze at the open but everything faded back during the day with the rest of the majors clinging on to positive gains. The last hour saw another big reversal smashing Small Caps up 2% on the day (up 3 straight days and the best day since mid-December)… with Nasdaq barely holding green.

The Dow and S&P 500 closed at new record highs…

Interestingly, the last hour melt-up was more driven by heavy put-covering flows (as calls actually saw negative delta)

‘Most Shorted’ stocks were ripped higher at the open – up 7% from Friday’s lows to today’s highs – but that momentum failed fast…

Source: Bloomberg

Magnificent 7 stocks extended gains at the open but selling pressure hit soon after, leaving them barely green on the day…

Source: Bloomberg

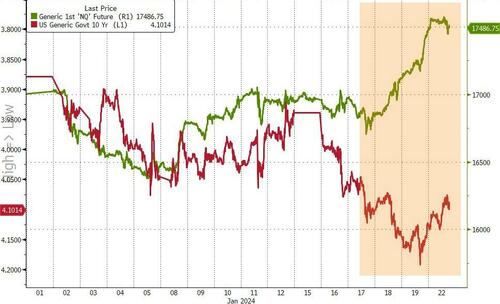

While the cap-weighted S&P 500 has continued to climb in the first three weeks of January, the equal-weighted index has dropped…

Source: Bloomberg

… as US treasury yields have backed up to 4.15%…

Source: Bloomberg

In other words, the year-to-date rally has been propelled by a handful of large-cap stocks whose momentum has rendered them largely immune – for now – to more prosaic concerns.

But for the majority of stocks in the index, bond yields still matter.

The dollar rallied relatively modestly on the day after opening weaker…

Source: Bloomberg

Spot Gold prices closed lower..

Source: Bloomberg

Finally, while LEI is screaming recession here, the lagged impact of the massive loosening of financial conditions seen in Q4 could be about to hit and lift macro data back rapidly stronger…

Source: Bloomberg

This is a problem – a re-emergence of economic ‘animal spirits’ is not what The Fed wants to see when they are still trying to tamp down inflation.

Simply put, the reflexive cycle of stronger stocks (on expectations of easier policy) driving financial conditions dramatically looser (doing The Fed’s job for it), remove the need for actual rate-cuts from The Fed… and remove the pillar that is supporting the buying-panic in stocks… and around we go.

Be careful what you wish for…

Loading…