Despite President Joe Biden‘s effort to turn “Bidenomics” into a positive phrase the public would embrace, most see “Bidenflation” undermining their financial health and future retirement.

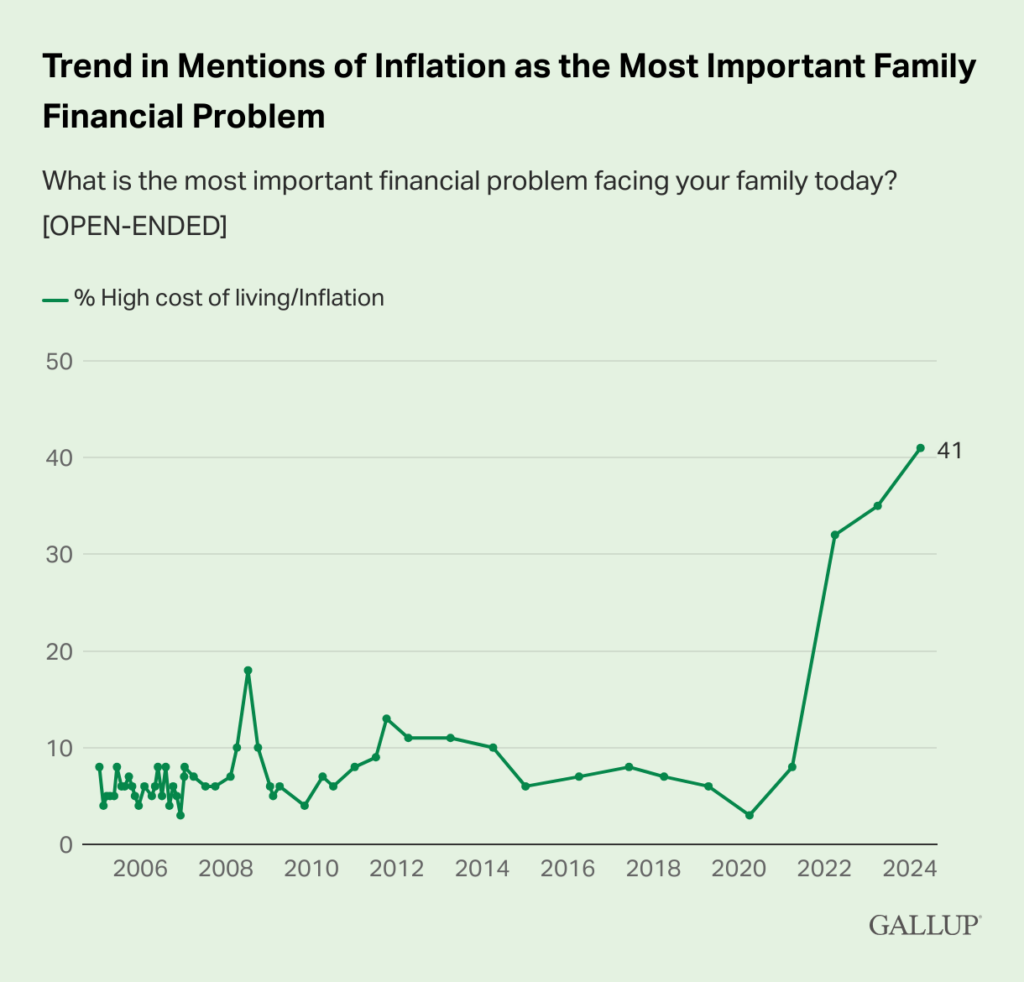

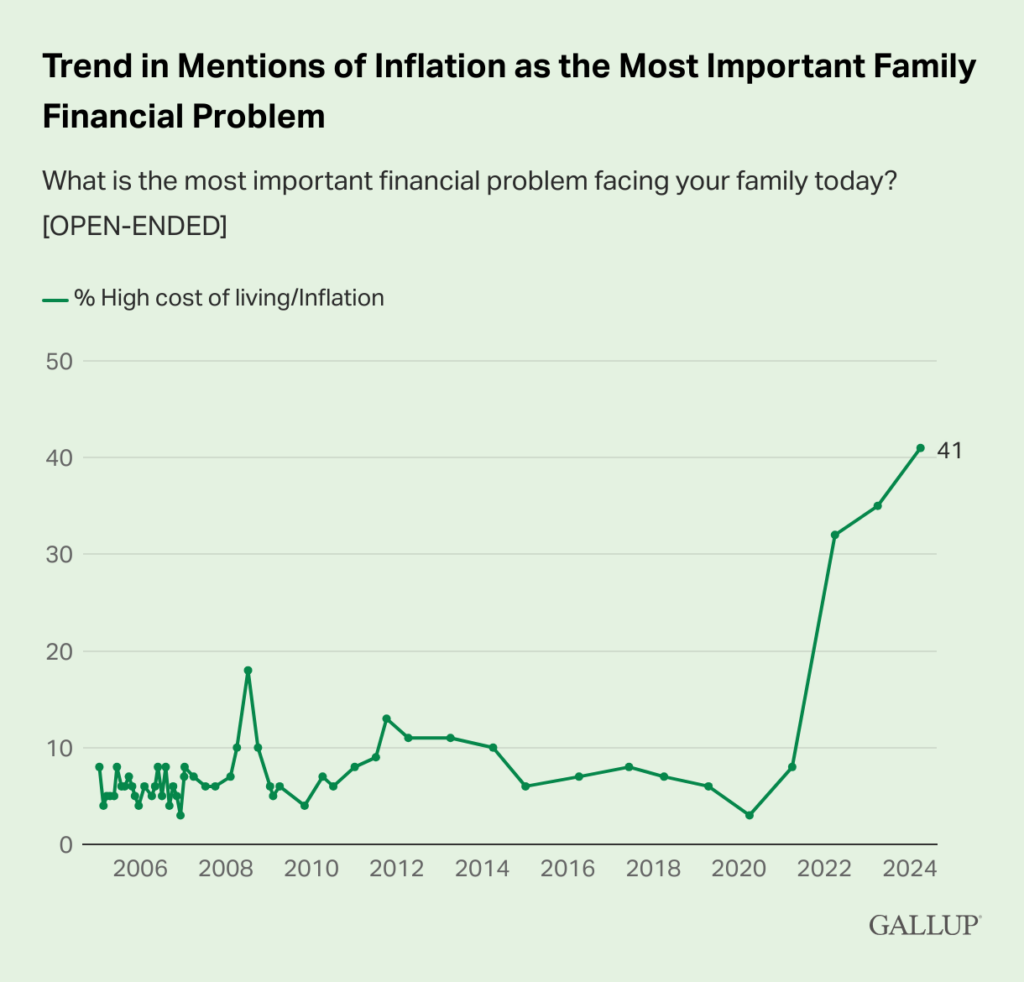

Gallup said on Thursday that the number of those who cited inflation as their top kitchen-table concern has hit another record high at 41%.

All three past yearly records have come during the Biden administration, which is planning to raise taxes soon, possibly as high as $14,000 on middle-income households, according to Americans for Tax Reform.

“For the third year in a row, the percentage of Americans naming inflation or the high cost of living as the most important financial problem facing their family has reached a new high. The 41% naming the issue this year is up slightly from 35% a year ago and 32% in 2022. Before 2022, the highest percentage mentioning inflation was 18% in 2008,” Gallup said.

Biden, his White House team, and Democratic surrogates have been trying to convince the nation that the economy is sound and healthy. They cite stock prices, low unemployment, and higher wages.

But the poll suggests that the public has a different view. Prices are high and staying high, retirement plans are on hold, houses and cars are too expensive, and gas prices are creeping back to $4 a gallon.

Add to that the flip-flopping by the Federal Reserve on cutting interest rates and the earlier blundering statements from Biden’s treasury secretary that inflation would be a short-term concern, and people are getting distrustful of government efforts and proclamations.

“The U.S. inflation rate has declined significantly since its peak in 2022, but that has done little to alter Americans’ perceptions of their finances. This could reflect the cumulative effect of higher prices for the past few years and the fact that inflation has remained above the lower rates in the U.S. between 2012 and 2020,” Gallup said.

SEE THE LATEST POLITICAL NEWS AND BUZZ FROM WASHINGTON SECRETS

“Inflation continues to be an issue for Americans and is likely why less than half are positive about their financial situation. In addition to being named the most important financial problem facing their family, inflation also ranks as one of the domestic problems Americans worry most about,” Gallup added.

No wonder, since many families feel the economy is worse than after the last Great Recession, Gallup said. “Americans’ ratings of their personal financial situation were worse than now between 2009 and 2012, as the U.S. was coming out of the Great Recession and unemployment was high. During those years, an average of 42% of Americans rated their personal finances positively,” the pollster said.