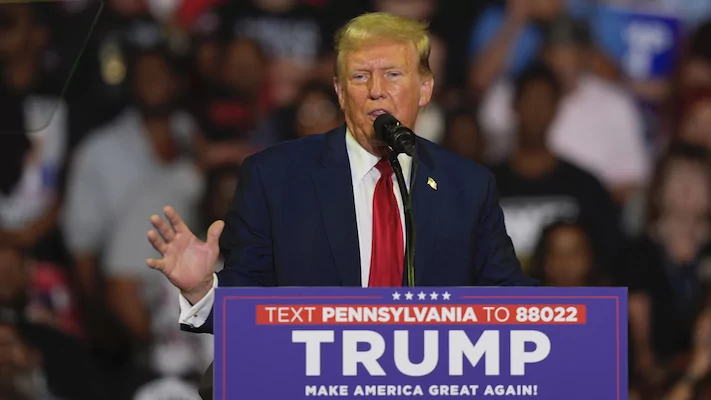

The top three men reportedly in the running to be former President Donald Trump’s vice presidential contender share many similarities in economic policy but also some key differences.

The three most likely candidates for the role are Gov. Doug Burgum (R-ND), Sen. J.D. Vance (R-OH), and Sen. Marco Rubio (R-FL), according to the New York Times and the political prediction markets. Rubio has been around the national political scene for a while, but Burgum is a relative newcomer to national politics, as is Vance.

Here is where the three politicians stand on key economic matters.

On the tax front, all three contenders are expected to support extending the 2017 Tax Cuts and Jobs Act, which is colloquially known as the Trump tax cuts. The TCJA was Trump’s signature legislative achievement and he is pushing to make expiring individual and business provisions in the law permanent.

Without Congress acting, nearly two dozen tax provisions that were part of the TCJA will sunset after 2025.

Among the provisions that will sunset are lower individual income tax rates and the ability for pass-through businesses to take a 20% deduction. Pass-through businesses, which are not subject to the corporate income tax, are the most common type of business and include sole proprietorships, partnerships, and S corporations — most small businesses.

The historic tax law also doubled the child tax credit, increasing it to $2,000 for qualifying families and doubling the estate, or death, tax exemption. That allowed people to keep more of their inheritance before being hit by federal taxes.

The child tax credit is a particularly noteworthy topic. All three men have expressed some form of support for boosting the child tax credit beyond the level set in the TCJA. Vance has spoken about the country’s declining birth rate, which is often an argument in favor of more tax benefits for families and mothers.

Vance expressed some support for recent bipartisan legislation to boost the child tax credit alongside business tax provisions after the bill passed the House, although the legislation never got a Senate vote.

Burgum also told the Washington Examiner during an interview while he was running for president that he supports a bigger child tax credit. As governor, he also signed into law a multimillion-dollar legislative bill to support child care services in North Dakota.

Rubio has long been a proponent of a bigger child tax credit. Rubio and Sen. Mike Lee (R-UT), in 2021, introduced a proposal that would have boosted the child tax credit to $3,500 per child and $4,500 per child under the age of six.

In terms of economic policy, a Trump presidency would usher in perhaps the most tectonic realignment on trade policy in modern history. The Republican Party has traditionally supported more free trade and less tariffs, but Trump supports a form of protectionism far removed from that.

He even floated the idea of 10% across-the-board tariffs. The former president has also flirted with the idea of reducing the income tax and replacing it with tariffs.

Vance would likely be the most in line with Trump’s trade vision. He, like Trump, supports boosting the country’s manufacturing sector through the use of tariffs and even grabbed headlines when he visited a picket line of striking autoworkers last year.

Speaking with the Washington Examiner before endorsing Trump, Burgum pushed back on the former president’s 10% universal tariff idea, saying it’s “too simplistic and doesn’t match the real world.” Burgum said such a plan would be inflationary.

“We have to be able to figure out, who are our friends? Who are our enemies? And then figure out a way to develop trade policy that supports our objectives that actually drives what’s best for American interests,” Burgum said.

Rubio’s views on tariffs have appeared to evolve a bit over time. In 2016, he pushed back on Trump’s tariff proposals and said “we need to be very careful with tariffs.”

“China doesn’t pay the tariff. The buyer pays the tariff,” Rubio said during a 2016 primary debate. “If you send a tie or a shirt made in China into the United States, and an American goes to buy it in the store, and there is a tariff on it, [the tariff] gets passed on in the price to the consumer.”

But in a May op-ed in the American Conservative titled “Trump is right: We should raise tariffs on China,” the Florida senator argued for increasing tariffs on Beijing.

“In reality, tariffs are good for the economy insofar as they counteract market inefficiencies created by adversarial trade practices,” he wrote. “China’s anticompetitive tactics, in particular, give Chinese companies an unfair cost advantage over American companies, which unnaturally shifts business, production, and jobs out of the United States.”

Job creation is a big focus for all three candidates, like anyone running for office.

Under President Joe Biden, the labor market has remained strong — despite inflation undercutting economic sentiment.

Burgum has some business bona fides. After earning a master’s degree in business administration from Stanford University, Burgum mortgaged $250,000 in farmland to buy a stake in Great Plains Software, then a fledgling company. He then bought out the founders in the mid-1980s, expanded the company, and took it public. Microsoft later acquired the company for more than one billion dollars.

Rubio has spoken a lot about the value of work and the country’s labor force. Last year, Rubio’s office published a report that found that, in 2022, there were 7 million men missing from the labor force and 10 million total without work.

Bonus contender: Sen. Tim Scott (R-SC). Scott is another person who has been talked about to appear on the ticket with Trump. Scott has been the champion of opportunity zones, which were created as part of the 2017 tax cuts and give tax breaks to businesses in impoverished areas to spur investment. The 2017 legislation only authorized their use for a decade, though.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

Scott told the Washington Examiner last year while running against Trump for the presidency that he wants to look at “opportunity zones 2.0.”

He said they “would allow us to target those areas of the country, specifically rural America, that could be the home of brand-new factories around the country. That would provide a haircut of 30% off the profits, which would be the same as reducing the 21% corporate tax rate down significantly.”