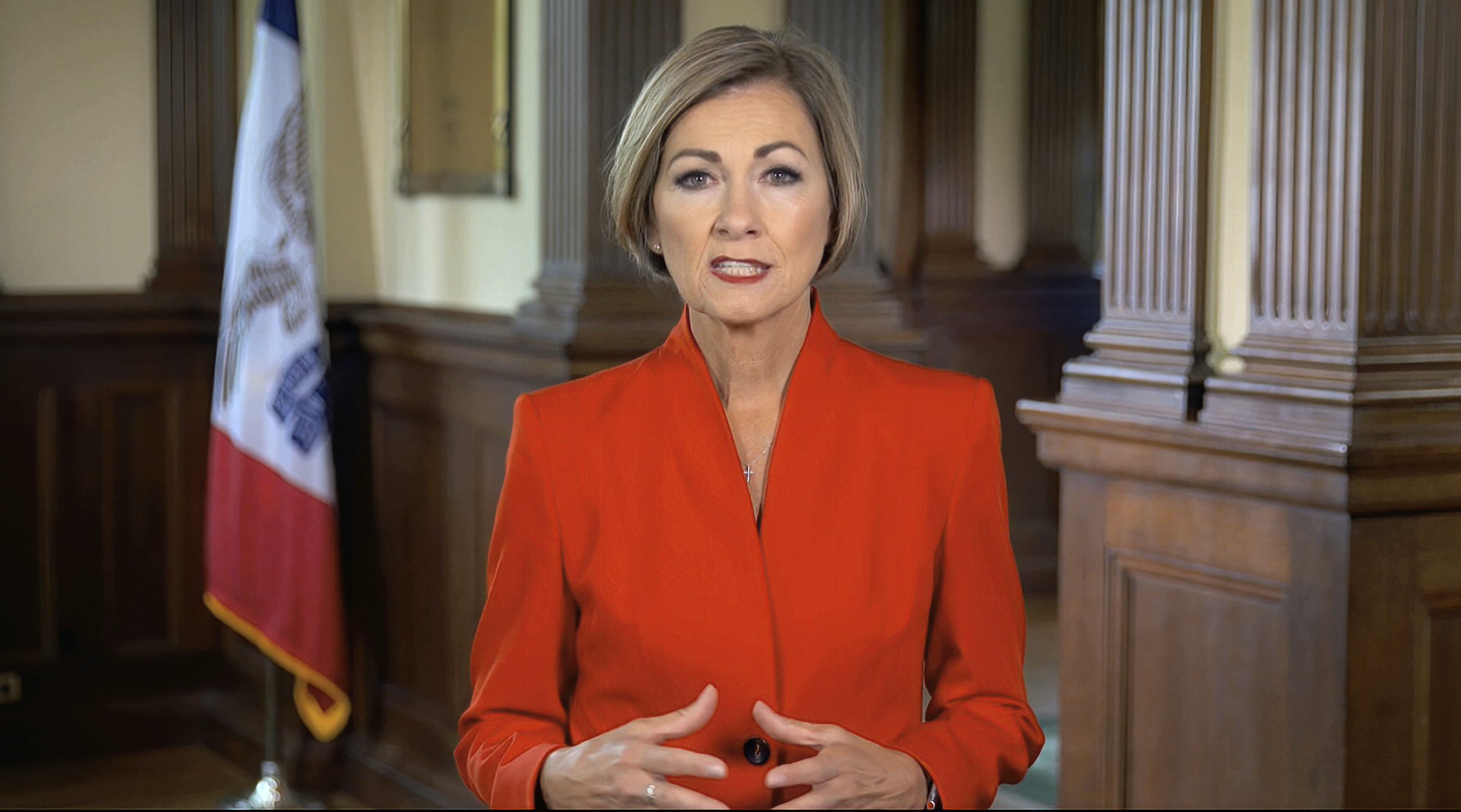

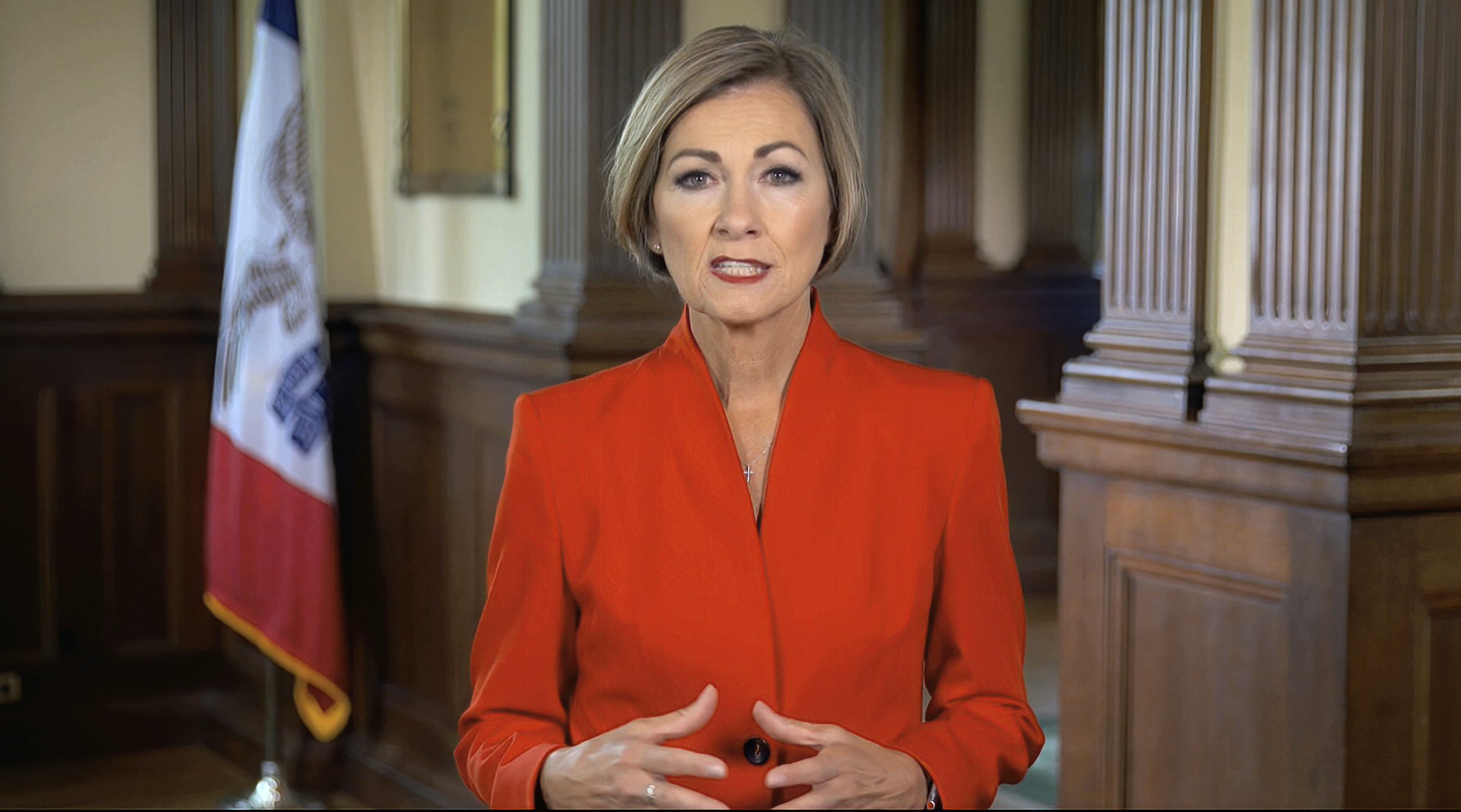

(The Center Square) – Iowa Gov. Kim Reynolds is asking lawmakers to implement a 3.65% flat income tax rate this year and a 3.5% flat tax in 2025.

Lawmakers passed a bill in 2022 that created a flat tax rate of 3.9% by 2026. Reynolds said in her Condition of the State address Tuesday night that the state’s $1.83 billion surplus from fiscal year 2023 and $900 million in reserves mean the state is taking too much from taxpayers.

“This bill represents a total savings of almost $3.8 billion for taxpayers over the next five years. And it gets there by cutting taxes for every Iowan who pays them,” Reynolds said. The average family of four with an income of about $78,000 will see a tax savings of over 25%. A single mother of two making $47,000 would see an even greater savings of more than 42%.”

House Minority Leader Jennifer Konfrst, D-Windsor Heights, said in an interview with Iowa Public Broadcasting that 500,000 Iowans will see no benefit from the flat tax.

“We didn’t hear anything tonight about affordable housing, about childcare, about utilities. We heard none of that.” Konfrst said. “Costs are more than income taxes.”

Reynolds is also asking the Legislature for $96 million to raise teacher salaries.

The money would increase starting teacher pay by 50% to $50,000 a year and set a $62,000 annual minimum salary for teachers with 12 years of experience, the governor said.

“In addition, I’m allocating $10 million to a merit-based grant program that will reward teachers who have gone above and beyond to help their students succeed,” Reynolds said. “These investments will put Iowa in the top-five states for starting pay and help recruit more of the best and brightest to join the teaching profession.”

The unemployment insurance fund is full. Reynolds wants to slash the unemployment insurance payments that employers make by half.

“The result will be significant savings for employers of all sizes, saving more than $800 million over five years,” Reynolds said. “Instead of paying money into the government, these businesses can create more jobs, increase salaries, or reinvest into their communities.”

Konfrst said Democrats have proposed teacher raises for some time, but other questions should be considered.

“We want to know what about paraprofessionals and other education professionals in the school,” Konfrst said. “Some of them are earning less than $10 an hour.”

The governor said she wants to move oversight of special education dollars from Area Education Agencies to the Department of Education. The agencies, commonly known as AEAs, have little accountability, she said.

“Over the last year, in dozens of conversations with parents, teachers, school administrators and AEA staff, it’s become clear that while some of our AEAs are doing great work, others are underperforming,” Reynolds said. “We have superintendents who won’t use their services but are still required to pay for them.”

Studies show Iowa students with disabilities perform below the national average.

“That’s unacceptable. And tonight, I’m announcing legislation to change it,” Reynolds said. “Under my proposal, AEAs will focus solely on students with disabilities, as they should. Independent oversight will move to the Department of Education. And most important, school districts will now control their special education funds—meaning they no longer will be mandated to send those funds to the AEAs.”