The Federal Trade Commission is warning about scammers targeting people with promises to cancel their student loans, and critics say President Joe Biden fueled the fire himself.

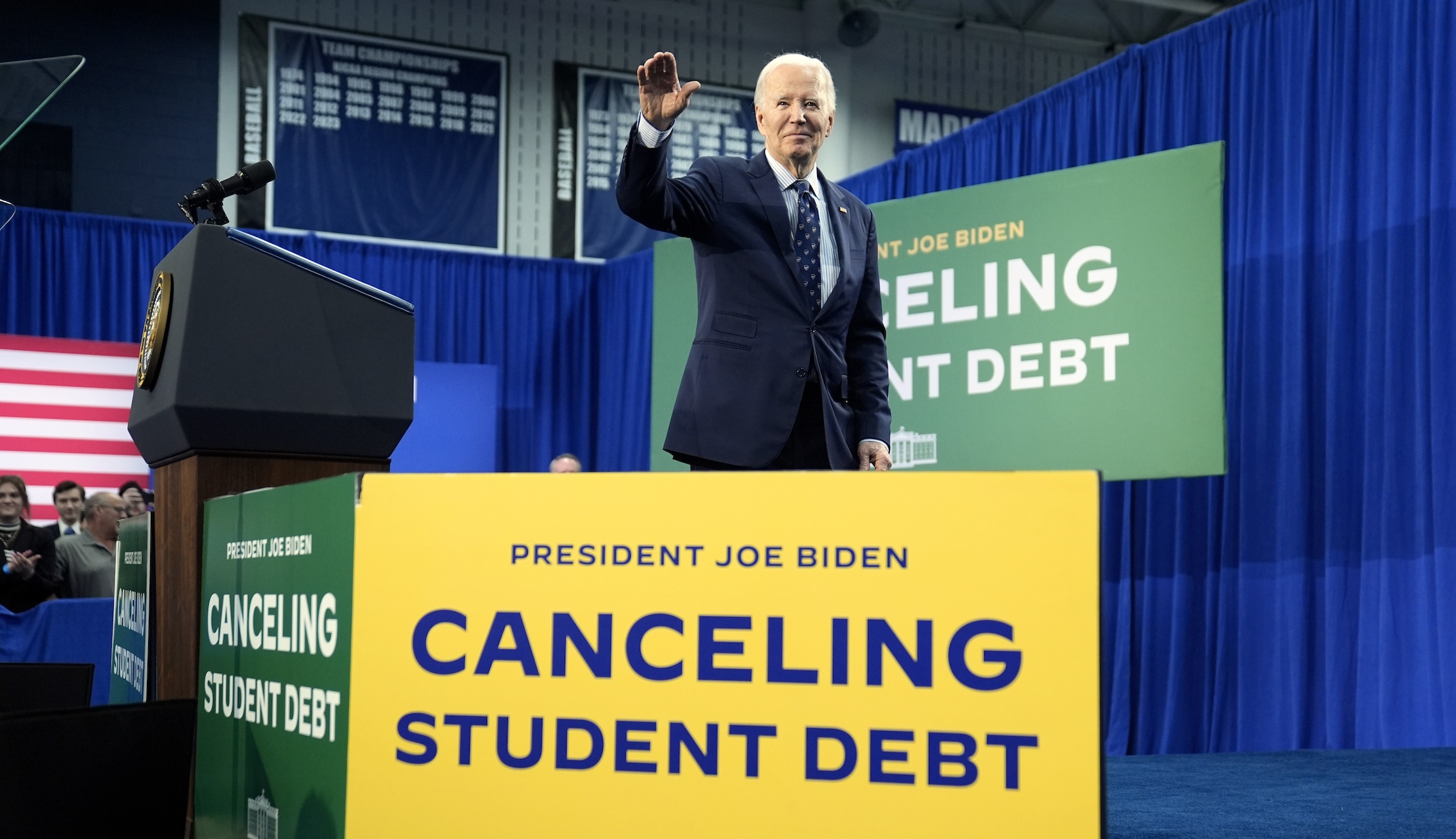

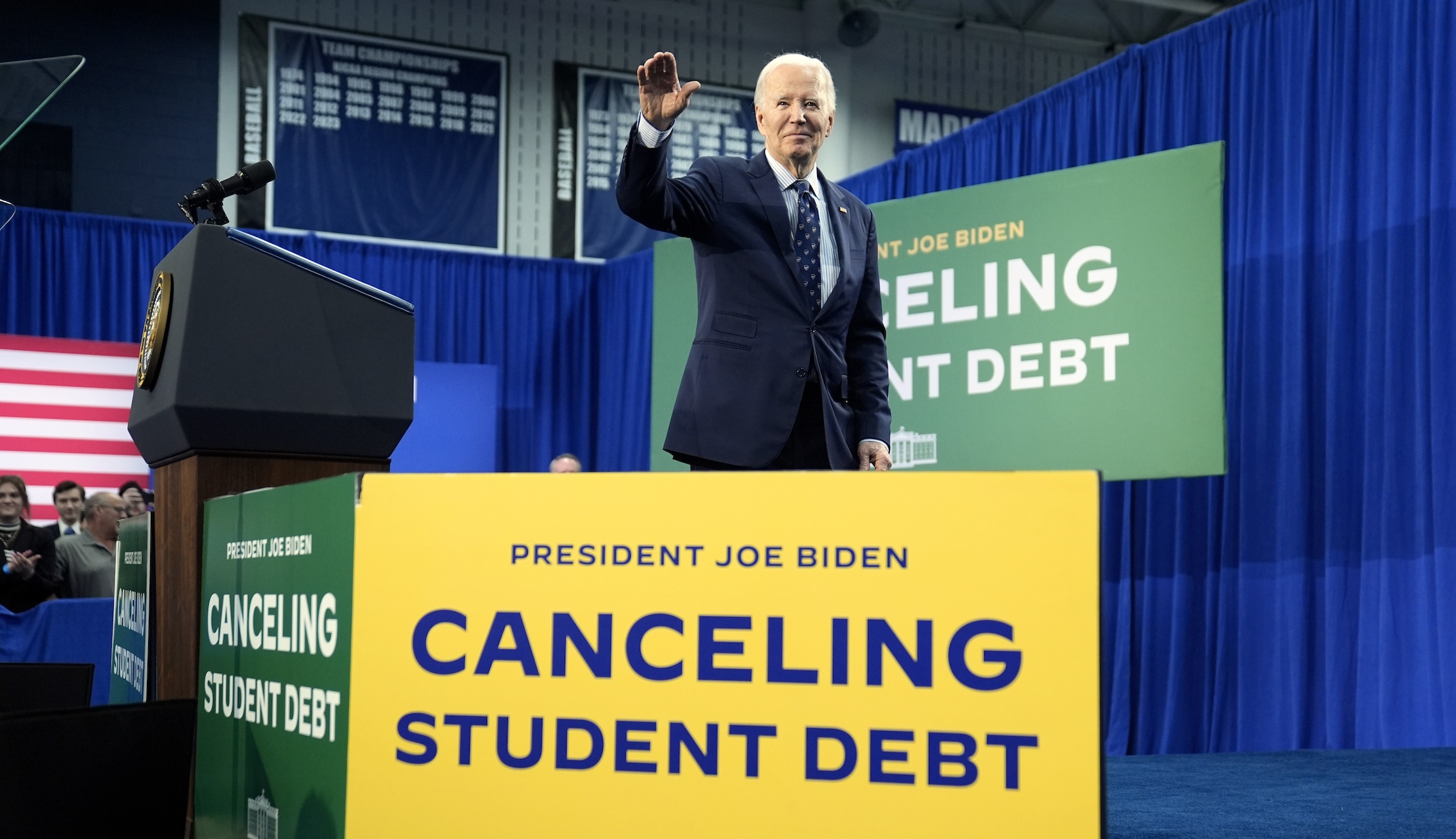

Biden has been pledging to cancel student loans since the 2020 presidential campaign and has rolled out a wide range of programs and proposals toward that end. While his actions so far have affected 4.3 million of the 44 million people with student debt, his headline-grabbing announcements have created an expectation that scammers are eager to exploit.

“Hearing a lot about federal student loan forgiveness in the news? You’re not alone — scammers are, too,” reads an April 16 release from the FTC. “You might get a call from someone saying they’re affiliated with Federal Student Aid (FSA) or the Department of Education. They’re not.”

House Education and the Workforce Committee Chairwoman Virginia Foxx (R-NC) says Biden shares some of the blame.

“The president’s continued hawking of his ‘free college’ agenda is a contributing factor to the rise in bad actors looking to defraud Americans — there’s no question about it,” Foxx said. “Not only does he bear responsibility for this uptick, but he also bears responsibility for pinning taxpayers with the tab every time he announces a new iteration of his scheme.”

The Washington Examiner has reached out to the White House for comment.

Biden proposed ahead of the 2020 presidential election to cancel at least $10,000 per person in student debt. His first attempt at that would cancel up to $20,000 per borrower at a total cost of at least $400 billion. That was struck down by the Supreme Court last summer.

The president has followed up with a stream of cancellation rounds that now tops $150 billion for just over 4 million borrowers. Any amounts that are not repaid are added to the public debt.

Biden and the Department of Education have also created the Saving on a Valuable Education, or SAVE, Plan to reduce the amount future borrowers repay drastically. The Penn Wharton Budget Model estimates that the plan will cost $475 billion over 10 years, and 18 states have argued it is illegal in two separate lawsuits.

“Thousands of people per month are eligible, about 25,000 a month,” Biden said Feb. 21. “They’ll be getting a letter from me letting them know they’re qualified. And when they get that letter, your debt is going to be forgiven.”

Plenty of letters have rolled in since that date, not all of them from the president.

One common scheme is from a fake entity calling itself the “Student-Loan Debt Department,” which sends out emails complete with a case number and a phone number to dial. In reality, it is a scam.

The FTC warning includes tips on how to spot scams, instructing debtors never to pay upfront fees, share login information, or buy into promises of special access to forgiveness programs. In March, the agency reimbursed $4.1 million to 27,584 people who lost money to scammers.

Yet the president’s own promises and overlapping patchwork of programs have led to a situation that is ripe for fraud, argues CATO Institute research fellow Andrew Gillen.

“If I get an offer out of the blue for someone to pay off my mortgage, I know it’s a scam,” Gillen said. “But if the president spent the last three years hyping mortgage forgiveness plans, I’d be much more receptive and gullible.”

A page on studentaid.gov warning against scams says that some make offers for “Biden loan forgiveness” and that loanees have received phone calls, emails, letters, and text messages offering them relief from their federal student loans. One false claim instructs borrowers to “act immediately to qualify for student loan forgiveness before the program is discontinued.”

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

Gillen, who follows education policy as a career, added that he has had trouble keeping track of all the details of Biden’s different cancellation plans and their legal status and says the administration’s rush to get debt forgiven before lawsuits emerge creates an artificial sense of urgency.

“They’ve been announcing big student loan forgiveness plans for years now, but many borrowers haven’t seen any forgiveness,” he said. “This makes borrowers more susceptible to scammers.”