Employers in the United States added 336,000 workers to their payrolls in September, the Department of Labor said Friday.

The unemployment rate was unchanged at 3.8 percent.

The much-better-than-expected surge in employment puts pressure on the Federal Reserve to hike again at its two meeting that starts on the final day of October. The Fed decided at its last meeting in September to hold rates steady to see how earlier rate increases are affecting the economy. Prior to today, the market was pricing in around a 20 percent chance of a hike at the next meeting.

In the preliminary report for August, the Labor Department said that the economy added 187,000 jobs and the unemployment rate rose to 3.8 percent. The change in employment for July was revised up by 79,000, from 157,000 to 236,000, and the change for August was revised up by 40,000, from 187,000 to 227,000. Those combine to raise employment by 119,000 higher than what had been reported.

Economists had forecast the economy would add around 160,000 jobs, with the range of forecasts in the Econoday survey running from 105,000 to 235,000. So the results were much higher than even the most bullish analysts had forecast.

The unemployment rate was expected to tick down to 3.7 percent from the 3.8 percent reported a month ago.

Earlier this week, the Labor Department said that job listings came in at 9.61 million on the last day in August, much higher than the consensus estimate and above the top of the range of forecasts. This suggests that demand for workers surged at the end of the summer, perhaps because many businesses no longer expect the economy to fall into a recession in the near term.

Yields on bonds with longer maturities have been soaring, narrowing the inversion in the yield curve. While many economists have begun to worry that higher interest rates could push the economy into a recession, others view the rise in long-term rates as a sign of confidence that growth will be stronger in the future.

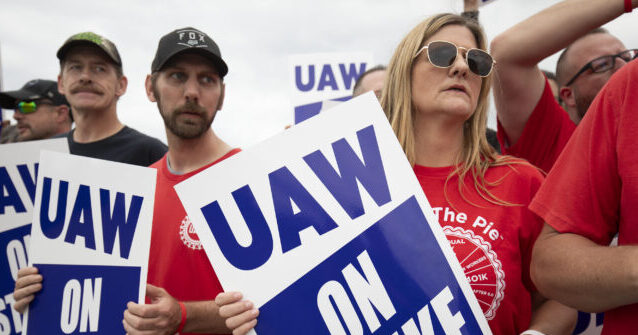

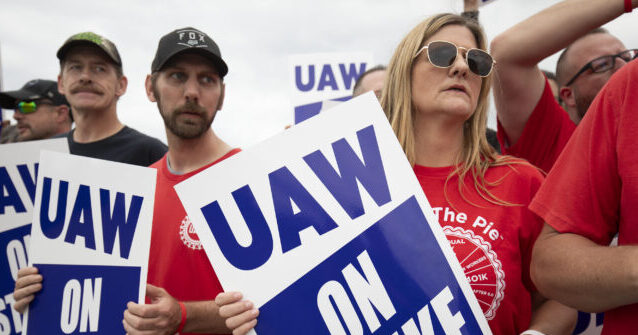

While the labor market has been rife with turmoil, most notably in the form of strikes by labor unions, employers are still holding on to workers. Jobless claims, which are a proxy for layoffs, were just 207,000 in in seven-day period through September 27 and the four-week moving average of claims fell to 208,750, a very low figure by historical standards.

The monthly jobs figures were initially reported at levels below expectations in both June and July, seemingly breaking a several-months-long streak in which jobs numbers consistently came in higher than forecast. The revisions show that July’s jobs figure of 227,000 was actually higher than the 200,000 expected.

The private sector added 263,000, according to the Labor Department. That was much higher than the 89,000 reported on Wednesday by ADP, the payroll processor. ADP says its report is no longer meant to forecast the Labor Department’s survey and is instead an independent data point about the economy.