Former Rep. Barney Frank (D-MA), author of the 2010 Dodd-Frank bill, sat on the board for Signature Bank which collapsed in the wake of the Silicon Valley Bank (SVB) implosion.

The U.S. Treasury Department, the Federal Reserve, and the Federal Deposit Insurance Corporation (FDIC) announced in a joint statement on Sunday the plan to manage the fallout of SVB’s collapse as well as the demise of Signature Bank.

“Today we are taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system,” the joint statement read. “This step will ensure that the U.S. banking system continues to perform its vital roles of protecting deposits and providing access to credit to households and businesses in a manner that promotes strong and sustainable economic growth.”

“We are also announcing a similar systemic risk exception for Signature Bank, New York, New York, which was closed today by its state chartering authority,” it added. “All depositors of this institution will be made whole. As with the resolution of Silicon Valley Bank, no losses will be borne by the taxpayer.”

Silicon Valley Bank collapsed last Friday after depositors rushed to withdraw money in fear of its impending fall. It was the 16th largest bank in the country.

NEW:

*Signature Bank has been closed

*All depositors of Silicon Valley Bank and Signature Bank will be fully protected

*Shareholders and certain unsecured debtholders will not be protected

*New Fed 13(3) facility announced with $25 billion from ESF to backstop bank deposits pic.twitter.com/LKipIRMg1T

— Nick Timiraos (@NickTimiraos) March 12, 2023

The bank that was just closed, Signature Bank, is the one that Barney Frank joined after retiring from Congress pic.twitter.com/25TNEFn3GK

— Lee Fang (@lhfang) March 12, 2023

Signature Bank became “popular among crypto companies” and provided “deposit services for its clients’ digital assets but did not make loans collateralized by them” according to Fox Business.

Prior to the SVB collapse, Signature said it had been trying to limit such deposits, pledging it was in a “well-diversified financial position” and had “limited digital-asset related deposit balances in the wake of industry developments.”

“We want to make it clear again that Signature Bank is a well-diversified, full-service commercial bank with more than two decades of history and solid performance serving middle market businesses,” Joseph J. DePaolo, Signature Bank Co-founder and Chief Executive Officer said in a statement.

“We have built a strong reputation serving commercial clients through nine business lines and reached in excess of $100 billion in assets by continually executing our single-point-of-contact, relationship-based model where banking teams are capable of meeting all client needs,” he added.

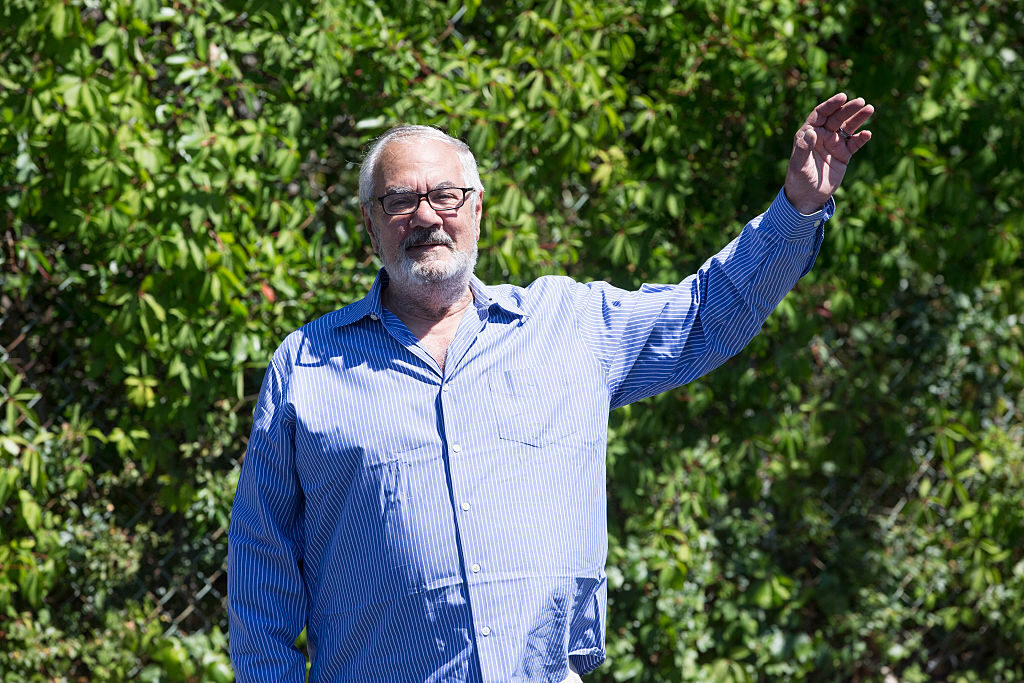

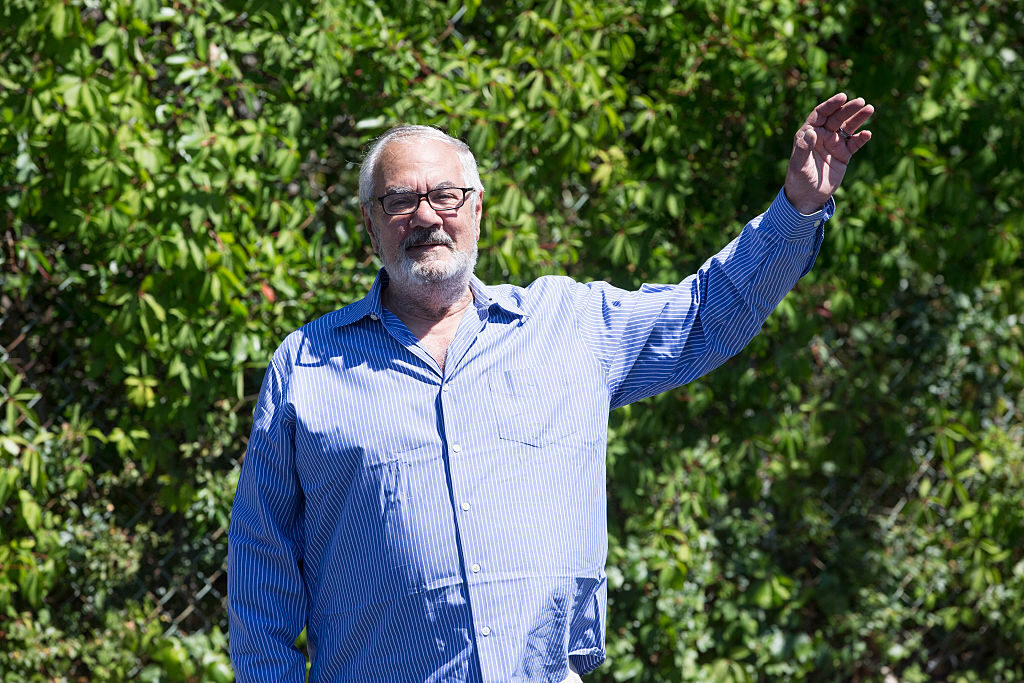

File/Retired Congressman Barney Frank arrives for a fundraiser for U.S. Presidential candidate Hillary Clinton in Provincetown, Mass., Aug. 21, 2016. (Keith Bedford/The Boston Globe via Getty)

Frank, who sat on Signature Bank’s board, strongly supported legislation in 2018 that curtailed some of the regulations that his own law Dodd-Frank put in place.

“Dodd-Frank imposed additional regulatory safeguards on banks with more than $50 billion in assets, but the rollback that passed this week, among other things, raises that threshold to $250 billion,” the Washington Post reported in 2018.

“Signature Bank has more than $40 billion in assets and can now grow significantly without automatically facing additional regulation. Frank has served on Signature’s board for three years and has received more than $1 million in payments from the bank during that time,” the report added.

Former Rep. Barney Frank (D-MA) endorsed changes to his own Dodd-Frank law in 2018 that freed mid-sized banks from undergoing stress tests. He sits on Signature Bank’s board, which just collapsed.

I reached him via phone tonight and he declined to comment https://t.co/JY77rtNkHt

— Joseph Zeballos-Roig (@josephzeballos) March 13, 2023

When pressed at the time, Frank said while indeed stood to benefit from the rollback, his position at Signature Bank did not influence his decision.

“My being on the board has not changed my position on this at all,” Frank said. “These efforts began well before I began at Signature Bank.”

In 2009, Breitbart News editor-at-large Joel Pollak confronted Frank, who was then the chairman of the House Financial Services Committee, asking if he shared any responsibility for the global financial meltdown of 2008.

“Frank, perhaps defensive over charges that he fought Bush administration efforts to reign in Freddie Mac and Fannie Mae in 2001, dismissed the question as ‘a right-wing attack,’ and challenged the student to make clear what else a Democratic congressman from Massachusetts might have done to prevent the crisis. Per the Los Angeles Times:

Frank, perhaps defensive over charges that he fought Bush administration efforts to reign in Freddie Mac and Fannie Mae in 2001, dismissed the question as ‘a right-wing attack,’ and challenged the student to make clear what else a Democratic congressman from Massachusetts might have done to prevent the crisis.

The student, Joel Pollak, replied that perhaps Frank could have done more to patrol executive bonuses to AIG and other giants bailed out with $700 billion in taxpayer funds. The exchange got pretty heated — another student came to Pollak’s rescue, imploring Frank not to label the student as a conservative but to answer his question.

But Frank insisted that he had not been chairman of the committee before 2007, and was hardly to blame for policies before that.

Speaking with Greta Van Susteren of Fox News after the exchange, Pollak said Frank had been putting too much blame on Republicans.

“When I heard his speech and I heard him blame everyone from Ronald Reagan to the conservatives of the 1930s for opposing whatever it was he was pushing, I thought to myself, Hang on a second,” said Pollak.

File/Speaker of the House Nancy Pelosi, D-Calif., greets former Rep. Barney Frank, D-Mass., during a bill enrolment ceremony after the House passed the Respect for Marriage Act in the U.S. Capitol on Thursday, December 8, 2022. The bill mandates federal protection for same-sex marriages. (Tom Williams/CQ-Roll Call, Inc via Getty Images)

“This guy is someone in a position of responsibility and authority. This guy is the one who’s making the regulations. He’s responsible, essentially, for recreating and redesigning our financial system, and he’s not taking any responsibility for what happened at all,” he added.