The White House Pulls in the Fed Vice Chair

Even President Joe Biden is having trouble finding qualified applicants for White House job openings.

The Wall Street Journal reports that Biden is planning to tap Federal Reserve Vice Chair Lael Brainard to serve as director of the National Economic Council. This would be something of a step down for Brainard, who is currently the number two at the Fed. Typically, an appointment to the NEC would be seen as a stepping stone to a Fed governorship or even the chair. The move suggests that the White House came up short when looking for economic policy advisers to replace the outgoing NEC honcho, Brian Deese.

Federal Reserve Governor Lael Brainard attends a “Fed Listens” event at the Federal Reserve headquarters in Washington, DC, on October 4, 2019. (ERIC BARADAT/AFP via Getty Images)

Brainard appears to have been promised the role of Treasury Secretary when Janet Yellen steps down. The Biden team had considered Brainard for the role early on but deferred to the objections of left-wing Democrat activists who saw her as too moderate and pro-business. Rumors that Yellen might be ready to leave the administration have been circulating for months, but the appointment of Brainard to the NEC suggests that no such departure is imminent. If Yellen were already moving toward the exit aisle, it would be cleaner to keep Brainard in place.

At the Fed, Brainard was seen as an advocate for a more dovish view on inflation. She was appointed to the Fed’s board of governors by President Barack Obama and elevated to Vice Chair for supervision of banks by Biden. Prior to the Fed, she served as the Treasury Department’s top diplomat and was an advisor to Bill Clinton on international economics.

Inflation Also Rises

The report on the consumer price index (CPI) for January showed that inflation is not falling as rapidly as some hoped. The headline figure came in slightly higher than the consensus estimate with a gain of 0.5 percent month-to-month and 6.4 percent from a year ago. This will get reported as a decline in year-over-year inflation, but rounding exaggerates the decline. In December, the year-over-year CPI gain was 6.45 percent. In January this declined to 6.41 percent.

The December figure was revised from a 0.1 percent decline to a 0.1 percent increase, and November was revised up as well, so inflation was already hotter than previously thought. As Jason Furman pointed out on Twitter, inflation looks much stronger than it did a month ago.

This is what 3-month annualized inflation looked like a month ago and what it looks like now. The difference is shifting the window to include January (a high month) and new seasonal factors.

Every measure 1.5 to 1.9pp higher now. pic.twitter.com/2V5NGxW1lb

— Jason Furman (@jasonfurman) February 14, 2023

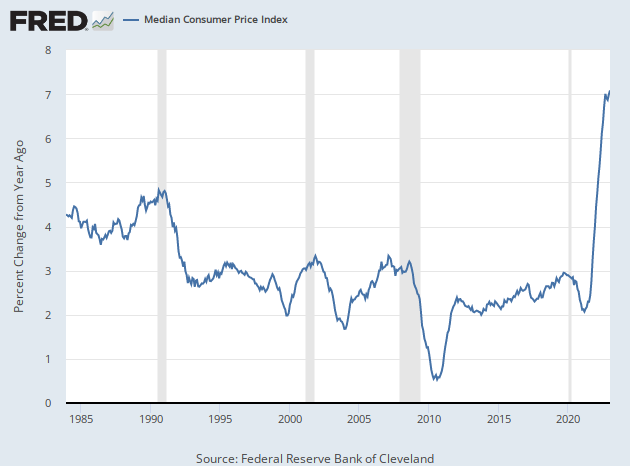

The Cleveland Fed’s median CPI rose from 0.6 percent to 0.7 percent. Sixteen percent trimmed mean CPI ticked up from 0.5 percent to 0.6 percent. This suggests that the move in inflation was driven not by outliers but by a rise in underlying inflation. This is the third consecutive rise in both median and trimmed mean inflation, suggesting that the underlying trend is for more inflation in the future. On a year-over-year basis, median CPI rose to 7.1 percent, the third consecutive increase and the highest in records going back to 1984.

Gimme Shelter…and Energy

The rise in headline CPI was driven by shelter and energy. According to the Bureau of Labor Statistics, which is responsible for producing the consumer price index, the index for shelter was by far the largest contributor to the CPI gain, accounting for nearly half of the monthly increase. The two percent rise in energy prices accounted for around another one-quarter of the overall increase. Gasoline prices jumped 2.4 percent, but every subcategory of the energy index was up.

Food prices continue to rise at an extremely rapid rate. The topline food index was up 0.5 percent, an acceleration from December’s 0.4 percent gain. On a 12-month basis, food prices are up 10.1 percent. Restaurant prices rose 0.6 percent, producing an 8.2 percent year-0ver-year increase. The prices of food at home — which rival gas prices for the most consumer salient prices — rose 0.4 percent and are up 11.3 percent for the year. The price of eggs rose 8.5 percent in January and is up 70 percent from a year ago.

Core CPI, which excludes food and energy prices, rose 0.4 percent, up from December’s 0.3 percent and a tenth of a percentage point higher than expected. Compared with a year ago, core prices are up 5.6 percent, down from December but also a tenth of a point higher than the consensus forecast. Over the last three months, core services prices have risen by 6.8 percent annualized. Much of that is due to ongoing inflation in the shelter category, which saw both rent and owners’ equivalent of rent rise by 0.7 percent for the month. Even excluding rent, however, services prices were up 0.6 percent.

A sign advertises an apartment for rent on June 24, 2016 in the Brooklyn borough of New York City. (Drew Angerer/Getty Images)

The biggest news in the CPI report may have been the unexpected increase in core goods prices. These rose 0.1 percent for the month, ending the three-month streak of declining goods prices. Used car prices fell again, tumbling 1.9 percent. But wholesale price data indicate that used car prices are probably going to be adding to inflation in future reports. Excluding used car prices, core goods rose 0.5 percent. The persistence of inflation in goods was not expected and may pull up some estimates of where inflation is headed.

The Fed Factor

Of course, what everyone wants to know is how the Fed will read this report. We suspect Jerome Powell will interpret it as confirming his view that disinflationary pressures remain too narrow and core services inflation too hot. Certainly, there’s nothing in the report that would cause the Fed to rethink its often stated position that at least two more hikes will be necessary.

Could the report push the Fed to be even more hawkish? While this report is probably not enough to push the Fed in a more hawkish direction, it does leave open the possibility if future inflation reports come in as strong. The underlying trends appear to be for a re-acceleration of inflation; and if those trends continue into the spring, predictions that the Fed will pause at the five percent to 5.25 percent range will have to be rethought.