The Biden administration will hold a massive offshore oil and gas lease sale Wednesday after its efforts to scrap the auction over potential climate and environmental impacts failed.

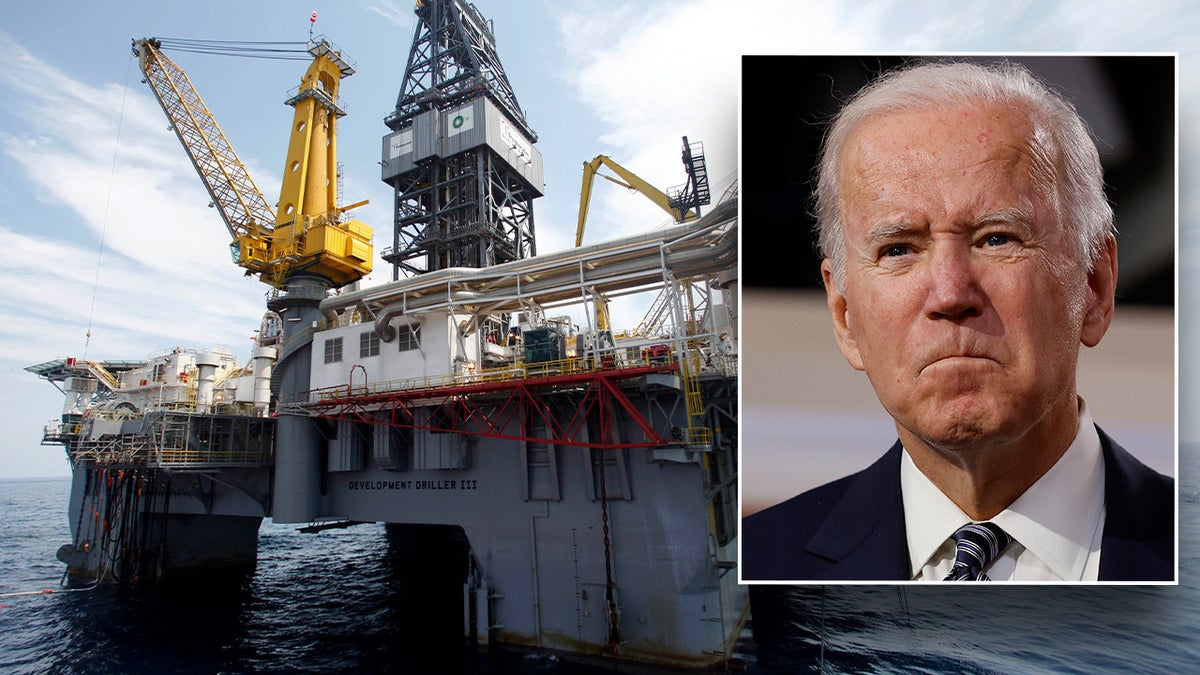

The Bureau of Ocean Energy Management (BOEM) will hold Lease Sale 261, which spans more than 73 million acres across the Gulf of Mexico and is expected to garner hundreds of millions of dollars worth of bids from industry. BOEM’s sale comes a month after an appeals court forced the agency to scrap eco restrictions on the sale and nearly two years after the White House tried to cancel the sale altogether.

“It’s a very important lease sale considering the uncertainty on the horizon for additional offshore oil and gas leasing,” said Erik Milito, president of the National Ocean Industries Association, which represents both traditional and renewable offshore energy producers. “There are competing pressures heading into the event.

“On one hand, unless there is congressional action, this marks the final lease sale until at least 2025,” he told Fox News Digital. “We operate in a prospective business where companies must acquire new lease blocks for exploration and potential development. However, there is no guarantee that acquired leases have enough hydrocarbons to warrant investment. Companies want to invest in the Gulf of Mexico, and this represents their final opportunity to gather more leases for a while.”

MAJOR ‘CLIMATE DECEPTION’ LAWSUIT AGAINST BIG OIL VOLUNTARILY DISMISSED

As a result of Biden administration policies, 2024 is expected to be the first year since 1966 without an offshore oil and gas lease sale. (Getty Images)

Milito added that, on the other hand, the Biden administration has “repeatedly shown an unwillingness” to encourage offshore oil and gas production and could pursue policies delaying or shrinking future sales. Such policies would discourage investment in domestic exploration, driving it overseas instead, he said.

“Companies have already faced a slate of regulatory and policy-driven disincentives as they try to develop what is fundamentally a national strategic asset,” Milito said. “While the U.S. offshore energy regulatory structure has historically been a competitive advantage, at a certain point, companies will choose to invest their dollars in regions with fair and predictable regulations and policies.”

DARK MONEY GROUP WIRED MILLIONS TO LAW FIRM SUING BIG OIL WITH DEM STATES

In November, the 5th Circuit Court of Appeals ruled that last-minute restrictions BOEM placed on Lease Sale 261 under a closed-door settlement with climate advocacy organization were illegal, and the agency was required to move forward with the sale as originally planned. Following the ruling, BOEM scheduled the sale, which had originally been slated for late September, for Wednesday.

The July settlement with environmental groups, meanwhile, came after years of litigation and specifically expands protections for the Rice’s whale, a species listed as endangered. The settlement made the lease sale smaller by 6 million acres and created multiple vessel restrictions for companies that obtain leases which energy groups argued would stifle industry interest.

According to the most recent federal data, about 2 million barrels of oil are drilled in the Gulf of Mexico daily. (Gary Tramontina/Corbis via Getty Images)

In May 2022, the White House intervened in Lease Sale 261 and the two other remaining scheduled offshore lease sales, canceling all three in an unexpected move “due to factors including conflicting court rulings.” However, the three sales were all reinstated under the 2022 Inflation Reduction Act, which tethers future oil and gas lease sales to future renewable energy lease sales, effectively forcing the administration to pursue both.

A BOEM spokesperson declined comment.

Under federal law, the Department of the Interior is required to periodically issue five-year plans scheduling future offshore lease sales. Lease Sale 261 is the final sale scheduled under the 2017 plan that expired last year.

CLICK HERE TO GET THE FOX NEWS APP

Earlier this month, the administration finalized the newest five-year offshore oil and gas leasing program, which schedules just three Gulf of Mexico lease sales through 2029, marking the fewest number of sales ever included in such a plan. As a result, the next sale is slated for 2025 and 2024 is expected to be the first year without an offshore lease sale since the mid-1960s.

“Simply put, this final 5-year program fails to meet the energy needs of the American people and could threaten to increase reliance on foreign energy sources,” American Petroleum Institute Vice President of Upstream Policy Holly Hopkins said last week.

“Demand for affordable, reliable energy is only growing, yet the administration is choosing to limit future production in a region that plays a critical role in powering our nation and supplies among the lowest carbon-intensive barrels in the world,” she added. “This program is a step in the wrong direction for U.S. energy security and will only make it harder to meet growing energy demand over the long-term.”