Six Republican-led states are suing the Biden administration over its proposal to forgive student loan debt for tens of millions of Americans.

The states — Iowa, Kansas, Missouri, Nebraska, South Carolina and Arkansas — are accusing the administration of overstepping its executive powers without authorization from Congress. Iowa has a Democratic attorney general, but Republican Gov. Kim Reynolds signed on the state’s behalf.

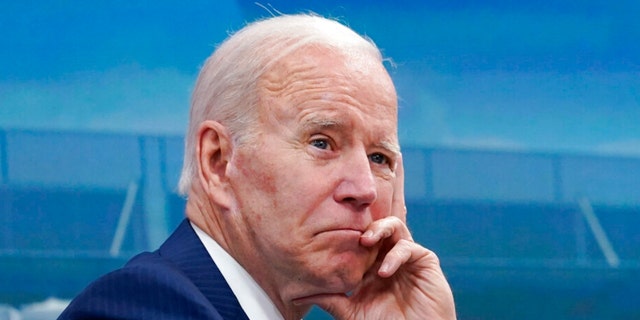

President Joe Biden said in August his administration would cancel up to $20,000 in student loan debt for tens of millions of Americans, leading conservatives to question the legality of the plan and the political motivation of the move given that the midterm elections are coming up.

But the administration this week quietly scaled back eligibility requirements for the debt relief. Now, borrowers with loans guaranteed by the federal government but held by private lenders are ineligible for debt cancelation, according to the Education Department.

CNN, MSNBC AVOID BIDEN’S ‘WHER’S JACKIE?’ SNAFU AFTER OBSESSING OVER TRUMP’S ‘TIM APPLE’ GAFFE

Six Republican-led states are suing the Biden administration over its proposal to forgive student loan debt for tens of millions of Americans. (AP Photo/Susan Walsh)

The department updated its website Thursday to say that borrowers with federal loans owned by private banks will now be ineligible under Biden’s plan unless they consolidated their loans into the government’s direct lending program before Thursday. The change will impact about 770,000 borrowers, the department said.

The GOP states argue in the lawsuit, filed Thursday in a federal court in Missouri, that Biden’s plan is “not remotely tailored to address the effects of the pandemic on federal student loan borrowers,” which is required under the 2003 federal law the administration is using to claim its legality.

The states highlight that Biden said in an interview last month that the COVID-19 pandemic is over, but is continuing to use the ongoing health emergency to justify the debt relief.

“It’s patently unfair to saddle hard-working Americans with the loan debt of those who chose to go to college,” Arkansas Attorney General Leslie Rutledge, who is leading the lawsuit, said in an interview.

“The Department of Education is required, under the law, to collect the balance due on loans. And President Biden does not have the authority to override that,” she continued.

The lawsuit said Missouri’s loan servicer is facing a number of “ongoing financial harms” due to the student loan forgiveness.

The states allege that Missouri’s loan servicer will lose revenue from loans it owns through the Federal Family Education Loan Program, which had allowed private banks to authorize and manage federally backed student loans until the program ended in 2010.

ARIZONA AG SUES BIDEN TO STOP ‘ILLEGAL’ STUDENT LOAN HANDOUT

The states — Iowa, Kansas, Missouri, Nebraska, South Carolina and Arkansas — are accusing the administration of overstepping its executive powers without authorization from Congress. (AP Photo/Evan Vucci)

Other states that joined the lawsuit argue that the president’s debt relief proposal will ultimately disrupt revenue to state coffers.

The administration maintains its belief that the forgiveness program sits on solid legal ground.

“Republican officials from these six states are standing with special interests, and fighting to stop relief for borrowers buried under mountains of debt,” White House spokesman Abdullah Hasan said Thursday. “The president and his administration are lawfully giving working and middle-class families breathing room as they recover from the pandemic and prepare to resume loan payments in January.”

Biden’s plan will cancel $10,000 in student loan debt for people making less than $125,000 or households making less than $250,000. Borrowers who meet the income limit and received a Pell Grant, aid given to applicants most in need financially, will have a total of $20,000 in debt forgiven.

The administration also said it would extend the current pause on federal student loan repayments through the end of the year. This hold on payments began near the start of the pandemic.

The administration maintains its belief that the forgiveness program sits on solid legal ground. (Getty Images)

CLICK HERE FOR THE FOX NEWS APP

Republican officials have slammed the proposal as an unfair government giveaway for relatively affluent people and that it will cost individuals who did not pursue a college degree. Democratic lawmakers in tough reelection races have distanced themselves from the student loan forgiveness plan.

The GOP has also attacked Biden’s plan over its price tag and impact on the nation’s budget deficit. The Congressional Budget Office said this week that the program will cost about $400 billion over the next three decades, but the White House said the CBO’s estimate of the $21 billion the plan will cost in its first year alone is lower than what the administration initially expected.

The Associated Press contributed to this report.