House Republicans said they obtained information to prove “indisputably” that Hunter Biden lied under oath multiple times during his congressional deposition earlier this year, Fox News Digital has learned.

The House Ways & Means Committee on Wednesday held a mark-up session to discuss documents protected under IRS code 6103 — a portion of the tax code that keeps certain information confidential. Discussing that material without it being properly released by the House Ways & Means Committee is considered a felony.

The panel voted on Wednesday to release that information.

“Hunter Biden has shown once again he believes there are two systems of justice in this country – one for his family, and one for everyone else. Not only did Hunter Biden refuse to comply with his initial subpoena until threatened with criminal contempt, but he then came before Congress and lied,” House Ways & Means Committee Chairman Jason Smith told Fox News Digital Wednesday. “The Ways and Means Committee’s investigation, and the documents released today, are not part of a personal vendetta against Hunter Biden, but are meant to ensure the equal application of the law.”

Smith said the documents the committee obtained reveal that Hunter Biden lied at least three times during his deposition.

Smith noted that “lying during sworn testimony is a felony offense that the Department of Justice has prosecuted numerous individuals for in recent years, and the American people expect the same accountability for the son of the President of the United States.”

“Hunter Biden’s lies under oath, and obstruction of a congressional investigation into his family’s potential corruption, calls into question other pieces of his testimony,” Smith said. “The newly released evidence affirms, once again, the only witnesses who can be trusted to tell the truth in this investigation are the IRS whistleblowers.”

Hunter Biden has been charged in two separate jurisdictions stemming from Special Counsel David Weiss’ years-long investigation into him.

The first son pleaded not guilty to federal gun charges in U.S. District Court for Delaware. He was charged with making a false statement in the purchase of a firearm; making a false statement related to information required to be kept by a licensed firearm dealer; and one count of possession of a firearm by a person who is an unlawful user of or addicted to a controlled substance.

The first son also pleaded not guilty to federal tax charges in the U.S. District Court for the Central District of California — specifically, three felonies and six misdemeanors concerning $1.4 million in owed taxes that have since been paid.

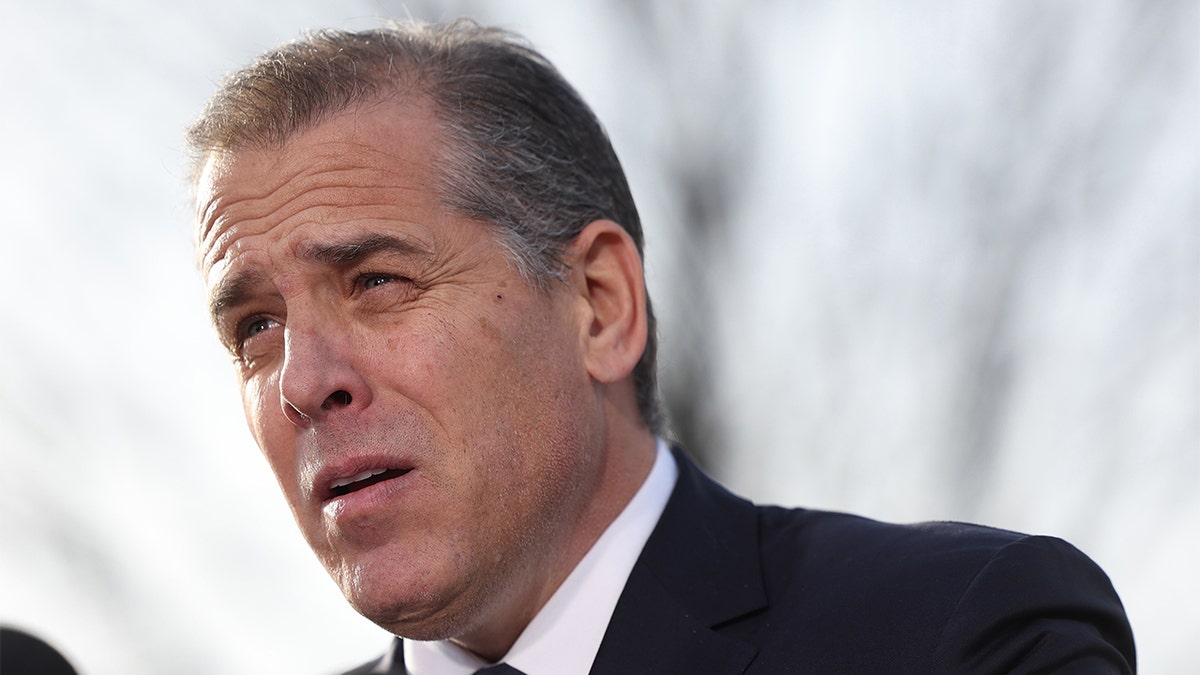

President Joe Biden’s son Hunter Biden has reportedly people that he may have to “flee” the country if Trump wins in 2024. (Kevin Dietsch/Getty Images)

Weiss alleged a “four-year scheme” when the president’s son did not pay his federal income taxes from January 2017 to October 2020 while also filing false tax reports. Weiss filed the charges in the U.S. District Court for the Central District of California.

IRS whistleblowers Gary Shapley and Joseph Ziegler approached Congress earlier this year, alleging that prosecutorial decisions made throughout the federal investigation into the president’s son were impacted by politics.

Shapley and Ziegler have said they were frustrated that the Justice Department did not charge Hunter Biden for failing to pay federal income tax for 2014 and 2015. They alleged that Weiss had allowed the statute of limitations to expire for tax charges against Hunter Biden from 2014 and 2015 in D.C.

Shapley, who led the IRS portion of the probe, said that Hunter Biden should have been charged with tax evasion for 2014, and for filing false tax returns for 2018 and 2019. With regard to the 2014 tax returns, Shapley said that Hunter Biden did not report income from Ukrainian natural gas firm Burisma Holdings.

Fox News Digital first reported in December 2020 that Hunter Biden did not report “approximately $400,000” in income he collected from his position on the board of Burisma Holdings when he joined in 2014.

This is a developing story. Please check back for updates.