Hunter Biden’s attorney blasted the decision by a federal judge who refused to dismiss tax charges against the first son, saying they will continue to fight the “abnormal way” Special Counsel David Weiss has handled the case.

U.S. District Judge Marc Scarsi of Los Angeles rejected Hunter Biden’s request to dismiss the charges against him, after Weiss accused the first son of a four-year scheme to avoid paying $1.4 million in taxes.

JUDGE REJECTS HUNTER BIDEN REQUEST TO TOSS FEDERAL TAX CHARGES

Hunter Biden’s lawyers claimed in their motions to dismiss the charges that federal prosecutors caved to political pressure from Republicans. They also claimed the president’s son had immunity under a previous plea deal that he had negotiated, which later collapsed.

President Biden and Hunter Biden during the Easter Egg Roll on the South Lawn of the White House on Monday, April 1, 2024. (Michael Reynolds/EPA/Bloomberg via Getty Images)

“We strongly disagree with the Court’s decision and will continue to vigorously pursue Mr. Biden’s challenges to the abnormal way the Special Counsel handled this investigation and charged this case,” Biden attorney Abbe Lowell said in a statement Tuesday.

Weiss charged Hunter Biden in December, alleging a “four-year scheme” when the president’s son did not pay his federal income taxes from January 2017 to October 2020, while also filing false tax reports.

The charges break down to three felonies and six misdemeanors concerning $1.4 million in owed taxes that have since been paid.

In the indictment, Weiss alleged that Hunter “engaged in a four-year scheme to not pay at least $1.4 million in self-assessed federal taxes he owed for tax years 2016 through 2019, from in or about January 2017 through in or about October 15, 2020, and to evade the assessment of taxes for tax year 2018 when he filed false returns in or about February 2020.”

Hunter Biden arrives with attorney Abbe Lowell at the O’Neill House Office Building for a closed-door deposition in a Republican-led investigation into the Biden family, on Capitol Hill, Feb. 28, 2024. (AP Photo/J. Scott Applewhite)

The special counsel alleged that Hunter “spent millions of dollars on an extravagant lifestyle rather than paying his tax bills,” and that in 2018, he “stopped paying his outstanding and overdue taxes for tax year 2015.”

PROSECUTORS SLAM HUNTER BIDEN ATTORNEYS IN FEDERAL COURT: ‘YOU ATTACK THE FACTS’

Hunter Biden pleaded not guilty to all charges.

Lowell, in court last week, argued that a diversion agreement on the tax charges was still in effect.

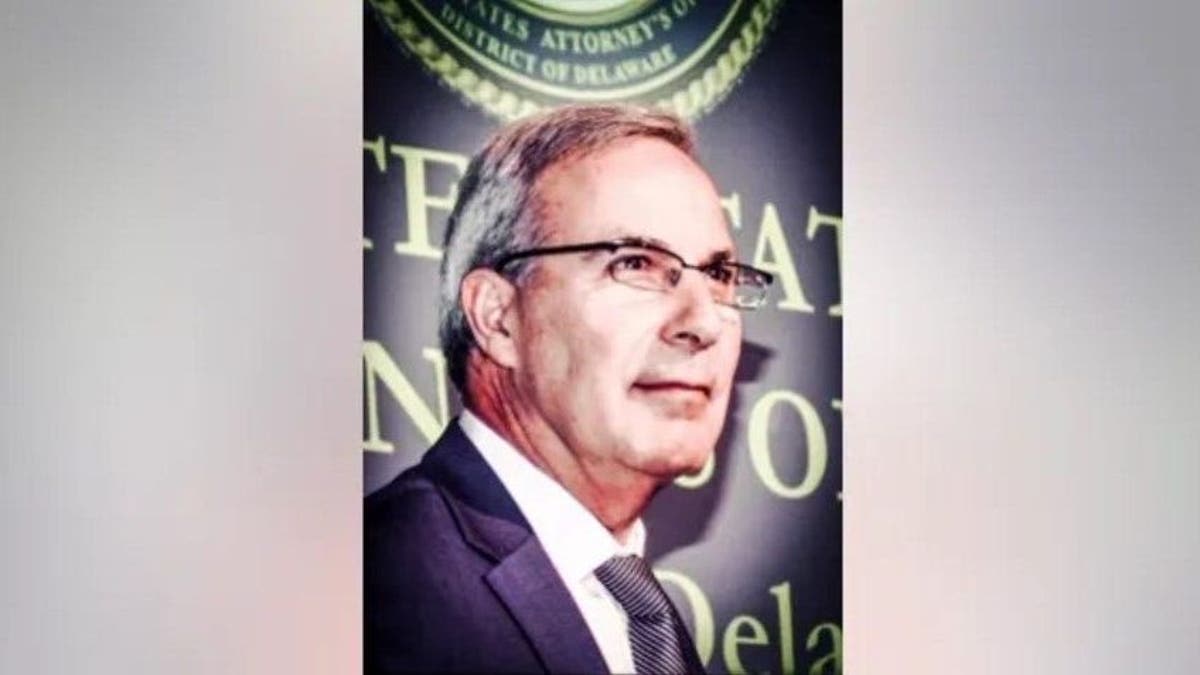

Special Counsel David Weiss (Department of Justice)

The diversion agreement was included as part of the original plea deal that collapsed in July. Biden was set to plead guilty to two misdemeanor tax counts of willful failure to pay federal income tax, which would have allowed him to avoid jail time on a felony gun charge. That deal fell apart during his last court appearance. The president’s son, in July, was then forced to plead not guilty to two misdemeanor tax charges and one felony gun charge when the deal collapsed in court.

CLICK HERE TO GET THE FOX NEWS APP

Lowell is also seeking to dismiss gun charges Weiss brought against Biden in Delaware. Hunter Biden pleaded not guilty to those charges in October.

The trial in the tax case in California is tentatively scheduled to begin on June 20 with jury selection.