NEWYou can now listen to Fox News articles!

Victor Owen Schwartz never imagined he would one day find himself challenging a president in the highest court in the land. But after President Donald Trump’s sweeping tariffs threatened the survival of his wine importing business, Schwartz became a plaintiff in a case that would ultimately reach the Supreme Court and prevail.

With wines and spirits arriving from 16 countries across five continents, nearly every corner of Schwartz’s supply chain was touched by the new tariffs.

On Friday, the nation’s highest court dealt Trump a significant blow to his trade policy. Schwartz watched the decision unfold over Zoom with his lawyers, the fate of his nearly 40-year-old business hanging in the balance.

SUPREME COURT DEALS BLOW TO TRUMP’S TRADE AGENDA IN LANDMARK TARIFF CASE

Victor Owen Schwartz, whose wine importing business was a plaintiff in a Supreme Court challenge to President Donald Trump’s tariffs. (Victor Schwartz)

“We are relieved and very excited to get back to doing what we love, bringing handmade authentic wines and spirits to American consumers,” Schwartz said. “It’s impossible to describe the feeling of elation, of seeing that, yes, we were right, and the court agrees with us, and a feeling that justice prevailed,” he told Fox News Digital.

Schwartz was a plaintiff in one of two cases brought before the Supreme Court. The challenges — Learning Resources Inc. v. Trump and Trump v. V.O.S. Selections Inc. — were filed by an educational toy manufacturer and Schwartz’s family-owned wine and spirits importer, both contesting the legality of Trump’s tariffs.

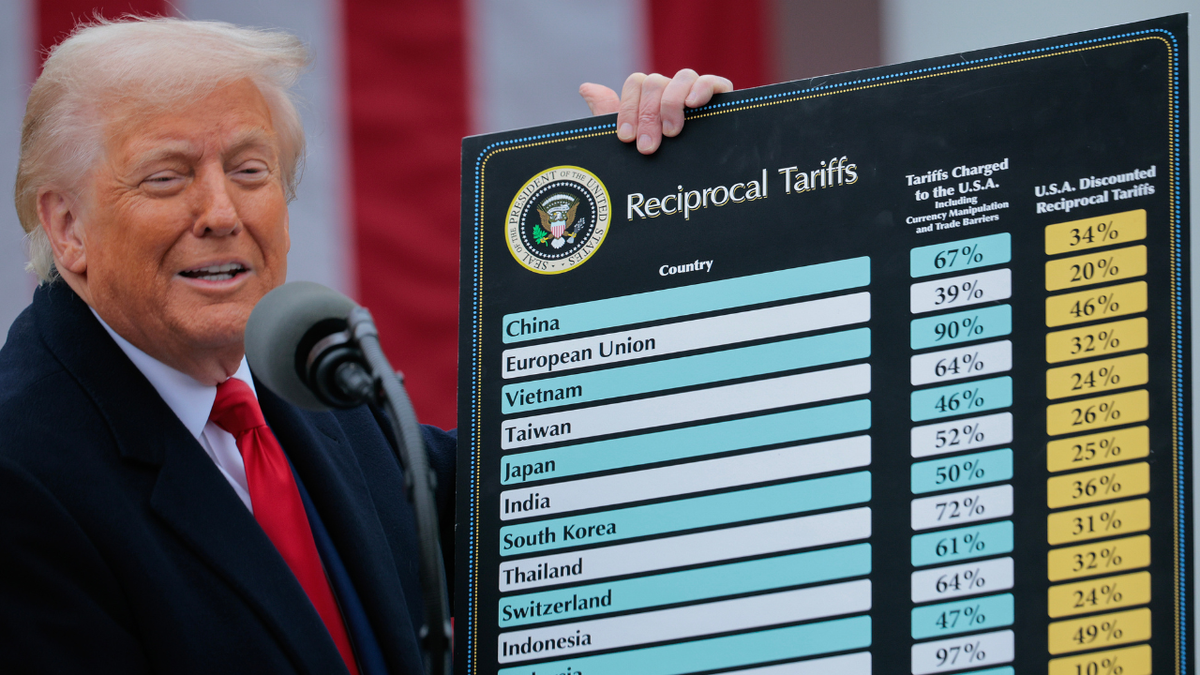

The disputes followed Trump’s so-called “Liberation Day” tariffs in April, a sweeping package of import duties he said would address trade imbalances and reduce reliance on foreign goods.

TRUMP’S TARIFF REVENUES HIT RECORD HIGHS AS SUPREME COURT DEALS MAJOR BLOW

President Donald Trump speaks during a “Make America Wealthy Again” trade announcement event in the Rose Garden at the White House on April 2, 2025, in Washington, D.C. (Chip Somodevilla/Getty Images)

“Last spring, thousands of American small businesses like mine were thrown into chaos,” Schwartz said, referring to the “Liberation Day” tariffs. “The administration’s unprecedented tariffs, which my business was forced to pay upfront, threatened our very existence,” he added.

Unlike previous tariffs enacted by Congress, which businesses could plan around, Schwartz said Trump’s sweeping duties felt unpredictable and arbitrary. He argued the new duties forced small companies to “gamble with our livelihoods by trying to predict the unpredictable,” calling them “an unconstitutional act of government overreach.”

Beyond the legal fight, Schwartz said the strain on cash flow was especially acute.

“A very important thing to realize in running any business, certainly a small business, is the impact on cash flow,” he said. “When you have to pay those tariffs up front before you have sold a single bottle of wine, that’s a major impact … cash flow is the lifeblood of a company.”

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

President Donald Trump responds to questions about the Supreme Court’s ruling against his tariffs. (Mandel Ngan/Getty Images)

Meanwhile, the Trump administration has argued that aggressive tariffs are necessary to confront what it calls years of unfair global trade — underscoring how central trade policy is to Trump’s broader economic strategy.

Shortly after the Supreme Court ruling, Trump announced a 10% global tariff and vowed to use other avenues to keep the duties in place.

While questions remain about what comes next for U.S. trade policy, Schwartz said he is focused on moving forward and receiving the “government’s refund of these improperly collected taxes.”