Justice Brett Kavanaugh offered President Donald Trump a workaround to the Supreme Court’s ruling Friday that struck down Trump’s broad use of emergency powers to impose tariffs as a tool of foreign policy.

In April, Trump imposed tariffs under a 1977 emergency powers law known as the International Emergency Economic Powers Act, citing a record $1.4 trillion trade deficit in 2024.

In Friday’s 6-3 ruling, the high court held IEEPA “does not authorize the President to impose tariffs.”

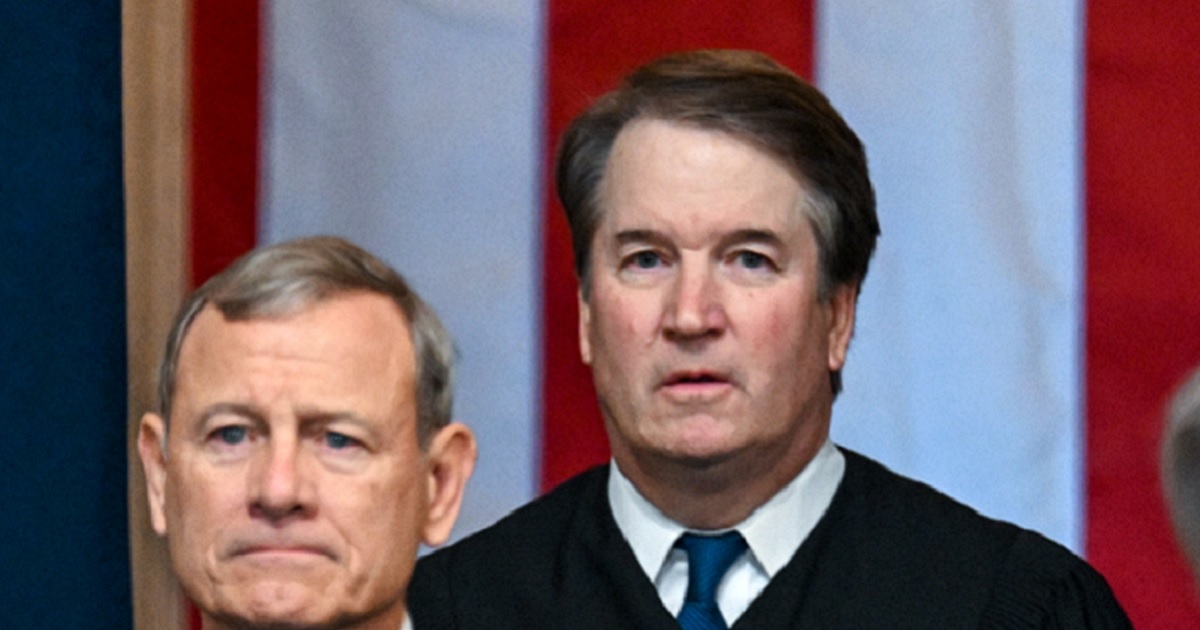

Chief Justice John Roberts wrote for the majority, joined by conservative Justices Amy Coney Barrett and Neil Gorsuch, as well as the liberals on the bench: Justices Sonia Sotomayor, Elena Kagan, and Ketanji Brown Jackson.

Kavanaugh, along with conservative Justices Samuel Alito and Clarence Thomas, dissented.

In his dissenting opinion, Kavanaugh wrote, “Although I firmly disagree with the Court’s holding today, the decision might not substantially constrain a President’s ability to order tariffs going forward. That is because numerous other federal statutes authorize the President to impose tariffs and might justify most (if not all) of the tariffs at issue in this case—albeit perhaps with a few additional procedural steps that IEEPA, as an emergency statute, does not require.”

“Those statutes include, for example, the Trade Expansion Act of 1962 (Section 232); the Trade Act of 1974 (Sections 122, 201, and 301); and the Tariff Act of 1930 (Section 338). In essence, the Court today concludes that the President checked the wrong statutory box by relying on IEEPA rather than another statute to impose these tariffs,” he argued.

Kavanaugh points out that even if today’s mess of a ruling creates all sorts of chaos for previously imposed tariffs, Trump has many other options for imposing tariffs going forward. pic.twitter.com/Rdw2ab4o1G

— Mollie (@MZHemingway) February 20, 2026

Kavanaugh added, “In the meantime, however, the interim effects of the Court’s decision could be substantial. The United States may be required to refund billions of dollars to importers who paid the IEEPA tariffs, even though some importers may have already passed on costs to consumers or others. As was acknowledged at oral argument, the refund process is likely to be a ‘mess.’

“In addition, according to the Government, the IEEPA tariffs have helped facilitate trade deals worth trillions of dollars—including with foreign nations from China to the United Kingdom to Japan, and more. The Court’s decision could generate uncertainty regarding those trade arrangements.

“In any event, the only issue before the Court today is one of law. In light of the statutory text, longstanding historical practice, and relevant Supreme Court precedents, I would conclude that IEEPA authorizes the President to ‘regulate . . . importation’ by imposing tariffs on foreign imports during declared national emergencies.”

For calendar year 2025, the Trump administration collected $287 billion in tariff revenue, a 192 percent increase over the preceding year, according to the Federal Reserve Bank of Richmond.

It was one of the reasons the federal budget deficit dropped by $600 billion during 2025, according to Trump’s Director of the National Economic Council, Kevin Hassett.

The Financial Times reported in December that Trump’s team was preparing to impose tariffs using other statutes should the Supreme Court rule against the administration.

“Nobody thinks the tariffs are going away,” Ted Murphy, a trade lawyer at Sidley Austin in Washington, said in the Financial Times report. “They are just going to be reissued under a different umbrella. They will reissue tariffs the same day.”

The Financial Times explained that the administration could use “an obscure national security law known as Section 232 of the Trade Expansion Act of 1962, which has already been activated to apply levies to cars, steel, aluminium, copper and lumber.”

“Investigations into semiconductors, pharmaceutical goods and medicines, critical minerals and aerospace parts are all under way using Section 232, but their conclusions have remained unpublished,” the outlet further noted.

Trump’s team could also use a measure known as Section 122 of the Trade Act of 1974, allowing for up to 15 percent tariffs to be imposed on trading partners for 150 days as an immediate stopgap measure while other levies are prepared.

Meanwhile, “A separate provision, Section 338 of the Tariff Act of 1930, could also be triggered, although it has been used very rarely in recent history. It allows the government to immediately issue levies of up to 50 per cent on a foreign country that discriminates against US commerce, and can be used to respond to any ‘unreasonable charge, exaction, regulation, or limitation,’” the Financial Times noted.

Each of those possibilities was mentioned in Kavanaugh’s dissent.

The Financial Times also noted a ruling against the Trump administration would be likely to rattle the U.S. Treasury bond market, with the prices dropping as buyers anticipate the federal government borrowing more money to make up for lost tariff revenue in the short term.

Advertise with The Western Journal and reach millions of highly engaged readers, while supporting our work. Advertise Today.