For those of us who are doomscrolling our social media feeds these days, a term that we’re coming across is “margin call.”

If you follow Elon Musk, it’s something that has been discussed at length over the past couple of weeks in relation to Tesla’s slumping stock price.

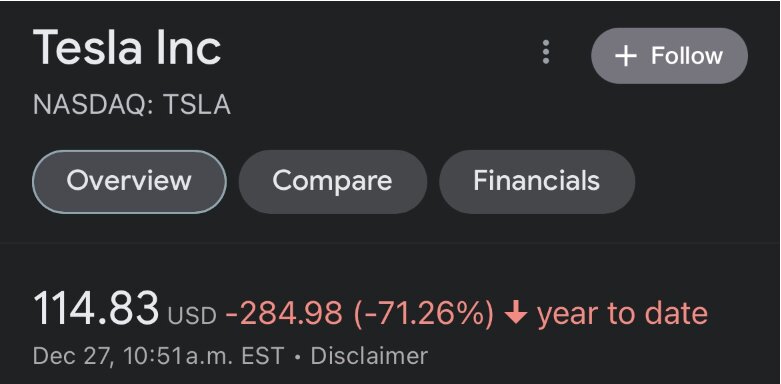

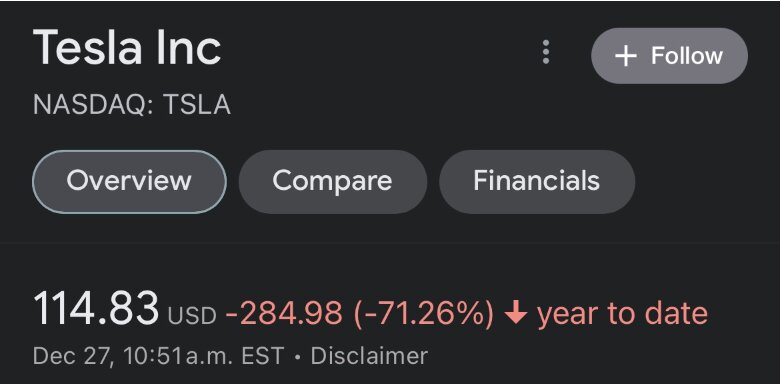

As of Tuesday morning, not long after trading opened, this is what the totality of Tesla’s year looked like:

No Tesla stakeholder, from Musk himself down to someone who owns one share of Tesla stock, is happy with a 71 percent decline in 2022. Experts believe this was driven in part by Musk selling close to $40 billion of his own Tesla stock to help fund his Twitter acquisition.

A margin call is a request to a broker to make up the difference between the value of securities or other assets held by a client and the loan that has been taken out to buy them. If you don’t comply, you lose your collateral and your rights in those assets.

Usually, this happens when your stocks have fallen in price below what you bought them for, so that you can’t cover the loan anymore.

Attorney Krenar Camili points out that “since a margin call is a demand from a lender or multiple lenders asking for additional capital or securities to add to the margin account, in a situation where the borrower has already liquidated significant assets, there might not be enough left to satisfy the call, which can lead to a default.”

All of this needs to be framed in the light of Musk being sued earlier this year for manipulating the price of Twitter stock, and that wasn’t the only time Musk is alleged to have manipulated a stock’s price.

From the Tesla perspective, Musk having sold so much stock is optically horrible, even though he pledged this month not to sell any more Tesla stock for up to two years. From the perspective of some Tesla shareholders, Musk is using Tesla as a personal ATM to fund his vanity project.

The call for Musk to be replaced as Tesla CEO is just beginning to gain a little traction, but even if Musk were to be replaced, he can’t be stopped from continuing to sell Tesla shares should he choose to do so.

Through all of this Tesla Sturm und Drang, some experts believe that Tesla’s precipitous drop in 2022, especially in December, is the perfect opportunity to buy Tesla stock. They argue that while Tesla has been “hammered … the underlying business is doing quite well,” which makes it an attractive buy. They argue that the overselling of Tesla stock is by people unwilling to play the necessary long game. Yet even the most optimistic of us should see this as a logical stretch.

The chef’s kiss in all of this is Musk’s own warning late last week against margin debt. In a case of “physician, heal thyself,” Musk warned people not to borrow against the value of their securities, as he did with Tesla stock to buy Twitter. For those who were unconvinced that irony is not dead, there you go.

The views expressed in this opinion article are those of their author and are not necessarily either shared or endorsed by the owners of this website. If you are interested in contributing an Op-Ed to The Western Journal, you can learn about our submission guidelines and process here.