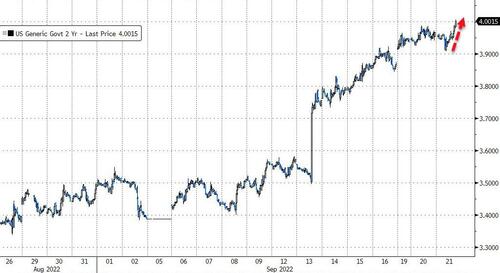

For the first time since October 2007, the yield on 2Y US Treasury bonds has topped 4.00%...

...having soared over 60bps since Fed Chair Powell gave his hyper-hawkish speech at Jackson Hole...

Meanwhile, the terminal rate for Fed rate-hikes has risen to 4.52% this morning, expected in March 2023...

Do we really think The Fed can get there without folding to political pressure or flip-flopping to abate risk-asset carnage?

As we noted earlier, how do we think Elizabeth Warren is going to react to this?

When the Fed hikes to 3.25% from 2.50%, it will be paying banks $460MM in daily interest on IOER/Reverse Repo.

— zerohedge (@zerohedge) September 20, 2022

When the Fed hikes to 4.25% by year end, it will be paying $600 million in daily interest to BANKS.

Think that won't be a political issue? Think again

Finally, which would you rather own - 2Y notes backed by the US govt paying 4% or the S&P 500 paying 1.7%?

TINA is dead... and remember all of this is priced into the rates market already...

What is priced in right now:

— zerohedge (@zerohedge) September 20, 2022

+75bps tomorrow;

+75bps in Nov,

+50bps in Dec.

-> 4.49% in March pic.twitter.com/G28WSGnz3A

Maybe not so much the stock market.

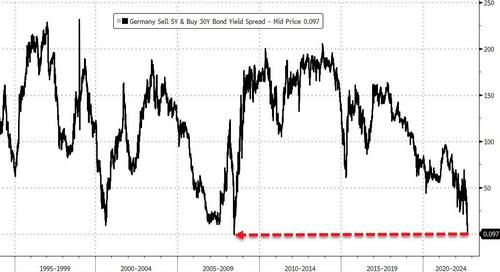

Meanwhile, the German yield curve is the most inverted... ever...

For the first time since October 2007, the yield on 2Y US Treasury bonds has topped 4.00%…

…having soared over 60bps since Fed Chair Powell gave his hyper-hawkish speech at Jackson Hole…

Meanwhile, the terminal rate for Fed rate-hikes has risen to 4.52% this morning, expected in March 2023…

Do we really think The Fed can get there without folding to political pressure or flip-flopping to abate risk-asset carnage?

As we noted earlier, how do we think Elizabeth Warren is going to react to this?

When the Fed hikes to 3.25% from 2.50%, it will be paying banks $460MM in daily interest on IOER/Reverse Repo.

When the Fed hikes to 4.25% by year end, it will be paying $600 million in daily interest to BANKS.

Think that won’t be a political issue? Think again

— zerohedge (@zerohedge) September 20, 2022

Finally, which would you rather own – 2Y notes backed by the US govt paying 4% or the S&P 500 paying 1.7%?

TINA is dead… and remember all of this is priced into the rates market already…

What is priced in right now:

+75bps tomorrow;

+75bps in Nov,

+50bps in Dec.

-> 4.49% in March pic.twitter.com/G28WSGnz3A— zerohedge (@zerohedge) September 20, 2022

Maybe not so much the stock market.

Meanwhile, the German yield curve is the most inverted… ever…