Authored by Mike Shedlock via MishTalk.com,

A pair of CNBC surveys show increasing financial stress in the US. The Fed predicts more of it and I am sure the Fed is correct.

CNBC Surveys

-

70% of Americans are feeling financially stressed, new CNBC survey finds

-

Most Americans are using tax refunds to boost savings or pay off debt

“People are worried that the money they’ve saved won’t last and are worried they’re going to have to lean more on their credit cards and other sources of debt just to get by,” said Bruce McClary, a senior vice president at the National Foundation for Credit Counseling.

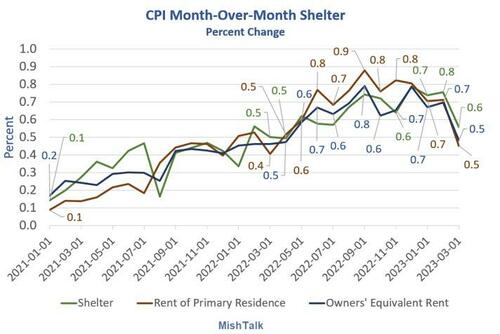

Cost of Shelter Still Rising Sharply

Shelter Costs Surge Again

For 14 consecutive months, the cost of shelter has risen at least 0.5 percent from the preceding month.

For discussion, please see The Tame March CPI Numbers Deceive as the Price of Rent Surges Again

Shelter Notes

-

Shelter comprises 34.47 percent of the CPI

-

Rent of primary residence is standard rent (not owner occupied), unfurnished without utilities.

-

Owners' Equivalent Rent (OER), is the estimated price one would pay to rent one's own house, unfurnished and without utilities. It is the single largest CPI component at 25.41 percent.

-

The shelter index increased 8.2 percent over the last year, accounting for over 60 percent of the total increase in all items less food and energy.

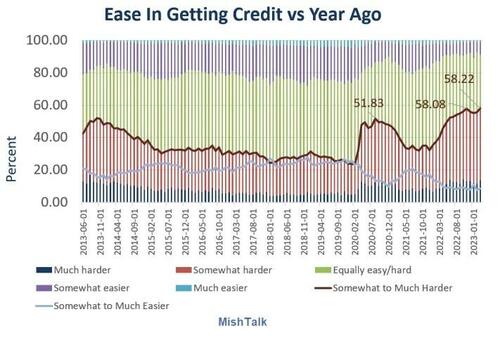

Consumers Are Having a Much Harder Time Getting Credit Than a Year Ago

Data from the New York Fed Survey of Consumer Expectations for March, chart by Mish

A New York Fed survey shows Consumers Are Having a Much Harder Time Getting Credit Than a Year Ago

What's Going On?

-

The inverted yield curve and QT act to restrict lending

-

Banks are fearful of a recession and credit losses

-

All the banks that leveraged into duration are suffering mark-to-market losses on their Treasury and MBS portfolios. The banks know this (and knew this even before Silicon Valley Bank was taken over).

Fed Minutes Now Predict a Recession This Year Along With Higher Unemployment

Please note Fed Minutes Now Predict a Recession This Year Along With Higher Unemployment

The Fed forecasts a recession, calls for higher unemployment and below trend growth, with risks to the downside.

The staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years.

The unemployment rate was projected to rise above the staff’s estimate of its natural rate early next year.

The Fed has never predicted a recession in advance. Is this a first or has a recession already started?

Perhaps you think there won't be a recession. Those 58% living paycheck to paycheck, sure hope hope there won't be one.

Meanwhile, President Biden is doing everything humanely possible with regulations, energy mandates, and support for unions to create more inflation.

The dilemma for the Fed, and it's a huge one, is that credit conditions are very deflationary, but the economic policies of this administration coupled with trade wars everywhere are very inflationary.

* * *

Like these reports? I hope so, and if you do, please Subscribe to MishTalk Email Alerts.

Authored by Mike Shedlock via MishTalk.com,

A pair of CNBC surveys show increasing financial stress in the US. The Fed predicts more of it and I am sure the Fed is correct.

CNBC Surveys

“People are worried that the money they’ve saved won’t last and are worried they’re going to have to lean more on their credit cards and other sources of debt just to get by,” said Bruce McClary, a senior vice president at the National Foundation for Credit Counseling.

Cost of Shelter Still Rising Sharply

Shelter Costs Surge Again

For 14 consecutive months, the cost of shelter has risen at least 0.5 percent from the preceding month.

For discussion, please see The Tame March CPI Numbers Deceive as the Price of Rent Surges Again

Shelter Notes

-

Shelter comprises 34.47 percent of the CPI

-

Rent of primary residence is standard rent (not owner occupied), unfurnished without utilities.

-

Owners’ Equivalent Rent (OER), is the estimated price one would pay to rent one’s own house, unfurnished and without utilities. It is the single largest CPI component at 25.41 percent.

-

The shelter index increased 8.2 percent over the last year, accounting for over 60 percent of the total increase in all items less food and energy.

Consumers Are Having a Much Harder Time Getting Credit Than a Year Ago

Data from the New York Fed Survey of Consumer Expectations for March, chart by Mish

A New York Fed survey shows Consumers Are Having a Much Harder Time Getting Credit Than a Year Ago

What’s Going On?

-

The inverted yield curve and QT act to restrict lending

-

Banks are fearful of a recession and credit losses

-

All the banks that leveraged into duration are suffering mark-to-market losses on their Treasury and MBS portfolios. The banks know this (and knew this even before Silicon Valley Bank was taken over).

Fed Minutes Now Predict a Recession This Year Along With Higher Unemployment

Please note Fed Minutes Now Predict a Recession This Year Along With Higher Unemployment

The Fed forecasts a recession, calls for higher unemployment and below trend growth, with risks to the downside.

The staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years.

The unemployment rate was projected to rise above the staff’s estimate of its natural rate early next year.

The Fed has never predicted a recession in advance. Is this a first or has a recession already started?

Perhaps you think there won’t be a recession. Those 58% living paycheck to paycheck, sure hope hope there won’t be one.

Meanwhile, President Biden is doing everything humanely possible with regulations, energy mandates, and support for unions to create more inflation.

The dilemma for the Fed, and it’s a huge one, is that credit conditions are very deflationary, but the economic policies of this administration coupled with trade wars everywhere are very inflationary.

* * *

Like these reports? I hope so, and if you do, please Subscribe to MishTalk Email Alerts.

Loading…