Crashed crypto markets, plunging stocks and bonds, looming housing market meltdown, interest rate shock, and the threat of a recession have spooked speculators, including ones bidding on a massive Bel Air mansion that flopped at auction, according to CNBC.

The mood among 'movers and shakers' is sheer pessimism as financial markets are stuck in a doom loop of turmoil thanks to the Federal Reserve embarking on one of the most aggressive tightening cycles in decades, if not ever.

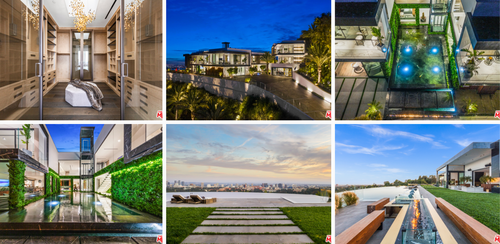

So the timing of dermatologist-turned-developer Alex Khadavi to auction off 777 Sarbonne Road, located in a residential neighborhood on the Westside of Los Angeles, was particularly bad. Though listing the modern mansion wasn't his choice considering he filed for Chapter 11 bankruptcy protection before listing the mansion last year.

Khadavi owes several creditors tens of millions of dollars. The mansion sat on the market for a year and was just auctioned off with Concierge Auctions. He was hoping for $87.8 million, though the highest bid came in just under $45.8 million, falling short of the $50 million reserve.

The bankruptcy court will now decide if the highest bid is an acceptable offer and determine if the home sale will move forward in early June. The sale would help Khadavi satisfy his debt with creditors.

Despite controversy between Khadavi and the auctioneer for not starting the bid at the reserve, Concierge's president, Chad Roffers, said:

"After a spirited auction, the bidding is closed and the high bid is in the hands of the Trustee. With over 80 qualified showings in the last 60 days, we are confident market value was delivered."

Co-listing agent, Aaron Kirman of Compass, said he wasn't pleased with the highest bid, though, "at the end of the day, the highest bidder is the highest bidder." It just so happens it's a 50% haircut from the initial list price one year ago.

The auction results suggest a souring mood among wealthy elites generally viewed as smart money. Perhaps this is an example of the shifting tide in real estate markets and how a broader market cooling is just ahead.

Crashed crypto markets, plunging stocks and bonds, looming housing market meltdown, interest rate shock, and the threat of a recession have spooked speculators, including ones bidding on a massive Bel Air mansion that flopped at auction, according to CNBC.

The mood among ‘movers and shakers’ is sheer pessimism as financial markets are stuck in a doom loop of turmoil thanks to the Federal Reserve embarking on one of the most aggressive tightening cycles in decades, if not ever.

So the timing of dermatologist-turned-developer Alex Khadavi to auction off 777 Sarbonne Road, located in a residential neighborhood on the Westside of Los Angeles, was particularly bad. Though listing the modern mansion wasn’t his choice considering he filed for Chapter 11 bankruptcy protection before listing the mansion last year.

Khadavi owes several creditors tens of millions of dollars. The mansion sat on the market for a year and was just auctioned off with Concierge Auctions. He was hoping for $87.8 million, though the highest bid came in just under $45.8 million, falling short of the $50 million reserve.

The bankruptcy court will now decide if the highest bid is an acceptable offer and determine if the home sale will move forward in early June. The sale would help Khadavi satisfy his debt with creditors.

Despite controversy between Khadavi and the auctioneer for not starting the bid at the reserve, Concierge’s president, Chad Roffers, said:

“After a spirited auction, the bidding is closed and the high bid is in the hands of the Trustee. With over 80 qualified showings in the last 60 days, we are confident market value was delivered.”

Co-listing agent, Aaron Kirman of Compass, said he wasn’t pleased with the highest bid, though, “at the end of the day, the highest bidder is the highest bidder.” It just so happens it’s a 50% haircut from the initial list price one year ago.

The auction results suggest a souring mood among wealthy elites generally viewed as smart money. Perhaps this is an example of the shifting tide in real estate markets and how a broader market cooling is just ahead.