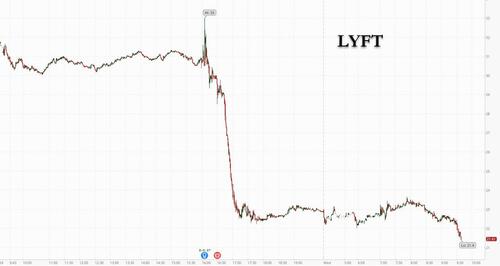

Another day, another sellside damage control dumpster fire, as a former Wall Street darling carshes and burns, in this case the 2nd biggest ride-hailing firm, Lyft, whose stock is cratering by the most on record this morning, plunging 30% to just above $21, the lowest price since December 2020...

... as Lyft stunned bulls with a far weaker-than-expected outlook (which was so bad, it dragged down UBER shares too, and forced it to rush and report earnings this morning ahead of schedule), but what shocked investors was Lyft's plan to aggressively boost spending on driver incentives, indicating that LYFT may have problems passing through inflation and hammering profits, even as Wall Street analysts, ever cheerful, spin this as indicating that Lyft is bullish about demand recovery, adding the postmarket plunge in the stock is “overdone.” Of course, this is to be expected from a sellside that as of yesterday had 26 Buys and 13 Holds, with a $51.64 12-month price target, and which has since been pulled to $45.50 as of this morning (and going much lower).

Here is a snapshot of what analysts have to say, courtesy of Bloomberg,

JPMorgan (overweight, PT $56)

- Recognize the impact to near-term profit as Lyft boosts driver incentives, but believe it reflects management’s bullishness on demand recovery and the importance of high service levels

- Calls plunge in Lyft shares after hours “overdone”

Truist Securities (buy, PT $50)

- Lyft is in the midst of an uneven recovery in rideshare, with a need to rebuild a finicky driver supply

- After investing heavily in driver supply in 2021 to meet the rapid demand recovery, Lyft is now facing another challenge in balancing supply/demand after the rapid recovery post-Omicron

Wedbush (outperform, PT $32)

- While the biggest near-term focus is on getting service levels back to where the company wants to be, there are a number of mid to long-term investments as well

- Clearly, Lyft will invest to accelerate its core business, expand emerging and new products like bikes and rentals, and invest in new innovation

Piper Sandler (overweight)

- If the stock opens at postmarket trading levels, it would imply a valuation round-trip to the darkest days of the pandemic, when hardly anybody was hailing rides and revenue was only 1/3 as high as it currently is

- “Such a dramatic selloff is overdone”

Cowen (outperform, PT $42)

- 1Q beat overshadowed by disappointing 2Q outlook

- Understand the disappointment in the forecast, but also think the after hours move “is a bit overdone”

MKM Partners (neutral, PT $32)

- The key negative read-through to Uber is the greater-than-expected uptick in driver incentives

- Favors Uber in longer term as it’s trading on par with Lyft valuation levels, and is a diversified global play on ridesharing and food delivery

Jefferies (hold, PT $34)

- While investing to support future growth is rational, the decelerating margin raise questions about the economic model and whether heavy driver incentives are a permanent expense

- Lyft is a pure-play on the recovery in U.S. ridehailing, but Jefferies prefers Uber for its leverage to global recovery theme, platform advantage and Covid hedge from delivery business

Of course, all of these justifications would have been unnecessary if Wall Street actually had done its job and correctly predicted what was about to happen.

Another day, another sellside damage control dumpster fire, as a former Wall Street darling carshes and burns, in this case the 2nd biggest ride-hailing firm, Lyft, whose stock is cratering by the most on record this morning, plunging 30% to just above $21, the lowest price since December 2020…

… as Lyft stunned bulls with a far weaker-than-expected outlook (which was so bad, it dragged down UBER shares too, and forced it to rush and report earnings this morning ahead of schedule), but what shocked investors was Lyft’s plan to aggressively boost spending on driver incentives, indicating that LYFT may have problems passing through inflation and hammering profits, even as Wall Street analysts, ever cheerful, spin this as indicating that Lyft is bullish about demand recovery, adding the postmarket plunge in the stock is “overdone.” Of course, this is to be expected from a sellside that as of yesterday had 26 Buys and 13 Holds, with a $51.64 12-month price target, and which has since been pulled to $45.50 as of this morning (and going much lower).

Here is a snapshot of what analysts have to say, courtesy of Bloomberg,

JPMorgan (overweight, PT $56)

- Recognize the impact to near-term profit as Lyft boosts driver incentives, but believe it reflects management’s bullishness on demand recovery and the importance of high service levels

- Calls plunge in Lyft shares after hours “overdone”

Truist Securities (buy, PT $50)

- Lyft is in the midst of an uneven recovery in rideshare, with a need to rebuild a finicky driver supply

- After investing heavily in driver supply in 2021 to meet the rapid demand recovery, Lyft is now facing another challenge in balancing supply/demand after the rapid recovery post-Omicron

Wedbush (outperform, PT $32)

- While the biggest near-term focus is on getting service levels back to where the company wants to be, there are a number of mid to long-term investments as well

- Clearly, Lyft will invest to accelerate its core business, expand emerging and new products like bikes and rentals, and invest in new innovation

Piper Sandler (overweight)

- If the stock opens at postmarket trading levels, it would imply a valuation round-trip to the darkest days of the pandemic, when hardly anybody was hailing rides and revenue was only 1/3 as high as it currently is

- “Such a dramatic selloff is overdone”

Cowen (outperform, PT $42)

- 1Q beat overshadowed by disappointing 2Q outlook

- Understand the disappointment in the forecast, but also think the after hours move “is a bit overdone”

MKM Partners (neutral, PT $32)

- The key negative read-through to Uber is the greater-than-expected uptick in driver incentives

- Favors Uber in longer term as it’s trading on par with Lyft valuation levels, and is a diversified global play on ridesharing and food delivery

Jefferies (hold, PT $34)

- While investing to support future growth is rational, the decelerating margin raise questions about the economic model and whether heavy driver incentives are a permanent expense

- Lyft is a pure-play on the recovery in U.S. ridehailing, but Jefferies prefers Uber for its leverage to global recovery theme, platform advantage and Covid hedge from delivery business

Of course, all of these justifications would have been unnecessary if Wall Street actually had done its job and correctly predicted what was about to happen.