Ahead of today's inflation print, JPMorgan predicted that a 7.7% headline CPI print (an outcome to which they assigned a 20% probability) would lead to a 2.5%-3.5% jump in stocks. Meanwhile, a far more subdued Goldman said that a print below 7.8% would lead to a 2%+ move in stocks. In retrospect, today's unexpectedly cool prints, which saw core CPI rise just 0.3% (only 1 economist out of all 60+ respondents polled by Bloomberg predicted a number this low) and 6.3% Y/Y (headline also came in well below expected at 0.4% vs Exp. 0.6% and 7.7% vs exp 7.9%), have led to an even more powerful thrust in stocks, with the S&P up 4% at last check and the Nasdaq soaring over 5%.

It's not just equities, of course: yields have plunged, the dollar is collapsing, and the rate market has sharply pared expectations for the terminal rate to just under 5%. The OIS markets are expecting 52-34-16 bps for the next three meetings. So the market thinks there’s about 100 bps to go before the Fed ends the tightening cycle.

And then there are the experts, traders and analysts. Courtesy of Bloomberg here is a recap of kneejerk responses to today's cooler than expected CPI prints.

Max Gokhman, AlphaTrAI

“Here’s my hot take: We expected that there would be deceleration of core goods prices, but seeing services slump too was a bigger bonus than any banker will get this year. That said, this won’t budge the Fed to rethink a 50bp hike in December, so traders curb their initial enthusiasm.”

Jim Bianco, founder of Bianco Research:

"This is only the third time in the past 20 months that inflation has come in below forecast." He says he cannot recall an immediate 2% plus move in US stock futures off an indicator like this: “It just goes how focused and how important this data is. This is the most important event of the month, for all financial markets.”

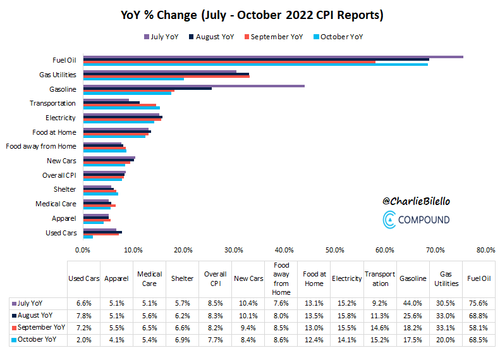

Charlie Bilello, CEO of Compound Capital Advisors

October CPI report vs. September CPI report: Lower YoY % increase: Gas Utilities, Gasoline, Electricity, Food at Home, New Cars, Overall CPI, Medical Care, Apparel, Used Cars; Higher YoY % increase: Fuel Oil, Transportation, Food away from Home, Shelter

Anna Wong, Chief Economist at Bloomberg Economics

“The soft October core CPI print offers Fed doves a powerful justification to slow the pace of rate hikes going forward. More widespread disinflation across goods sectors, and a measurement quirk in medical care services -- factors we expect to continue in the months ahead -- helped bring down inflation in October. Still, robust services inflation keeps alive the threat that inflation expectations will become unmoored, which would justify a higher terminal rate. Bloomberg Economics’ baseline is for the FOMC to raise rates by 50 basis points at its December meeting.”

“Shelter costs grew at a robust 0.8% pace in October. The good news is that the monthly gains in rent of primary residence and owners’ equivalent rent of residence both slowed, after several months marching higher. We expect these two important shelter components to peak in the next few months, but we don’t expect the year-over-year increase to peak until 1H 2023.”

Ian Shepherdson, Chief Economist at Pantehon Macro

"The fever is breaking in rents"

Rubeela Farooqi, Chief US Economist, High Frequency Economics:

“Overall, the 12-month changes in both headline and core consumer prices remain uncomfortably high and we would hesitate to overemphasize one report. However, the data will be welcome news for the FOMC, finally showing some response in prices to 375-bps of rate hikes.”

Ellen Zentner, chief economist at Morgan Stanley

“The softening of core inflation in the October release is welcome news for the Fed. Policymakers have indicated that their preferred next move would be a step down to a 50 basis-point rate increase at the December FOMC. Signs of deceleration will help Fed officials moderate the reduction in the pace of tightening, though a stronger than expected December payroll print (300k+) could still complicate the issue at the margin.”

Katherine Judge, economist at CIBC Capital Markets,

“While the deceleration in core prices is a welcome development, and we continue to expect supply chain improvements to feed through to the index more meaningfully ahead, the strength in core services still supports an outsized rate hike at the December FOMC.”

Win Thin, global head of currency strategy at BBH

He says the inflation reading makes the case for a 50 basis-point hike in December: “But we still get one more jobs report, one more CPI report, and two each of PPI and retail sales,” he says. “Powell was clear that the data may change the near-term pace but not the terminal rate. At least not yet. We have to see a lot more of numbers like this before the terminal rate comes down.”

Matthew Luzzetti, chief US economist at Deutsche Bank

Says not to over-emphasize that 0.3% core increase. He points out we’ve seen this before. In fact, as recently as July. And again back in March. Those readings didn’t augur a big change in inflation momentum.

John Lynch, CIO for Comerica

“The equity markets are reacting optimistically to the easing of headline inflation. Though bear market rallies are fueled with optimism, we remain mindful of technical resistance overhead, a relatively calm VIX, dollar strength, high yield spreads, and 2023 EPS estimates that remain too high. Consequently, investors should view any gains on today’s CPI news as suspect.”

Neil Dutta, head of US economic research at Renaissance Macro

“At 1.493 million for the week ending October 29th, the level of continuing claims is the highest since late March. This is still consistent with a tight labor market in absolute terms, but at the margin, conditions are slackening a bit. Financial conditions are easing sharply as today’s data breathes life into the notion that the Fed can step down. This is a problem because core inflation is still running close to 6.0% at an annual rate over the last three months. Ultimately, stronger real growth will put pressure on capacity, and that challenges the immaculate disinflation thesis.”

Omar Sharif, Inflation Insights

“I noted prior to the September CPI that I thought we were on the cusp of more persistent 0.3% (and maybe even 0.2%) type readings. I think this is the start of that string of lower prints. There’s more going on here than just a quirky move in health insurance. I wouldn’t be so dismissive of this as some kind of outlier.”

From Ian Lyngen of BMO Capital Markets:

“From here, we’re watching for any write-up from the WSJ/Timiraos suggesting Fed officials ‘won’t adjust policy based on a single print’ -- or something to that effect. This should take 75 basis points off the table for December, but not 50 basis points.”

Source: BBG

Ahead of today’s inflation print, JPMorgan predicted that a 7.7% headline CPI print (an outcome to which they assigned a 20% probability) would lead to a 2.5%-3.5% jump in stocks. Meanwhile, a far more subdued Goldman said that a print below 7.8% would lead to a 2%+ move in stocks. In retrospect, today’s unexpectedly cool prints, which saw core CPI rise just 0.3% (only 1 economist out of all 60+ respondents polled by Bloomberg predicted a number this low) and 6.3% Y/Y (headline also came in well below expected at 0.4% vs Exp. 0.6% and 7.7% vs exp 7.9%), have led to an even more powerful thrust in stocks, with the S&P up 4% at last check and the Nasdaq soaring over 5%.

It’s not just equities, of course: yields have plunged, the dollar is collapsing, and the rate market has sharply pared expectations for the terminal rate to just under 5%. The OIS markets are expecting 52-34-16 bps for the next three meetings. So the market thinks there’s about 100 bps to go before the Fed ends the tightening cycle.

And then there are the experts, traders and analysts. Courtesy of Bloomberg here is a recap of kneejerk responses to today’s cooler than expected CPI prints.

Max Gokhman, AlphaTrAI

“Here’s my hot take: We expected that there would be deceleration of core goods prices, but seeing services slump too was a bigger bonus than any banker will get this year. That said, this won’t budge the Fed to rethink a 50bp hike in December, so traders curb their initial enthusiasm.”

Jim Bianco, founder of Bianco Research:

“This is only the third time in the past 20 months that inflation has come in below forecast.” He says he cannot recall an immediate 2% plus move in US stock futures off an indicator like this: “It just goes how focused and how important this data is. This is the most important event of the month, for all financial markets.”

Charlie Bilello, CEO of Compound Capital Advisors

October CPI report vs. September CPI report: Lower YoY % increase: Gas Utilities, Gasoline, Electricity, Food at Home, New Cars, Overall CPI, Medical Care, Apparel, Used Cars; Higher YoY % increase: Fuel Oil, Transportation, Food away from Home, Shelter

Anna Wong, Chief Economist at Bloomberg Economics

“The soft October core CPI print offers Fed doves a powerful justification to slow the pace of rate hikes going forward. More widespread disinflation across goods sectors, and a measurement quirk in medical care services — factors we expect to continue in the months ahead — helped bring down inflation in October. Still, robust services inflation keeps alive the threat that inflation expectations will become unmoored, which would justify a higher terminal rate. Bloomberg Economics’ baseline is for the FOMC to raise rates by 50 basis points at its December meeting.”

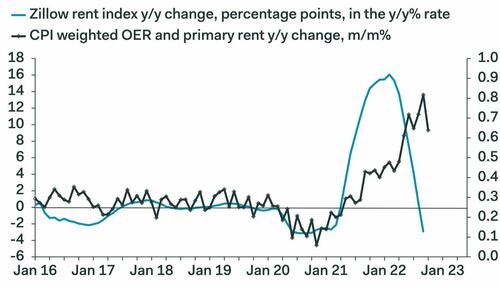

“Shelter costs grew at a robust 0.8% pace in October. The good news is that the monthly gains in rent of primary residence and owners’ equivalent rent of residence both slowed, after several months marching higher. We expect these two important shelter components to peak in the next few months, but we don’t expect the year-over-year increase to peak until 1H 2023.”

Ian Shepherdson, Chief Economist at Pantehon Macro

“The fever is breaking in rents”

Rubeela Farooqi, Chief US Economist, High Frequency Economics:

“Overall, the 12-month changes in both headline and core consumer prices remain uncomfortably high and we would hesitate to overemphasize one report. However, the data will be welcome news for the FOMC, finally showing some response in prices to 375-bps of rate hikes.”

Ellen Zentner, chief economist at Morgan Stanley

“The softening of core inflation in the October release is welcome news for the Fed. Policymakers have indicated that their preferred next move would be a step down to a 50 basis-point rate increase at the December FOMC. Signs of deceleration will help Fed officials moderate the reduction in the pace of tightening, though a stronger than expected December payroll print (300k+) could still complicate the issue at the margin.”

Katherine Judge, economist at CIBC Capital Markets,

“While the deceleration in core prices is a welcome development, and we continue to expect supply chain improvements to feed through to the index more meaningfully ahead, the strength in core services still supports an outsized rate hike at the December FOMC.”

Win Thin, global head of currency strategy at BBH

He says the inflation reading makes the case for a 50 basis-point hike in December: “But we still get one more jobs report, one more CPI report, and two each of PPI and retail sales,” he says. “Powell was clear that the data may change the near-term pace but not the terminal rate. At least not yet. We have to see a lot more of numbers like this before the terminal rate comes down.”

Matthew Luzzetti, chief US economist at Deutsche Bank

Says not to over-emphasize that 0.3% core increase. He points out we’ve seen this before. In fact, as recently as July. And again back in March. Those readings didn’t augur a big change in inflation momentum.

John Lynch, CIO for Comerica

“The equity markets are reacting optimistically to the easing of headline inflation. Though bear market rallies are fueled with optimism, we remain mindful of technical resistance overhead, a relatively calm VIX, dollar strength, high yield spreads, and 2023 EPS estimates that remain too high. Consequently, investors should view any gains on today’s CPI news as suspect.”

Neil Dutta, head of US economic research at Renaissance Macro

“At 1.493 million for the week ending October 29th, the level of continuing claims is the highest since late March. This is still consistent with a tight labor market in absolute terms, but at the margin, conditions are slackening a bit. Financial conditions are easing sharply as today’s data breathes life into the notion that the Fed can step down. This is a problem because core inflation is still running close to 6.0% at an annual rate over the last three months. Ultimately, stronger real growth will put pressure on capacity, and that challenges the immaculate disinflation thesis.”

Omar Sharif, Inflation Insights

“I noted prior to the September CPI that I thought we were on the cusp of more persistent 0.3% (and maybe even 0.2%) type readings. I think this is the start of that string of lower prints. There’s more going on here than just a quirky move in health insurance. I wouldn’t be so dismissive of this as some kind of outlier.”

From Ian Lyngen of BMO Capital Markets:

“From here, we’re watching for any write-up from the WSJ/Timiraos suggesting Fed officials ‘won’t adjust policy based on a single print’ — or something to that effect. This should take 75 basis points off the table for December, but not 50 basis points.”

Source: BBG