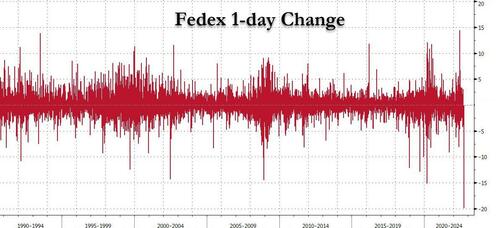

After shocking Wall Street by yanking its guidance, flagging weakness in Asia, challenges in Europe, announcing office closures and mass layoffs - a fate that awaits most of corporate America - and warning that conditions could deteriorate further in the current quarter, Fedex shares have plunged 21% in premarket trading, its biggest drop on record...

... and - as usual on Wall Street - the move has triggered an avalanche of downgrades from countless banks such as Bank of America, Stifel, JP Morgan and KeyBanc... banks who are supposed to predict the move not react to it, and yet despite the biggest drop ever, there is still just one sell rating!

Then again, nobody ever accused sellside analysts of actually being able to predict the future: if they did, they would be on the buside.

With that said, here’s what analysts have to say:

Bank of America, Ken Hoexter (cuts to neutral from buy)

- Notes Express segment revenues coming $400m below forecasts due to macro weakness in Asia and service issues in Europe

- Miss against BofA’s own EPS target due to elevated costs

- Lowers FY23/24/25 EPS estimates due to impact from rapidly falling macro environment and FedEx’s fixed cost structure

- PT dropped to $186 from $275

Stifel, J. Bruce Chan (cuts to hold from buy)

- The print was disappointing, as Stifel had given FedEx the benefit of the doubt following “operational missteps” in areas such as the Ground division and progress with TNT integration in Europe

- Says FedEx should have achieved similar results to UPS by following same playbook, though thinks it is becoming clear that UPS is executing better.

- “We think FedEx is now very much a ‘show me’ story”

- PT slashed to $195 from $288

KeyBanc, Todd Fowler (cuts to sector-weight from overweight)

- Says KeyBanc’s own near-term expectations were “overly optimistic”; notes the Express segment had meaningfully missed expectations

- Sees “challenging path” ahead in the near-term, particularly when decelerating macro datapoints and low confidence in management’s execution are taken into consideration

- Timing and magnitude of miss, along with weaker 2Q guidance, after providing an upbeat FY23 outlook and FY25 targets in June will “likely meaningfully shake credibility”

JPMorgan, Brian Ossenbeck (cuts to neutral from overweight)

- Results likely had a material tailwind from fuel surcharges in a similar way to 4Q22, masking underlying weakness in 1Q23 results and 2Q23 guide

- “It is a sobering thought to consider Express could have lost money (ex-fuel) during the quarter”

- Notes how the lack of “freight wave” from China’s reopening seems to have impacted FedEx first due to its status as the leading airfreight carrier in the Asia-Pac region

- Says latest confirmation of weak peak season has negative impact on entire sector; expects “shockingly low” Express margin to have the clearest negative read-through to UPS

- PT cut to $214 from $258

Morgan Stanley, Ravi Shanker (equal-weight)

- Results are the start of a post-pandemic unwind; notes key ocean and air freight pricing benchmarks have mean reverted back to levels seen in 2020, showing that an “industry wide unwind is underway”

- Cost inflation remains a risk as revenue mean reverts to pre-pandemic levels; sees new independent service provider contracts being a drag on earnings in FY23 due to higher inflation

- Notes the read- across to UPS being significant, despite it not having as much international airfreight exposure

Citi, Christian Wetherbee (neutral)

- Says results were “significantly worse” than feared when Citi downgraded to neutral last week

- Has seen clear trend in lower freight, though the performance from FedEx “likely stands out to the downside” versus UPS

- “FedEx will expedite long-term cost-out initiatives, but we see EPS risk into the mid-teens, yielding short-term downside risk to shares toward $150.”

Oppenheimer, Scott Schneeberger (perform)

- Preliminary results were below expectations, with Express and Ground segments coming below internal expectations

- Notes Freight outperformance; segment revenue consistent with consensus estimates, while operating income exceeded

Source: Bloomberg

After shocking Wall Street by yanking its guidance, flagging weakness in Asia, challenges in Europe, announcing office closures and mass layoffs – a fate that awaits most of corporate America – and warning that conditions could deteriorate further in the current quarter, Fedex shares have plunged 21% in premarket trading, its biggest drop on record…

… and – as usual on Wall Street – the move has triggered an avalanche of downgrades from countless banks such as Bank of America, Stifel, JP Morgan and KeyBanc… banks who are supposed to predict the move not react to it, and yet despite the biggest drop ever, there is still just one sell rating!

Then again, nobody ever accused sellside analysts of actually being able to predict the future: if they did, they would be on the buside.

With that said, here’s what analysts have to say:

Bank of America, Ken Hoexter (cuts to neutral from buy)

- Notes Express segment revenues coming $400m below forecasts due to macro weakness in Asia and service issues in Europe

- Miss against BofA’s own EPS target due to elevated costs

- Lowers FY23/24/25 EPS estimates due to impact from rapidly falling macro environment and FedEx’s fixed cost structure

- PT dropped to $186 from $275

Stifel, J. Bruce Chan (cuts to hold from buy)

- The print was disappointing, as Stifel had given FedEx the benefit of the doubt following “operational missteps” in areas such as the Ground division and progress with TNT integration in Europe

- Says FedEx should have achieved similar results to UPS by following same playbook, though thinks it is becoming clear that UPS is executing better.

- “We think FedEx is now very much a ‘show me’ story”

- PT slashed to $195 from $288

KeyBanc, Todd Fowler (cuts to sector-weight from overweight)

- Says KeyBanc’s own near-term expectations were “overly optimistic”; notes the Express segment had meaningfully missed expectations

- Sees “challenging path” ahead in the near-term, particularly when decelerating macro datapoints and low confidence in management’s execution are taken into consideration

- Timing and magnitude of miss, along with weaker 2Q guidance, after providing an upbeat FY23 outlook and FY25 targets in June will “likely meaningfully shake credibility”

JPMorgan, Brian Ossenbeck (cuts to neutral from overweight)

- Results likely had a material tailwind from fuel surcharges in a similar way to 4Q22, masking underlying weakness in 1Q23 results and 2Q23 guide

- “It is a sobering thought to consider Express could have lost money (ex-fuel) during the quarter”

- Notes how the lack of “freight wave” from China’s reopening seems to have impacted FedEx first due to its status as the leading airfreight carrier in the Asia-Pac region

- Says latest confirmation of weak peak season has negative impact on entire sector; expects “shockingly low” Express margin to have the clearest negative read-through to UPS

- PT cut to $214 from $258

Morgan Stanley, Ravi Shanker (equal-weight)

- Results are the start of a post-pandemic unwind; notes key ocean and air freight pricing benchmarks have mean reverted back to levels seen in 2020, showing that an “industry wide unwind is underway”

- Cost inflation remains a risk as revenue mean reverts to pre-pandemic levels; sees new independent service provider contracts being a drag on earnings in FY23 due to higher inflation

- Notes the read- across to UPS being significant, despite it not having as much international airfreight exposure

Citi, Christian Wetherbee (neutral)

- Says results were “significantly worse” than feared when Citi downgraded to neutral last week

- Has seen clear trend in lower freight, though the performance from FedEx “likely stands out to the downside” versus UPS

- “FedEx will expedite long-term cost-out initiatives, but we see EPS risk into the mid-teens, yielding short-term downside risk to shares toward $150.”

Oppenheimer, Scott Schneeberger (perform)

- Preliminary results were below expectations, with Express and Ground segments coming below internal expectations

- Notes Freight outperformance; segment revenue consistent with consensus estimates, while operating income exceeded

Source: Bloomberg