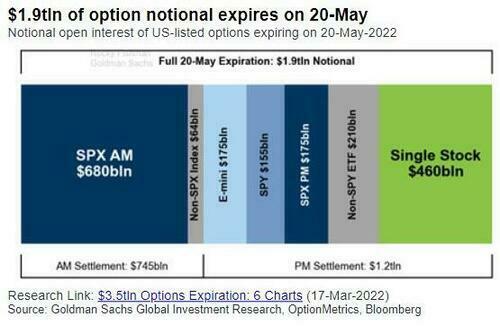

Traders will close old positions for an estimated $1.9 trillion of derivatives while rolling out new exposures on Friday. This time round, $460 billion of derivatives across single stocks is scheduled to expire, and $855 billion of S&P 500-linked contracts will expire according to Goldman.

As SpotGamma notes, this expiration is not particularly large for SPX or QQQ with our models showing ~15% of delta & gamma expiring, but sizeable for SPY (37% of gamma, 20% of delta).

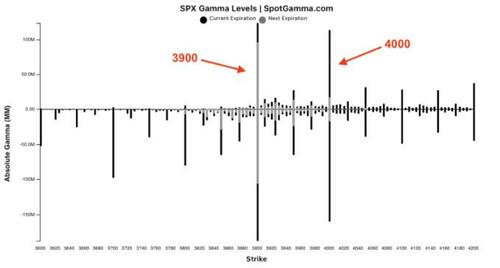

The impact of the sizable 3900 strike gamma exposure cannot be understated however...

Most of this position expires today, as does a large percentage of the at-the-money SPX/SPY/QQQ options position (seen in light grey). The expiration of these positions reads as less support for next week.

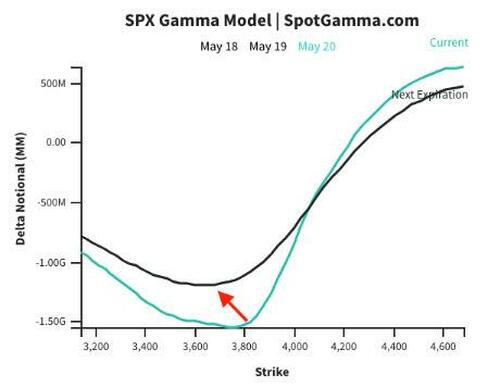

To this point, as SpotGamma mentioned yesterday that <=3800 it seemed that gamma would produce buying from dealers, but that this expiration shifts that level down towards 3700.

This general trend of traders uninterested in calls and systematically rolling puts “down & out” continues to suggest an acceptance of and positioning for lower stock prices.

Traders will close old positions for an estimated $1.9 trillion of derivatives while rolling out new exposures on Friday. This time round, $460 billion of derivatives across single stocks is scheduled to expire, and $855 billion of S&P 500-linked contracts will expire according to Goldman.

As SpotGamma notes, this expiration is not particularly large for SPX or QQQ with our models showing ~15% of delta & gamma expiring, but sizeable for SPY (37% of gamma, 20% of delta).

The impact of the sizable 3900 strike gamma exposure cannot be understated however…

Most of this position expires today, as does a large percentage of the at-the-money SPX/SPY/QQQ options position (seen in light grey). The expiration of these positions reads as less support for next week.

To this point, as SpotGamma mentioned yesterday that <=3800 it seemed that gamma would produce buying from dealers, but that this expiration shifts that level down towards 3700.

This general trend of traders uninterested in calls and systematically rolling puts “down & out” continues to suggest an acceptance of and positioning for lower stock prices.