US short-seller Hindenburg Research and Indian billionaire Gautam Adani are locked in an epic game of ping pong as both throw barbs at each other.

Last week, Hindenburg published a 100-page report alleging Adani's company Adani Enterprises Ltd. is built on accounting fraud, while Adani's legal team called the short report "maliciously mischievous and unresearched."

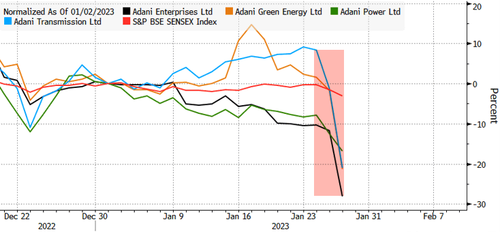

Hindenburg's report led to a $50 billion selloff in Adani's corporate empire.

The next round of fighting between the short seller and India's richest person occurred on Sunday when Adani Group published a 413-page rebuttal to the short seller's claims, calling it "nothing short of calculated securities fraud" and declared that the US company was attacking India as a whole.

"This is not merely an unwarranted attack on any specific company but a calculated attack on India, the independence, integrity and quality of Indian institutions, and the growth story and ambition of India," Adani said.

Adani reiterated it will "exercise our rights to pursue remedies to safeguard our stakeholders before all appropriate authorities."

Combing through some of Adani's rebuttals is Bloomberg's Brian Chappatta. He outlined a few of the responses.

Some responses about the Mauritius-based entities and entities associated with Monterosa Investment Holdings.

— Brian Chappatta (@BChappatta) January 29, 2023

tl:dr -- they're public shareholders in listed Adani companies. We don't control who buys/sells/owns those shares and aren't required to know the source of the funds. pic.twitter.com/a2PSd59ASa

On multiple questions about Gautam's older brother, Vinod, this appears to be the boilerplate answer:

— Brian Chappatta (@BChappatta) January 29, 2023

"Vinod Adani does not hold any managerial position in any Adani listed entities or their subsidiaries and has no role in their day to day affairs." pic.twitter.com/Kmn0IzicRS

This is an interesting reply.

— Brian Chappatta (@BChappatta) January 29, 2023

The question about related party transactions (and what counts and doesn't) is key to all of this. pic.twitter.com/ZwAj4qBT9g

Here's the 413-page rebuttal.

Meanwhile, Pershing Square's Bill Ackman doubled down Sunday morning on his criticism about Adani.

I don’t see how the bankers for the @AdaniOnline equity offering can allow it to close without doing due diligence on the issues identified in the @HindenburgRes report. There is just too much liability exposure for the banks. https://t.co/3I6kruZUaJ

— Bill Ackman (@BillAckman) January 29, 2023

And we wonder just how long it will take for Hindenburg to respond to Adani's rebuttal.

US short-seller Hindenburg Research and Indian billionaire Gautam Adani are locked in an epic game of ping pong as both throw barbs at each other.

Last week, Hindenburg published a 100-page report alleging Adani’s company Adani Enterprises Ltd. is built on accounting fraud, while Adani’s legal team called the short report “maliciously mischievous and unresearched.”

Hindenburg’s report led to a $50 billion selloff in Adani’s corporate empire.

The next round of fighting between the short seller and India’s richest person occurred on Sunday when Adani Group published a 413-page rebuttal to the short seller’s claims, calling it “nothing short of calculated securities fraud” and declared that the US company was attacking India as a whole.

“This is not merely an unwarranted attack on any specific company but a calculated attack on India, the independence, integrity and quality of Indian institutions, and the growth story and ambition of India,” Adani said.

Adani reiterated it will “exercise our rights to pursue remedies to safeguard our stakeholders before all appropriate authorities.”

Combing through some of Adani’s rebuttals is Bloomberg’s Brian Chappatta. He outlined a few of the responses.

Some responses about the Mauritius-based entities and entities associated with Monterosa Investment Holdings.

tl:dr — they’re public shareholders in listed Adani companies. We don’t control who buys/sells/owns those shares and aren’t required to know the source of the funds. pic.twitter.com/a2PSd59ASa

— Brian Chappatta (@BChappatta) January 29, 2023

On multiple questions about Gautam’s older brother, Vinod, this appears to be the boilerplate answer:

“Vinod Adani does not hold any managerial position in any Adani listed entities or their subsidiaries and has no role in their day to day affairs.” pic.twitter.com/Kmn0IzicRS

— Brian Chappatta (@BChappatta) January 29, 2023

This is an interesting reply.

The question about related party transactions (and what counts and doesn’t) is key to all of this. pic.twitter.com/ZwAj4qBT9g

— Brian Chappatta (@BChappatta) January 29, 2023

Here’s the 413-page rebuttal.

Meanwhile, Pershing Square’s Bill Ackman doubled down Sunday morning on his criticism about Adani.

I don’t see how the bankers for the @AdaniOnline equity offering can allow it to close without doing due diligence on the issues identified in the @HindenburgRes report. There is just too much liability exposure for the banks. https://t.co/3I6kruZUaJ

— Bill Ackman (@BillAckman) January 29, 2023

And we wonder just how long it will take for Hindenburg to respond to Adani’s rebuttal.

Loading…