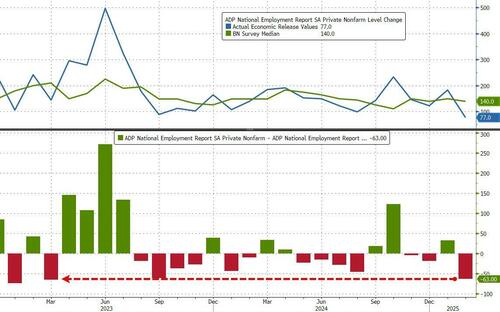

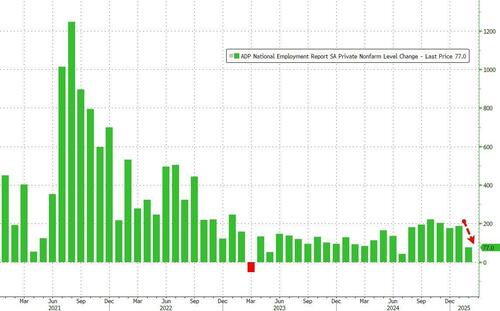

According to the latest data from ADP, hiring slowed to the smallest level of gains since July, with trade and transportation, health care and education, and information showing job losses. Small business employment also fell.

That was the biggest miss for ADP headline data since March 2023...

According to Nela Richardson, Chief Economist at ADP, "policy uncertainty and a slowdown in consumer spending might have led to layoffs or a slowdown in hiring last month. Our data, combined with other recent indicators, suggests a hiring hesitancy among employers as they assess the economic climate ahead."

Oddly, as we noted above, job losses were concentrated in Small Businesses... (we say oddly because we have seen Small Business Optimism explode higher since Trump was elected...)?

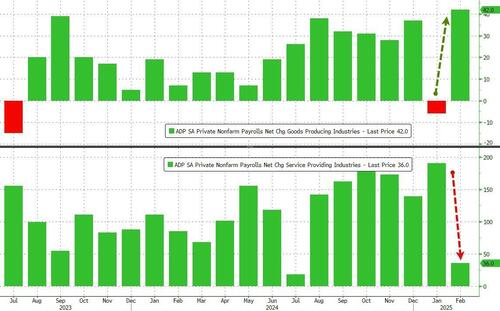

Perhaps more odd still is the fact that goods-producing firms saw a huge jump in job additions (Trump driving confidence in manufacturing with the biggest addition since Oct 2022) while Services was job additions tumble...

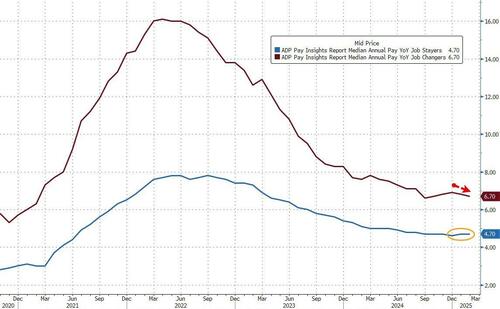

On the potentially positive side of the ledger - wage growth slowed for job-changers (and was flat for job-stayers)...

But given the levels of wage inflation (and labor weakness), it still has the stench of stagflation.

According to the latest data from ADP, hiring slowed to the smallest level of gains since July, with trade and transportation, health care and education, and information showing job losses. Small business employment also fell.

That was the biggest miss for ADP headline data since March 2023…

According to Nela Richardson, Chief Economist at ADP, “policy uncertainty and a slowdown in consumer spending might have led to layoffs or a slowdown in hiring last month. Our data, combined with other recent indicators, suggests a hiring hesitancy among employers as they assess the economic climate ahead.”

Oddly, as we noted above, job losses were concentrated in Small Businesses… (we say oddly because we have seen Small Business Optimism explode higher since Trump was elected…)?

Perhaps more odd still is the fact that goods-producing firms saw a huge jump in job additions (Trump driving confidence in manufacturing with the biggest addition since Oct 2022) while Services was job additions tumble…

On the potentially positive side of the ledger – wage growth slowed for job-changers (and was flat for job-stayers)…

But given the levels of wage inflation (and labor weakness), it still has the stench of stagflation.

So, to sum things up:

Small biz optimism is thru the roof… but small biz see the most layoffs.

…and policy uncertainty is cited as the reason for weakness BUT manufacturers (which is where all the uncertainty is) added the most jobs since Oct 2022…

Is someone trying to force a confidence collapse narrative?

Loading…