The presidential election is on November 5th, and radical economic promises abound. The very next day, the Fed will meet to decide on more interest rate cuts. Gold and silver are holding all-time highs. With all these factors and more, after Halloween, we will see just how spooky things can get for the US economy.

Markets are trying to figure out who will win the election.

-

“Trump Trade” advocates think that a second Trump administration is coming, and a bullish indicator as his promises for deregulation and lower corporate taxes come to fruition.

-

Contrasted with Kamala Harris’s constitutionally questionable plan to give handouts to African-Americans as her support with the demographic wanes, markets appear to prefer the former

...but as Peter Schiff recently pointed out on his podcast, bullish market sentiment doesn’t mean the economy is in good shape.

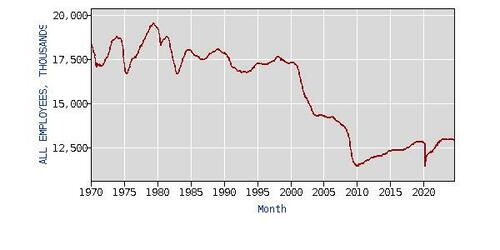

It’s in big trouble regardless of who wins. While Trump is more likely to reduce the size of the government, neither candidate seems likely to fully reverse our staggering budget deficits. We have low interest rates and a growing economy, but a completely dead manufacturing base and a commercial real estate market that’s teetering on the brink. Trump has promised to eliminate the income tax and replace it with tariffs, but you can’t do that in a country that doesn’t produce anything. As Peter Schiff said:

“It’s not like all these companies are going to start manufacturing in America–they can’t. Because if they manufactured in America, the prices would be so high that they couldn’t sell the product. That’s why they left in the first place. They left to stay competitive. And…if they come back under the current environment, they won’t be. So we need massive deregulation.”

US Manufacturing Employees Since 1970, US Bureau of Labor Statistics

In Japan, the dovish new Japanese prime minister is reversing his previous position and signaling that Japan shouldn’t raise interest rates. The dying yen carry trade has momentarily reincarnated since imploding in August amidst tremendous yen volatility and crashing Japanese equities. However, it isn’t the prime minister’s choice to raise rates or not, and of course, politicians make all kinds of comments during election season. Japanese central bank governor Kazuo Ueda was classically vague about which direction the Bank of Japan would go in the coming months.

Even after the Fed slashed the federal funds rate, and is expected to cut further, mortgage rates are still stubbornly up. The 10-year Treasury Yield has ticked higher this month, and combined with high inflation, mortgage rates are responding. Even with a lower cost of borrowing, out of control inflation will keep getting worse with more rate cuts, as borrowing becomes more attractive even as goods and services become less and less affordable.

10-Year Treasury Yields, 2023-2024 (MacroTrends.net)

With the Fed’s interest rate-cutting bonanza and a money supply that has risen for 11 straight months, higher inflation is a guarantee for cash-strapped and over-indebted consumers who are already stretched thin — regardless of what happens to Japanese yen and in the US election.

The inflationary period in 1970 came after a two-year lag in money supply growth, portending a massive decline in the dollar’s purchasing power in the next 24 months no matter who wins this November.

The spooky economy will just keep getting spookier. And unfortunately, neither Kamala Harris’s plan to “invest” in African Americans, nor Trump’s plan to replace the income tax with tariffs overnight, are anywhere close to being viable solutions that can save it.

The presidential election is on November 5th, and radical economic promises abound. The very next day, the Fed will meet to decide on more interest rate cuts. Gold and silver are holding all-time highs. With all these factors and more, after Halloween, we will see just how spooky things can get for the US economy.

Markets are trying to figure out who will win the election.

-

“Trump Trade” advocates think that a second Trump administration is coming, and a bullish indicator as his promises for deregulation and lower corporate taxes come to fruition.

-

Contrasted with Kamala Harris’s constitutionally questionable plan to give handouts to African-Americans as her support with the demographic wanes, markets appear to prefer the former

…but as Peter Schiff recently pointed out on his podcast, bullish market sentiment doesn’t mean the economy is in good shape.

It’s in big trouble regardless of who wins. While Trump is more likely to reduce the size of the government, neither candidate seems likely to fully reverse our staggering budget deficits. We have low interest rates and a growing economy, but a completely dead manufacturing base and a commercial real estate market that’s teetering on the brink. Trump has promised to eliminate the income tax and replace it with tariffs, but you can’t do that in a country that doesn’t produce anything. As Peter Schiff said:

“It’s not like all these companies are going to start manufacturing in America–they can’t. Because if they manufactured in America, the prices would be so high that they couldn’t sell the product. That’s why they left in the first place. They left to stay competitive. And…if they come back under the current environment, they won’t be. So we need massive deregulation.”

US Manufacturing Employees Since 1970, US Bureau of Labor Statistics

In Japan, the dovish new Japanese prime minister is reversing his previous position and signaling that Japan shouldn’t raise interest rates. The dying yen carry trade has momentarily reincarnated since imploding in August amidst tremendous yen volatility and crashing Japanese equities. However, it isn’t the prime minister’s choice to raise rates or not, and of course, politicians make all kinds of comments during election season. Japanese central bank governor Kazuo Ueda was classically vague about which direction the Bank of Japan would go in the coming months.

Even after the Fed slashed the federal funds rate, and is expected to cut further, mortgage rates are still stubbornly up. The 10-year Treasury Yield has ticked higher this month, and combined with high inflation, mortgage rates are responding. Even with a lower cost of borrowing, out of control inflation will keep getting worse with more rate cuts, as borrowing becomes more attractive even as goods and services become less and less affordable.

10-Year Treasury Yields, 2023-2024 (MacroTrends.net)

With the Fed’s interest rate-cutting bonanza and a money supply that has risen for 11 straight months, higher inflation is a guarantee for cash-strapped and over-indebted consumers who are already stretched thin — regardless of what happens to Japanese yen and in the US election.

The inflationary period in 1970 came after a two-year lag in money supply growth, portending a massive decline in the dollar’s purchasing power in the next 24 months no matter who wins this November.

The spooky economy will just keep getting spookier. And unfortunately, neither Kamala Harris’s plan to “invest” in African Americans, nor Trump’s plan to replace the income tax with tariffs overnight, are anywhere close to being viable solutions that can save it.

Loading…