For those who missed it, the latest BOJ announcement held no surprises: the Japanese central bank maintained the status quo across all monetary policy parameters—yield curve control (YCC), asset purchase programs, and forward guidance. The only notable revision was that the Core CPI forecast revised down for FY24 (2.8% -> 2.4%) and up for FY25 (1.7% -> 1.8%). Core-Core CPI remains unchanged for both FY24/25 at 1.9%. Here is how Goldman's sellside explained the changes:

In the quarterly Outlook Report, while the BOJ lowered its near-term price outlook to reflect lower crude oil prices, it upgraded its long-term price outlook statement and added to the summary that the likelihood of realizing its price stability target has continued to gradually rise. On the other hand, the BOJ’s economic assessment is largely unchanged.

A key point in the Outlook Report was the addition of a statement in the summary that “…although there remain high uncertainties over future developments,” “…the likelihood of realizing this outlook has continued to gradually rise…” in referring to its price stability target. In its October 2023 Outlook Report, the BOJ added the statement that “toward the end of the projection period, underlying CPI inflation is likely to increase gradually toward achieving the price stability target…,” suggesting the BOJ’s long-term price outlook was gradually, albeit slightly, being revised upward. However, it is necessary to wait for the press conference to judge whether the distance to a rate hike has narrowed sufficiently or whether a rate hike is still a distant prospect.

While the BOJ statement was viewed as dovish, hawkish comments from Ueda during the presser spooked yen shorts as they suggested the BOJ is a step closer to ending the negative interest rate in the near future.

Specifically, Ueda said that "labor unions are asking for higher pay gains in annual wage negotiations", and noted that he’s still watching to gauge the state of progress toward a virtuous cycle as rippling effects from higher wages spread toward prices little by little He says he’ll continue to assess data carefully, including information on wage negotiations.

More importantly, Ueda said that many businesses have already announced plans to raise interest rates. That came after he earlier noted that a certain amount of key information will be available before the March meeting. He also noted, however, that it’s still uncertain how widespread hikes will be, or how large they’ll be. The BOJ head pledged to decide on negative rate with a view on inflation, and added that reaching the bank’s inflation goal doesn’t necessarily require that the economy show a clear plus in the GDP gap.

Next, we turn to commentary from Goldman's trading desk, starting with FX specialist Michael Cahill, who noted that there are some minor hawkish elements at the margin in the decision:

- the Bank did not revise down median new core inflation projections as we had expected, instead leaving them at 1.9%, although the top end of the range of estimates for 2025 came down slightly.

- the Bank also included a new line that, taking account of wage setting behavior, "The likelihood of realizing this outlook has continued to gradually rise, although there remain high uncertainties over future developments.” They also removed a reference about risks to 2025 being skewed to the downside (at the same time there is a growing gap between the BoJ's projections and our own).

Overall, Cahill writes, "there are signs that the BoJ is moving very gradually towards the exit with incremental changes in that direction today. Time will tell whether this is a signal that the BoJ is finding reasons to be more optimistic as it slowly heads to the exits, but that's my initial read."

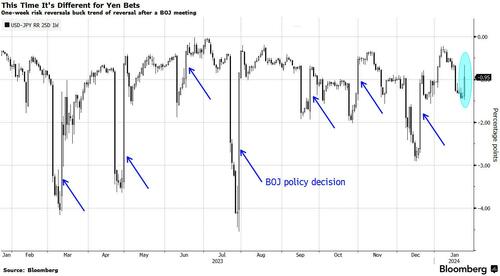

Meanwhile, Bloomberg commentator Vassilis Karamanis toed the party line, writing that while at first look, the Bank of Japan policy decision was no game changer for the yen, risk reversals suggested this could be a turning point for the market:

USD/JPY rose by 0.3% to 148.55 day high after the central bank maintained its -0.1% short-term rate and kept its yield curve control parameters intact, but the move quickly lost traction

Governor Kazuo Ueda’s comments came on the hawkish side as he said that labor unions are asking for higher pay, that some information will be available before the March meeting and that the central bank will mull hiking if its price goal is in sight

USD/JPY fell as much as 0.8% to 146.99 and now steadies around 148.0

But what’s different this time round, according to Karamanis, is that one-week risk reversals aren’t fully pricing out the one-week rollover move as seen at last year’s BOJ meetings. The gauge traded at 67 basis points on a knee-jerk reaction basis, and it seemed that the 2023 pattern of yen topside premium narrowing to pre-one-week rollover levels would hold.

Yet, demand for the Japanese currency resurfaced and riskies now trade at 93 basis points, which suggests that bulls’ conviction is growing for tighter BOJ policy and that the March meeting weighting could be repriced higher.

Finally, we turn to Goldman FX trader Luke Molyneux who writes that "the slightly hawkish tilt to Ueda’s comments garnering some attention with $/JPY trading to 147.00 after trading above 148.50 earlier in the session. Whilst we agree with this to some extent, we think much of this move comes from the overextension to the topside that’s been so well publicised and the market now happy to come back in and sell dollars now that BOJ is out the way. Positioning wise the short term, short dollar trade now feels much cleaner after much of that short $/JPY positioning in the orderbook was cleared out last week on the move through 146.50/75 area."

Longer term, the Goldman trader believes that while JPY should remain in the funding camp of carry pairs, he is playing for the "tactical pull back toward 145.50 before the resumption higher."

For those who missed it, the latest BOJ announcement held no surprises: the Japanese central bank maintained the status quo across all monetary policy parameters—yield curve control (YCC), asset purchase programs, and forward guidance. The only notable revision was that the Core CPI forecast revised down for FY24 (2.8% -> 2.4%) and up for FY25 (1.7% -> 1.8%). Core-Core CPI remains unchanged for both FY24/25 at 1.9%. Here is how Goldman’s sellside explained the changes:

In the quarterly Outlook Report, while the BOJ lowered its near-term price outlook to reflect lower crude oil prices, it upgraded its long-term price outlook statement and added to the summary that the likelihood of realizing its price stability target has continued to gradually rise. On the other hand, the BOJ’s economic assessment is largely unchanged.

A key point in the Outlook Report was the addition of a statement in the summary that “…although there remain high uncertainties over future developments,” “…the likelihood of realizing this outlook has continued to gradually rise…” in referring to its price stability target. In its October 2023 Outlook Report, the BOJ added the statement that “toward the end of the projection period, underlying CPI inflation is likely to increase gradually toward achieving the price stability target…,” suggesting the BOJ’s long-term price outlook was gradually, albeit slightly, being revised upward. However, it is necessary to wait for the press conference to judge whether the distance to a rate hike has narrowed sufficiently or whether a rate hike is still a distant prospect.

While the BOJ statement was viewed as dovish, hawkish comments from Ueda during the presser spooked yen shorts as they suggested the BOJ is a step closer to ending the negative interest rate in the near future.

Specifically, Ueda said that “labor unions are asking for higher pay gains in annual wage negotiations”, and noted that he’s still watching to gauge the state of progress toward a virtuous cycle as rippling effects from higher wages spread toward prices little by little He says he’ll continue to assess data carefully, including information on wage negotiations.

More importantly, Ueda said that many businesses have already announced plans to raise interest rates. That came after he earlier noted that a certain amount of key information will be available before the March meeting. He also noted, however, that it’s still uncertain how widespread hikes will be, or how large they’ll be. The BOJ head pledged to decide on negative rate with a view on inflation, and added that reaching the bank’s inflation goal doesn’t necessarily require that the economy show a clear plus in the GDP gap.

Next, we turn to commentary from Goldman’s trading desk, starting with FX specialist Michael Cahill, who noted that there are some minor hawkish elements at the margin in the decision:

- the Bank did not revise down median new core inflation projections as we had expected, instead leaving them at 1.9%, although the top end of the range of estimates for 2025 came down slightly.

- the Bank also included a new line that, taking account of wage setting behavior, “The likelihood of realizing this outlook has continued to gradually rise, although there remain high uncertainties over future developments.” They also removed a reference about risks to 2025 being skewed to the downside (at the same time there is a growing gap between the BoJ’s projections and our own).

Overall, Cahill writes, “there are signs that the BoJ is moving very gradually towards the exit with incremental changes in that direction today. Time will tell whether this is a signal that the BoJ is finding reasons to be more optimistic as it slowly heads to the exits, but that’s my initial read.“

Meanwhile, Bloomberg commentator Vassilis Karamanis toed the party line, writing that while at first look, the Bank of Japan policy decision was no game changer for the yen, risk reversals suggested this could be a turning point for the market:

USD/JPY rose by 0.3% to 148.55 day high after the central bank maintained its -0.1% short-term rate and kept its yield curve control parameters intact, but the move quickly lost traction

Governor Kazuo Ueda’s comments came on the hawkish side as he said that labor unions are asking for higher pay, that some information will be available before the March meeting and that the central bank will mull hiking if its price goal is in sight

USD/JPY fell as much as 0.8% to 146.99 and now steadies around 148.0

But what’s different this time round, according to Karamanis, is that one-week risk reversals aren’t fully pricing out the one-week rollover move as seen at last year’s BOJ meetings. The gauge traded at 67 basis points on a knee-jerk reaction basis, and it seemed that the 2023 pattern of yen topside premium narrowing to pre-one-week rollover levels would hold.

Yet, demand for the Japanese currency resurfaced and riskies now trade at 93 basis points, which suggests that bulls’ conviction is growing for tighter BOJ policy and that the March meeting weighting could be repriced higher.

Finally, we turn to Goldman FX trader Luke Molyneux who writes that “the slightly hawkish tilt to Ueda’s comments garnering some attention with $/JPY trading to 147.00 after trading above 148.50 earlier in the session. Whilst we agree with this to some extent, we think much of this move comes from the overextension to the topside that’s been so well publicised and the market now happy to come back in and sell dollars now that BOJ is out the way. Positioning wise the short term, short dollar trade now feels much cleaner after much of that short $/JPY positioning in the orderbook was cleared out last week on the move through 146.50/75 area.”

Longer term, the Goldman trader believes that while JPY should remain in the funding camp of carry pairs, he is playing for the “tactical pull back toward 145.50 before the resumption higher.”

Loading…