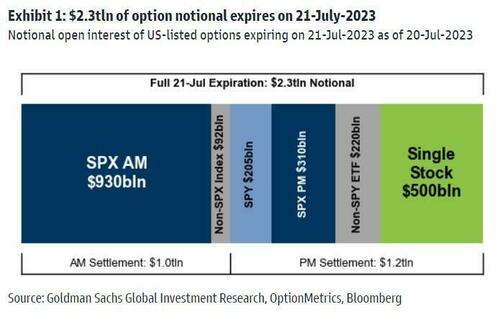

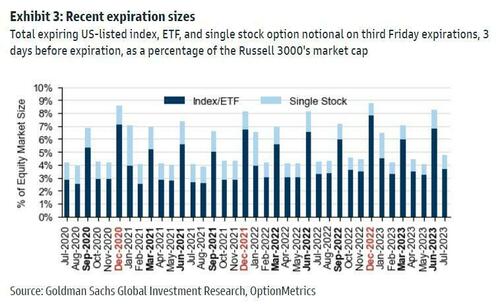

As we previewed in far more detail yesterday, today is the largest July options expiration in history, driven by continued growth in index and ETF options volumes.

According to Goldman estimates, over $2.3 trillion of notional options exposure will expire including $500 billion notional of single stock options at the close, and $1 trillion in index options at the open.

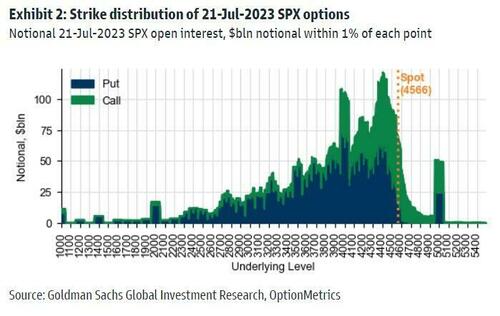

And since the market has rallied through significant overwrites for the second month in a row (+200 handles between May and Jun expiry // +150 handles between Jun and July expiry), following this morning's index expiration, Goldman's vol desk notes that dealers will be left "long right tails and relatively clean (which might as well be short) left tails." Translation: exposure is very call-sided.

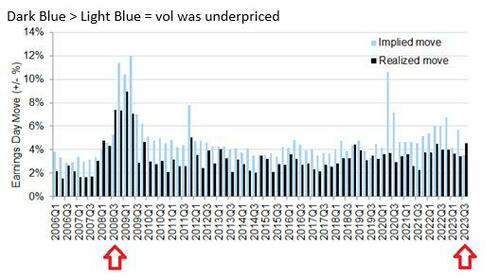

While superficially that means that the VIX will likely get whacked, it's not immediately clear that we will see another VIX bleed: according to Goldman's Gillian Hood, the average realized move this earnings season has been +/-4.6% vs a +/-3.6% implied move 5 days prior to earnings: as Hood notes, "this 1% difference is quite large" and "it’s rare to see the average realized move outperform the implied move by this much, or at all."

In fact, the last time we saw stocks meaningfully outperform their implied moves was Q3 2008, suggesting that implied volatility (i.e. VIX) is extremely underpriced.

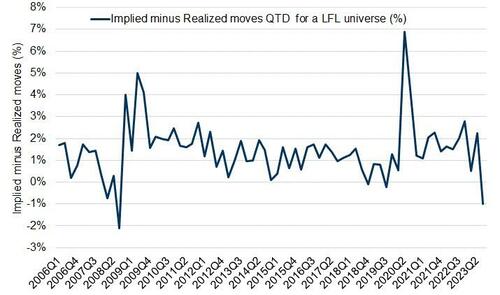

Another way to visualize it: the lower the implied less realized, the greater the realized stock moves versus implied. i.e., market is prone to downside shocks.

As Goldman concludes, while it’s still early in the earnings season (only ~50 SPX names have reported thus far), this is a great testament to the “vol is too low” sentiment.

As we previewed in far more detail yesterday, today is the largest July options expiration in history, driven by continued growth in index and ETF options volumes.

According to Goldman estimates, over $2.3 trillion of notional options exposure will expire including $500 billion notional of single stock options at the close, and $1 trillion in index options at the open.

And since the market has rallied through significant overwrites for the second month in a row (+200 handles between May and Jun expiry // +150 handles between Jun and July expiry), following this morning’s index expiration, Goldman’s vol desk notes that dealers will be left “long right tails and relatively clean (which might as well be short) left tails.” Translation: exposure is very call-sided.

While superficially that means that the VIX will likely get whacked, it’s not immediately clear that we will see another VIX bleed: according to Goldman’s Gillian Hood, the average realized move this earnings season has been +/-4.6% vs a +/-3.6% implied move 5 days prior to earnings: as Hood notes, “this 1% difference is quite large” and “it’s rare to see the average realized move outperform the implied move by this much, or at all.“

In fact, the last time we saw stocks meaningfully outperform their implied moves was Q3 2008, suggesting that implied volatility (i.e. VIX) is extremely underpriced.

Another way to visualize it: the lower the implied less realized, the greater the realized stock moves versus implied. i.e., market is prone to downside shocks.

As Goldman concludes, while it’s still early in the earnings season (only ~50 SPX names have reported thus far), this is a great testament to the “vol is too low” sentiment.

Loading…