From coffee to cocoa, orange juice to gold, and silver to copper, commodity prices are spiking across the board (we outlined this on Monday). The latest surge occurred Tuesday when aluminum tagged 23-month highs due to ongoing production issues emerging from Australia. The broad-based commodity rally signals the inflation storm central bankers are battling is not over.

Rio Tinto, one of the largest aluminum producers, declared force majeure on third-party contracts for exporting alumina from its refineries in Queensland, Australia. This is due to a broken natural gas pipeline operated by Queensland Gas Pipeline.

A spokesperson for the company told Dow Jones that NatGas supplies will return to capacity at a much later date than previously anticipated:

"The pipeline operator's current estimate [is] for a return to normal levels in the second half of 2024.

"Until then, Yarwun and QAL [Queensland Alumina Limited] will continue to operate at lower capacities."

On the London Metal Exchange, aluminum contracts settled up 3.6% at $2,725.50 a metric ton, the highest level since early summer 2022.

Colin Hamilton, managing director for commodities research at BMO Capital Markets, told Bloomberg that today's price action in aluminum markets suggests mounting fears about "dwindling aluminum output" — a situation he views as "unlikely."

Hamilton noted that industrial metal could be "part of the digital and electrical revolution we know is coming ... is going to benefit." We call this "The Next AI Trade."

One base metal that has been on everyone's radars is copper. Comex prices have squeezed to record highs and continue on Tuesday.

Since February, industrial metals tracked by Bloomberg have soared 30%.

Precious metals tracked by Bloomberg have also broken out.

Commodities as a whole, tracked by Bloomberg, have soared.

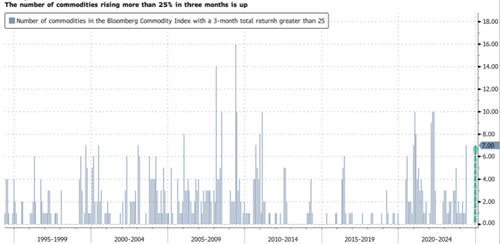

Bloomberg's Cameron Crise pointed out that the number of commodities in the Bloomberg Commodity Index that are up by at least 25% over the three month period have risen to seven.

Crise continues:

Currently, there are seven: cocoa, copper, nickel, orange juice, silver, tin, and zinc. Clearly industrial metals are a theme in that list, which itself raises the question of how valid some of the global growth concerns might be. Anyhow, the current total of seven is the highest since the middle of 2022; coincidentally (or not), the industrial metals subindex total return is also the highest since the same point in time.

He added:

Obviously, over long periods of time the link between the series above and inflation isn't necessarily that great; the highest-ever reading came in 2009 with the correction of the GFC downside overshoot in commodity prices. Still, the relatively broad-based rise in industrial metals is noteworthy and raises another question about just how benign the inflation outlook might be moving forwards.

The hot commodity market is posing new challenges for Fed chair Jerome Powell and his friends in the White House...

From coffee to cocoa, orange juice to gold, and silver to copper, commodity prices are spiking across the board (we outlined this on Monday). The latest surge occurred Tuesday when aluminum tagged 23-month highs due to ongoing production issues emerging from Australia. The broad-based commodity rally signals the inflation storm central bankers are battling is not over.

Rio Tinto, one of the largest aluminum producers, declared force majeure on third-party contracts for exporting alumina from its refineries in Queensland, Australia. This is due to a broken natural gas pipeline operated by Queensland Gas Pipeline.

A spokesperson for the company told Dow Jones that NatGas supplies will return to capacity at a much later date than previously anticipated:

“The pipeline operator’s current estimate [is] for a return to normal levels in the second half of 2024.

“Until then, Yarwun and QAL [Queensland Alumina Limited] will continue to operate at lower capacities.”

On the London Metal Exchange, aluminum contracts settled up 3.6% at $2,725.50 a metric ton, the highest level since early summer 2022.

Colin Hamilton, managing director for commodities research at BMO Capital Markets, told Bloomberg that today’s price action in aluminum markets suggests mounting fears about “dwindling aluminum output” — a situation he views as “unlikely.”

Hamilton noted that industrial metal could be “part of the digital and electrical revolution we know is coming … is going to benefit.” We call this “The Next AI Trade.”

One base metal that has been on everyone’s radars is copper. Comex prices have squeezed to record highs and continue on Tuesday.

Since February, industrial metals tracked by Bloomberg have soared 30%.

Precious metals tracked by Bloomberg have also broken out.

Commodities as a whole, tracked by Bloomberg, have soared.

Bloomberg’s Cameron Crise pointed out that the number of commodities in the Bloomberg Commodity Index that are up by at least 25% over the three month period have risen to seven.

Crise continues:

Currently, there are seven: cocoa, copper, nickel, orange juice, silver, tin, and zinc. Clearly industrial metals are a theme in that list, which itself raises the question of how valid some of the global growth concerns might be. Anyhow, the current total of seven is the highest since the middle of 2022; coincidentally (or not), the industrial metals subindex total return is also the highest since the same point in time.

He added:

Obviously, over long periods of time the link between the series above and inflation isn’t necessarily that great; the highest-ever reading came in 2009 with the correction of the GFC downside overshoot in commodity prices. Still, the relatively broad-based rise in industrial metals is noteworthy and raises another question about just how benign the inflation outlook might be moving forwards.

The hot commodity market is posing new challenges for Fed chair Jerome Powell and his friends in the White House…

Loading…