Americans, hit by inflation, higher interest rates, and supply-chain issues, are buying fewer new vehicles. The four-year average for annual sales is now 15.5 million, down from 17.7 million pre-pandemic, per the Bureau of Economic Analysis.

The slowdown in new car sales might seem like good news for auto repair and parts companies, as older vehicles typically need more maintenance. Cars between four and eleven years old are in the "sweet spot" for repairs, yet signs show many Americans are cutting back on maintenance spending, according to the Wall Street Journal.

In May, tire retailer Monro reported a sharp decline in same-store sales, citing low- to middle-income consumers opting for cheaper, off-brand tires due to a glut of imports. Spending on services like brakes and shocks dropped even more.

Similarly, in September, Genuine Parts, owner of Napa auto-supply stores, experienced its worst single-day stock drop in decades, as retail sales fell significantly. CEO William Stengel blamed a "cautious end consumer deferring certain service and maintenance-related purchases."

The Journal wrote that Valvoline also reported weaker-than-expected sales recently, with its shares falling 9%. CEO Lori Flees noted that competitors, like tire service centers, were offering discounted oil changes to attract traffic, as many consumers delayed core services.

Carfax data shows 30% of vehicles in the U.S. are overdue for tire rotation and 19% for an oil change. This penny-pinching is widespread, with lower-income households trading down to cheaper options across industries. However, skimping on car maintenance could backfire.

A no-name tire costing $149.99 for a Ford Explorer comes with a 40,000-mile warranty, while a Goodyear option priced at $254 offers a 60,000-mile warranty and better safety.

The Manheim Used Vehicle Value Index is up 36% over five years, meaning maintenance investments now have a greater payoff. Still, iconic brands like Goodyear, which saw an 8.3% drop in tire sales in the Americas last quarter, face pressure from cheap imports that are gaining market share.

However, while motorists might trade down on parts, they still need local services—an advantage foreign manufacturers can't replicate.

The rise in EV sales, which require less maintenance, could impact auto parts stores and quick-lube chains, but it’s too recent to explain the current dip in spending, the report says.

Pandemic-related shifts, like remote work and fewer miles driven since 2020, have also played a role, though driving levels have recently returned to 2019 norms.

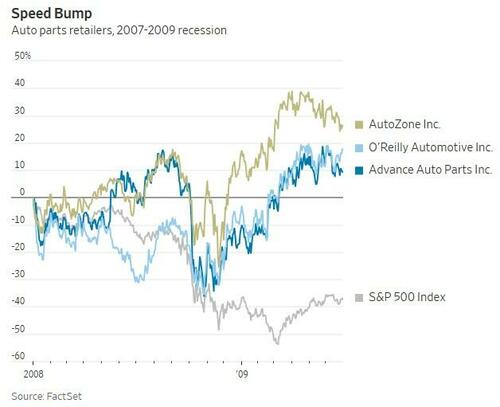

Maintenance spending should stabilize as wear-and-tear returns to normal, even if the economy weakens. Historically, during downturns like the 2007-2009 recession, auto-parts retailers outperformed, with the three most retail-focused chains beating the S&P 500 by an average of 55 percentage points.

Americans, hit by inflation, higher interest rates, and supply-chain issues, are buying fewer new vehicles. The four-year average for annual sales is now 15.5 million, down from 17.7 million pre-pandemic, per the Bureau of Economic Analysis.

The slowdown in new car sales might seem like good news for auto repair and parts companies, as older vehicles typically need more maintenance. Cars between four and eleven years old are in the “sweet spot” for repairs, yet signs show many Americans are cutting back on maintenance spending, according to the Wall Street Journal.

In May, tire retailer Monro reported a sharp decline in same-store sales, citing low- to middle-income consumers opting for cheaper, off-brand tires due to a glut of imports. Spending on services like brakes and shocks dropped even more.

Similarly, in September, Genuine Parts, owner of Napa auto-supply stores, experienced its worst single-day stock drop in decades, as retail sales fell significantly. CEO William Stengel blamed a “cautious end consumer deferring certain service and maintenance-related purchases.”

The Journal wrote that Valvoline also reported weaker-than-expected sales recently, with its shares falling 9%. CEO Lori Flees noted that competitors, like tire service centers, were offering discounted oil changes to attract traffic, as many consumers delayed core services.

Carfax data shows 30% of vehicles in the U.S. are overdue for tire rotation and 19% for an oil change. This penny-pinching is widespread, with lower-income households trading down to cheaper options across industries. However, skimping on car maintenance could backfire.

A no-name tire costing $149.99 for a Ford Explorer comes with a 40,000-mile warranty, while a Goodyear option priced at $254 offers a 60,000-mile warranty and better safety.

The Manheim Used Vehicle Value Index is up 36% over five years, meaning maintenance investments now have a greater payoff. Still, iconic brands like Goodyear, which saw an 8.3% drop in tire sales in the Americas last quarter, face pressure from cheap imports that are gaining market share.

However, while motorists might trade down on parts, they still need local services—an advantage foreign manufacturers can’t replicate.

The rise in EV sales, which require less maintenance, could impact auto parts stores and quick-lube chains, but it’s too recent to explain the current dip in spending, the report says.

Pandemic-related shifts, like remote work and fewer miles driven since 2020, have also played a role, though driving levels have recently returned to 2019 norms.

Maintenance spending should stabilize as wear-and-tear returns to normal, even if the economy weakens. Historically, during downturns like the 2007-2009 recession, auto-parts retailers outperformed, with the three most retail-focused chains beating the S&P 500 by an average of 55 percentage points.

Loading…