Authored by Michael Maharrey via SchiffGold.com,

Mainstream financial network pundits and government officials keep telling us that the economy is chugging along because Americans continue to spend money. But it’s clear that borrowing is the only thing sustaining this spending spree.

Meanwhile, the “resilient” American consumer is drowning under a surging tidal wave of debt.

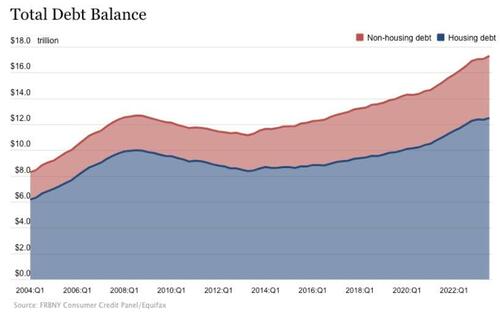

Total household debt rose by $228 billion in the third quarter, setting a new record of $17.29 trillion, according to the latest data from the New York Federal Reserve.

Surging credit card balances led the way, increasing by 4.7% to a record $1.08 trillion. Year-on-year, credit card debt spiked by $154 billion. That was the biggest annual increase since 1999.

The bigger problem is the double whammy of rising debt and rising interest rates. Average credit card interest rates eclipsed the previous record high of 17.87% months ago. The average annual percentage rate (APR) currently stands at 20.72%.

According to the Consumer Financial Protection Bureau, Americans paid $130 billion in interest and fees on their credit cards over the last year. That was the largest amount on record.

As prices skyrocketed last year, Americans blew through their savings to make ends meet. Aggregate savings peaked at $2.1 trillion in August 2021. As of June, the San Francisco Fed estimated that aggregate savings had dropped to $190 billion.

In other words, Americans ate away $1.9 trillion in savings in just two years.

Then they turned to credit cards.

“People have to deal with this somehow. After blowing through savings to buy essentials, they do what’s next: Find sources to borrow,” Villanova University finance professor John Sedunov told ABC News.

According to MarketWatch, “Americans appear to be relying more on debt to pay for their purchases. They are also using more ‘buy now and pay later’ plans.”

New York Fed economic research advisor Donghoon Lee also credited the resilience of the American consumer to Visa and Mastercard.

Credit card balances experienced a large jump in the third quarter, consistent with strong consumer spending and real GDP growth.”

Debt.com chairman Howard Dvorkin told CNBC, “Consumers are maintaining and supporting their lifestyles using credit card debt.”

In other words, the economic growth President Biden and others keep bragging about is merely a function of borrowing.

This is not exactly indicative of a healthy economy, and it’s not sustainable.

Consumer spending, which we all know is the base of GDP, is really being held up by credit card debt and maybe it’s not sustainable,” American University economic professor Mary Hansen told ABC News.

There are some signs that the debt-fueled spending spree is slowing down. After rising by over 13% in August, revolving credit growth (primarily credit card balances) slowed to 2.9% in September, according to the latest Federal Reserve consumer credit data. This could signal a significant slowdown in spending. That would mean an end to the mythical “strong” economic growth.

Americans aren’t just borrowing using credit cards. Every other category of debt also increased in the third quarter.

Mortgage balances rose by $126 billion from the previous quarter and stood at $12.14 trillion at the end of September. The big increase in mortgage balances happened despite a drop in new mortgage originations, reflecting rapidly increasing mortgage rates.

Despite the higher rates, more Americans appear to be tapping into their home equity to make ends meet. Balances on home equity lines of credit (HELOC) increased by $9 billion and now stand at $349 billion.

Auto loan balances rose by $13 billion and now stand at $1.6 trillion. Auto loan debt has grown consistently since 2011.

Outstanding student loan debt increased by $30 billion and stood at $1.6 trillion at the end of Q3.

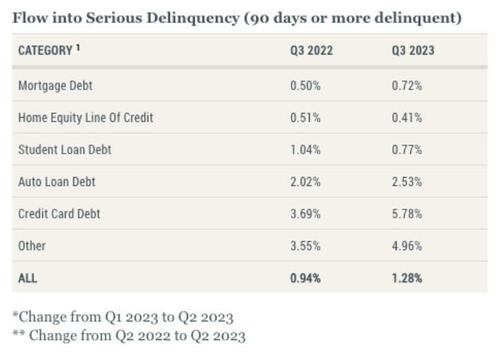

There are signs that Americans are starting to crack under the strain of this debt load. Delinquencies rose across all debt categories.

As of the end of September, 3% of outstanding debt was in some stage of delinquency. According to the New York Fed, delinquency transition rates increased for most debt types except student loans and home equity lines of credit.

The report noted a big jump in credit card delinquency, particularly in the 30-39 year old age range.

The continued rise in credit card delinquency rates is broad-based across area income and region, but particularly pronounced among millennials and those with auto loans or student loans,” Lee said.

Missed federal student loan payments will not be reported to credit bureaus until Q4 2024.

According to the Consumer Financial Protection Bureau, “nearly one-tenth of credit card users find themselves in ‘persistent debt’ where they are charged more in interest and fees each year than they pay toward the principal — a pattern that is increasingly difficult to break.”

The surge in household debt signals that Americans are struggling to make ends meet as prices rapidly rise, and they’re burying themselves in debt to keep their heads above water. The stimulus checks are long gone. Savings are being depleted. The average person has no choice but to borrow.

Debt is creating an illusion of prosperity and economic growth. The question is how long can that last?

Rising levels of debt are also a problem for the Federal Reserve as it tries to battle sticky price inflation with higher interest rates. The longer rates stay elevated, the harder it will be for people to maintain these massive levels of debt. At some point, something has to break.

Authored by Michael Maharrey via SchiffGold.com,

Mainstream financial network pundits and government officials keep telling us that the economy is chugging along because Americans continue to spend money. But it’s clear that borrowing is the only thing sustaining this spending spree.

Meanwhile, the “resilient” American consumer is drowning under a surging tidal wave of debt.

Total household debt rose by $228 billion in the third quarter, setting a new record of $17.29 trillion, according to the latest data from the New York Federal Reserve.

Surging credit card balances led the way, increasing by 4.7% to a record $1.08 trillion. Year-on-year, credit card debt spiked by $154 billion. That was the biggest annual increase since 1999.

The bigger problem is the double whammy of rising debt and rising interest rates. Average credit card interest rates eclipsed the previous record high of 17.87% months ago. The average annual percentage rate (APR) currently stands at 20.72%.

According to the Consumer Financial Protection Bureau, Americans paid $130 billion in interest and fees on their credit cards over the last year. That was the largest amount on record.

As prices skyrocketed last year, Americans blew through their savings to make ends meet. Aggregate savings peaked at $2.1 trillion in August 2021. As of June, the San Francisco Fed estimated that aggregate savings had dropped to $190 billion.

In other words, Americans ate away $1.9 trillion in savings in just two years.

Then they turned to credit cards.

“People have to deal with this somehow. After blowing through savings to buy essentials, they do what’s next: Find sources to borrow,” Villanova University finance professor John Sedunov told ABC News.

According to MarketWatch, “Americans appear to be relying more on debt to pay for their purchases. They are also using more ‘buy now and pay later’ plans.”

New York Fed economic research advisor Donghoon Lee also credited the resilience of the American consumer to Visa and Mastercard.

Credit card balances experienced a large jump in the third quarter, consistent with strong consumer spending and real GDP growth.”

Debt.com chairman Howard Dvorkin told CNBC, “Consumers are maintaining and supporting their lifestyles using credit card debt.”

In other words, the economic growth President Biden and others keep bragging about is merely a function of borrowing.

This is not exactly indicative of a healthy economy, and it’s not sustainable.

Consumer spending, which we all know is the base of GDP, is really being held up by credit card debt and maybe it’s not sustainable,” American University economic professor Mary Hansen told ABC News.

There are some signs that the debt-fueled spending spree is slowing down. After rising by over 13% in August, revolving credit growth (primarily credit card balances) slowed to 2.9% in September, according to the latest Federal Reserve consumer credit data. This could signal a significant slowdown in spending. That would mean an end to the mythical “strong” economic growth.

Americans aren’t just borrowing using credit cards. Every other category of debt also increased in the third quarter.

Mortgage balances rose by $126 billion from the previous quarter and stood at $12.14 trillion at the end of September. The big increase in mortgage balances happened despite a drop in new mortgage originations, reflecting rapidly increasing mortgage rates.

Despite the higher rates, more Americans appear to be tapping into their home equity to make ends meet. Balances on home equity lines of credit (HELOC) increased by $9 billion and now stand at $349 billion.

Auto loan balances rose by $13 billion and now stand at $1.6 trillion. Auto loan debt has grown consistently since 2011.

Outstanding student loan debt increased by $30 billion and stood at $1.6 trillion at the end of Q3.

There are signs that Americans are starting to crack under the strain of this debt load. Delinquencies rose across all debt categories.

As of the end of September, 3% of outstanding debt was in some stage of delinquency. According to the New York Fed, delinquency transition rates increased for most debt types except student loans and home equity lines of credit.

The report noted a big jump in credit card delinquency, particularly in the 30-39 year old age range.

The continued rise in credit card delinquency rates is broad-based across area income and region, but particularly pronounced among millennials and those with auto loans or student loans,” Lee said.

Missed federal student loan payments will not be reported to credit bureaus until Q4 2024.

According to the Consumer Financial Protection Bureau, “nearly one-tenth of credit card users find themselves in ‘persistent debt’ where they are charged more in interest and fees each year than they pay toward the principal — a pattern that is increasingly difficult to break.”

The surge in household debt signals that Americans are struggling to make ends meet as prices rapidly rise, and they’re burying themselves in debt to keep their heads above water. The stimulus checks are long gone. Savings are being depleted. The average person has no choice but to borrow.

Debt is creating an illusion of prosperity and economic growth. The question is how long can that last?

Rising levels of debt are also a problem for the Federal Reserve as it tries to battle sticky price inflation with higher interest rates. The longer rates stay elevated, the harder it will be for people to maintain these massive levels of debt. At some point, something has to break.

Loading…