Apple shares traded lower in premarket trading in New York after Jefferies downgraded the world's most valuable company from "Hold" to "Underperform." Adding to the pressure, independent research firm Counterpoint revealed disappointing iPhone sales data in China.

Jefferies analysts led by Edison Lee downgraded Apple to Underperform from Hold, slashing their price target of $211.84 to $200.75. They cited underwhelming iPhone sales in the world's largest handset market that weren't being boosted by AI hype, adding that Q1 2025 revenue will unlikely be met.

Lee also reduced the outlook for the iPhone 17/18 due to slower AI uptake and commercialization, adding that Apple's AI outlook appears "subdued."

The analysts noted that iPhone and consumer electronics sales were weaker than expected.

Adding to the gloom, Counterpoint's Market Pulse Service showed China's smartphones declined 3.2% YoY in Q4 2024, marking the only quarter in 2024 to log a YoY drop.

Counterpoint Associate Director Ethan Qi commented on the report, "The country's smartphone market saw a rebound in the first three quarters of the year, with positive YoY growth each quarter. However, momentum began to slow in Q4 as consumers adopted cautious spending behavior."

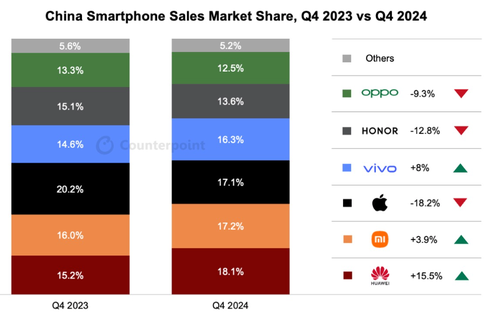

The report showed that the iPhone lost the top position as China's best-selling smartphone, falling from first to third in the fourth quarter of 2024: "During the quarter, Huawei took the top spot, followed by Xiaomi and Apple."

iPhone sales tumbled 18.2% YoY in the quarter.

Counterpoint Senior Research Analyst Mengmeng Zhang said, "In Q4 2024, Huawei climbed to the top spot with an 18.1% share. This is the first time since the US ban that Huawei regained the leading position. Huawei's sales increased 15.5% YoY driven by the launch of the mid-end Nova 13 series and high-end Mate 70 series."

Apple faces intensifying market competition from Huawei and other Chinese brands expanding into the premium market. Apple had about 17.1% market share last quarter.

Counterpoint's data is nothing new for readers who have known for months about the muted launch of Apple Intelligence:

-

Apple Slides After Guiding Below Consensus, Missing On Wearables, China And Service Revenues

-

Foxconn Sales Growth Slows Amid Underwhelming AI-Enabled iPhone Upgrade Supercycle

-

Global Smartphone Sales Rebound, But Apple AI Falls Short Of Sparking Upgrade Boom

Goldman's Allen Chang and Verena Jeng recently provided clients with insights into Apple's big dilemma in China: How it plans to compete with Chinese brands offering low-cost, AI-equipped smartphones priced as low as $168.

In a separate report from another independent research firm, Canalys, last week, iPhone sales in China plunged by 25% YoY for the final quarter of 2024.

The takeaway is that AI-equipped iPhones failed to excite Chinese consumers, who are increasingly gravitating toward cheaper domestic-made AI smartphones. How can Apple compete?

Come on, Tim Cook. Think... Moar stock buybacks?

Apple shares traded lower in premarket trading in New York after Jefferies downgraded the world’s most valuable company from “Hold” to “Underperform.” Adding to the pressure, independent research firm Counterpoint revealed disappointing iPhone sales data in China.

Jefferies analysts led by Edison Lee downgraded Apple to Underperform from Hold, slashing their price target of $211.84 to $200.75. They cited underwhelming iPhone sales in the world’s largest handset market that weren’t being boosted by AI hype, adding that Q1 2025 revenue will unlikely be met.

Lee also reduced the outlook for the iPhone 17/18 due to slower AI uptake and commercialization, adding that Apple’s AI outlook appears “subdued.”

The analysts noted that iPhone and consumer electronics sales were weaker than expected.

Adding to the gloom, Counterpoint’s Market Pulse Service showed China’s smartphones declined 3.2% YoY in Q4 2024, marking the only quarter in 2024 to log a YoY drop.

Counterpoint Associate Director Ethan Qi commented on the report, “The country’s smartphone market saw a rebound in the first three quarters of the year, with positive YoY growth each quarter. However, momentum began to slow in Q4 as consumers adopted cautious spending behavior.”

The report showed that the iPhone lost the top position as China’s best-selling smartphone, falling from first to third in the fourth quarter of 2024: “During the quarter, Huawei took the top spot, followed by Xiaomi and Apple.”

iPhone sales tumbled 18.2% YoY in the quarter.

Counterpoint Senior Research Analyst Mengmeng Zhang said, “In Q4 2024, Huawei climbed to the top spot with an 18.1% share. This is the first time since the US ban that Huawei regained the leading position. Huawei’s sales increased 15.5% YoY driven by the launch of the mid-end Nova 13 series and high-end Mate 70 series.”

Apple faces intensifying market competition from Huawei and other Chinese brands expanding into the premium market. Apple had about 17.1% market share last quarter.

Counterpoint’s data is nothing new for readers who have known for months about the muted launch of Apple Intelligence:

Goldman’s Allen Chang and Verena Jeng recently provided clients with insights into Apple’s big dilemma in China: How it plans to compete with Chinese brands offering low-cost, AI-equipped smartphones priced as low as $168.

In a separate report from another independent research firm, Canalys, last week, iPhone sales in China plunged by 25% YoY for the final quarter of 2024.

The takeaway is that AI-equipped iPhones failed to excite Chinese consumers, who are increasingly gravitating toward cheaper domestic-made AI smartphones. How can Apple compete?

Come on, Tim Cook. Think… Moar stock buybacks?

Loading…