Apple stock, which on any given day is either the most or 2nd most valuable company in the world, rotating with MSFT, reversed earlier gains and slumped to session lows after widely-read TF International Securities analyst Ming-Chi Kuo (best known for gathering intelligence from his contacts in Apple's Asian supply chain) reported that Apple has lowered its 2024 iPhone shipments of key upstream semiconductor components to about 200 million units, which correspondents to a decline of 15% year-on-year.

As a result, he notes that iPhone 15 series and new iPhone 16 series shipments will decline by 10–15% year-on-year in 1H 2024 and 2H 2024, respectively (compared to iPhone 14 series shipments in 1H 2023 and iPhone 15 series shipments in 2H 2023, respectively). Even worse, Apple’s weekly shipments in China have declined by 30–40% year-on-year in recent weeks, and this downward trend is expected to continue.

From the highly critical note:

- My latest supply chain survey indicates that Apple has lowered its 2024 iPhone shipments of key upstream semiconductor components to about 200 million units (down 15% YoY). Apple may have the most significant decline among the major global mobile phone brands in 2024.

- iPhone 15 series and new iPhone 16 series shipments will decline by 10–15% YoY in 1H24 and 2H24, respectively (compared to iPhone 14 series shipments in 1H23 and iPhone 15 series shipments in 2H23, respectively).

- The iPhone faces structural challenges that will lead to a significant decline in shipments in 2024, including the emergence of a new paradigm in high-end mobile phone design and the continued decline in shipments in the Chinese market.

- The new high-end mobile phone design paradigm includes AI (GenAI) and foldable phones. The main reason for the decline in the Chinese market is the return of Huawei and the increasing preference for foldable phones among high-end users as their first choice for phone replacement.

- Benefiting from the higher-than-expected demand due to the high integration of GenAI functions, Samsung has revised up the shipments of the Galaxy S24 series in 2024 by 5–10%, while Apple has revised down the shipment forecast of iPhone 15 in 1H24.

- Apple’s weekly shipments in China have declined by 30–40% YoY in recent weeks, and this downward trend is expected to continue. The main reason for the decline is the return of Huawei and the fact that foldable phones have gradually become the first choice for high-end users in the Chinese market.

- It is expected that Apple will not launch new iPhone models with significant design changes and the more comprehensive/differentiated GenAI ecosystem/applications until 2025 at the earliest. Until then, it will likely harm Apple’s iPhone shipment momentum and ecosystem growth

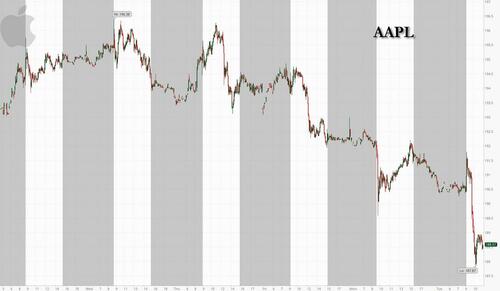

Apple has yet to comment on the report (it probably won't until it reports earnings), but the market is not too happy and AAPL stock is sliding...

... dragging the Nasdaq to session lows...

... with just hours to go until MSFT and GOOGL are set to launch the gigacap tech earnings season after the close today.

Apple stock, which on any given day is either the most or 2nd most valuable company in the world, rotating with MSFT, reversed earlier gains and slumped to session lows after widely-read TF International Securities analyst Ming-Chi Kuo (best known for gathering intelligence from his contacts in Apple’s Asian supply chain) reported that Apple has lowered its 2024 iPhone shipments of key upstream semiconductor components to about 200 million units, which correspondents to a decline of 15% year-on-year.

As a result, he notes that iPhone 15 series and new iPhone 16 series shipments will decline by 10–15% year-on-year in 1H 2024 and 2H 2024, respectively (compared to iPhone 14 series shipments in 1H 2023 and iPhone 15 series shipments in 2H 2023, respectively). Even worse, Apple’s weekly shipments in China have declined by 30–40% year-on-year in recent weeks, and this downward trend is expected to continue.

From the highly critical note:

- My latest supply chain survey indicates that Apple has lowered its 2024 iPhone shipments of key upstream semiconductor components to about 200 million units (down 15% YoY). Apple may have the most significant decline among the major global mobile phone brands in 2024.

- iPhone 15 series and new iPhone 16 series shipments will decline by 10–15% YoY in 1H24 and 2H24, respectively (compared to iPhone 14 series shipments in 1H23 and iPhone 15 series shipments in 2H23, respectively).

- The iPhone faces structural challenges that will lead to a significant decline in shipments in 2024, including the emergence of a new paradigm in high-end mobile phone design and the continued decline in shipments in the Chinese market.

- The new high-end mobile phone design paradigm includes AI (GenAI) and foldable phones. The main reason for the decline in the Chinese market is the return of Huawei and the increasing preference for foldable phones among high-end users as their first choice for phone replacement.

- Benefiting from the higher-than-expected demand due to the high integration of GenAI functions, Samsung has revised up the shipments of the Galaxy S24 series in 2024 by 5–10%, while Apple has revised down the shipment forecast of iPhone 15 in 1H24.

- Apple’s weekly shipments in China have declined by 30–40% YoY in recent weeks, and this downward trend is expected to continue. The main reason for the decline is the return of Huawei and the fact that foldable phones have gradually become the first choice for high-end users in the Chinese market.

- It is expected that Apple will not launch new iPhone models with significant design changes and the more comprehensive/differentiated GenAI ecosystem/applications until 2025 at the earliest. Until then, it will likely harm Apple’s iPhone shipment momentum and ecosystem growth

Apple has yet to comment on the report (it probably won’t until it reports earnings), but the market is not too happy and AAPL stock is sliding…

… dragging the Nasdaq to session lows…

… with just hours to go until MSFT and GOOGL are set to launch the gigacap tech earnings season after the close today.

Loading…