With most of the megatechs having already released earnings, all eyes were on the last Mag7 to report during the heart of earnings season (there is still Nvidia, but due to a calendar quirk that's not for a month) which is also the company which until recently was the undisputed market cap world champion until it was overtaken by the mAIcrosoft juggernaut: Apple. Having failed to enjoy the same AI-driven euphoria some of its giga cap peers, Apple stock had languished for months and was in fact relegated by Goldman recently to the Meh 3 (AAPL, GOOGL, TSLA) and away from the Fab 4 (META, NVDA, MSFT, AMZN). But much of that was recovered after hours when AAPL not only reported blowout earnings but unveiled a massive, record-breaking $110 billion stock buyback program (because when your best product is the 5 pound neck brace known as the Vision Pro you have no choice but to buy your own stock since nobody else will do it for you) which sent the stock soaring after hours.

Here is what AAPL reported for the quarter ended March 31:

- EPS $1.53 vs. $1.52 y/y, and beating the estimate $1.50

- Revenue $90.75 billion, down 4.3% y/y primarily on China weakness, but beating the recently lowered estimate of $90.33 billion

- Products revenue $66.89 billion, -9.5% y/y, just missing the estimate $66.95 billion

- IPhone revenue $45.96 billion, -10% y/y, beating estimate $45.76 billion

- Mac revenue $7.45 billion, +3.9% y/y, beating the estimate $6.79 billion

- IPad revenue $5.56 billion, -17% y/y, missing estimate of $5.91 billion

- Wearables, home and accessories $7.91 billion, down 9.6% y/y, and badly missing estimate $8.29 billion now that the Vision Pro is a confirmed flop

- Service revenue $23.87 billion, +14% y/y, beating the estimate $23.28 billion

- Greater China rev. $16.37 billion, -8.1% y/y, beating the estimate $15.87 billion. This was probably the one item everyone was closely watching due to the big swing impact the recent plunge in China sales would have on the company. It ended up being not as bad as feared.

- Products revenue $66.89 billion, -9.5% y/y, just missing the estimate $66.95 billion

Going down the line:

- Total operating expenses $14.37 billion, higher than the estimate $14.33 billion

- Gross margin $42.27 billion, +0.7% y/y, higher than the estimate $42.01 billion

- Cash and cash equivalents $32.70 billion, below the estimate $36.83 billion

And so on.

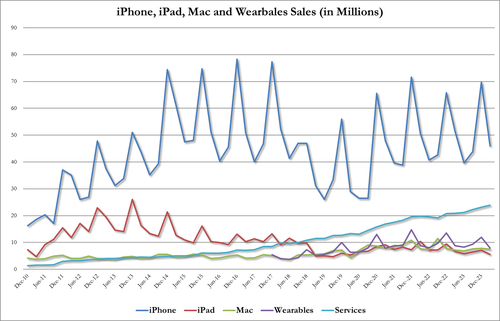

Looking at a breakdown of sales by product category we find that, as expected, iphone sales dropped 10% in a quarter which most knew would be ugly for the iphone maker, but at $46bn they just barely beat expectations of $45.8 billion. The rest of the product suite was mixed with Macs surprisingly beating estimates while both iPads and wearables missed. In any case the trend is clear: while sales may not be plunging, they have certainly topped out and the only ting that is still rising is Services.

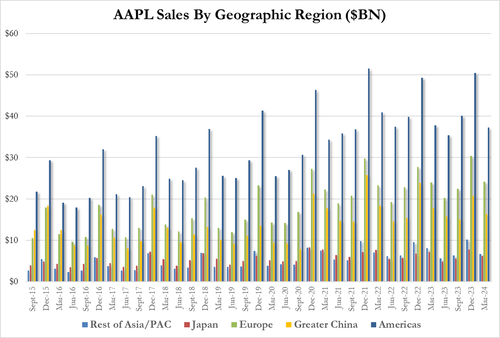

Looking at a geographic breakdown we find that while sales declined across almost every region, with the notable exception of Europe...

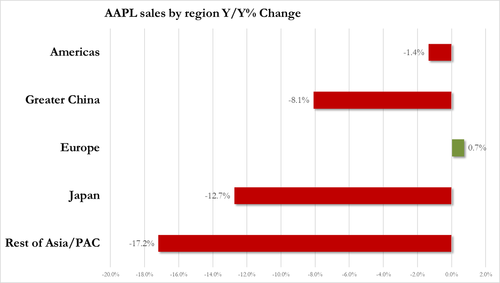

... the 8.1% drop in China sales was not nearly as bad as consensus expected, which fear a double digit drop was coming.

CFO Maestri said that the China concerns were overblown. “We were happy with our results in China,” he said. “The reality is different from maybe what you read at times.”

CEO Cook also pushed back on the idea that the iPhone was suffering in the country, saying that revenue from the device actually grew in mainland China. The weakness stemmed from other parts of the business, he said.

“Other products didn’t fare as well,” he said on a conference call. “And so we clearly have work there to do.”

At the same time, Bloomberg notes that Apple hasn’t shown that new product categories can reinvigorate growth. It canceled work on a self-driving car in February, eliminating a project that some had hoped could become one of its famous “next big things.”

Services were a relative bright spot, growing 14% to $23.9 billion in revenue. That topped Wall Street expectations of $23.3 billion: the category includes Apple Music, the TV+ streaming platform and iCloud subscriptions, but its revenue primarily comes from the App Store. But that business is under pressure from regulators, with Apple being forced to allow third-party marketplaces and payment services in the European Union. Depending on how Apple fares in a legal battle with the Justice Department, it may have to make changes in the US as well.

The company did push into the mixed-reality headset market this year, with the Feb. 2 debut of the Vision Pro. But that product is off to a slow start and could take years before it adds meaningfully to Apple’s revenue. Apple didn’t disclose Vision Pro sales figures on Thursday, but said that the device is generating interest among corporate customers.

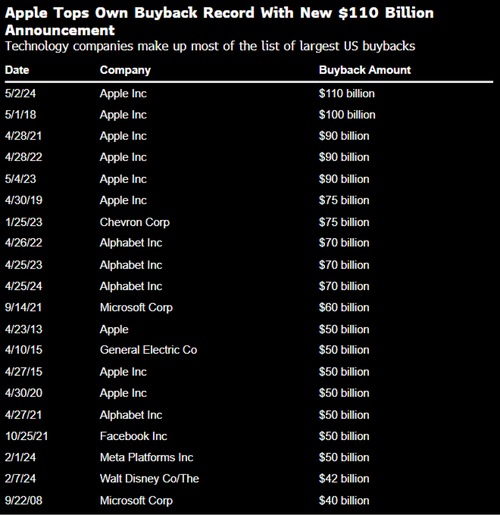

But while the results were solid, and beat reduced estimates it's what was not part of the income statement that stunned investors: the company announced a mind-blowing new stock buyback program, of $110 billion, beating the previous record set by - who else - Apple, and which itself is bigger than the market cap of Boeing (although now that all Boeing whistleblowers have died, expect BA to soar), and also bigger than both GM and Ford combined!

If that wasn't enough, AAPL also predicted a return to growth in the current period, sparking optimism that a slowdown is easing. A lack of innovative new devices has contributed to slow sales at Apple, but the company looks to begin fixing that on May 7. That’s when it plans to unveil new iPads — the first updates to its tablet line in 1 1/2 years.

The results came as a relief to investors, who have been waiting for the iPhone maker to pull out of a long slump. Apple has posted sales declines in five of the past six quarters, hurt by a sluggish smartphone market and headwinds in China. The company had warned analysts in February that revenue in the latest period would be down about 5% from a year earlier.

In the current period, Apple expects sales to climb by a percentage in the low single digits. The company predicted that both its iPad and services business would grow by a rate in the double digits, but declined to give a forecast for the iPhone — its flagship product.

But wait there's more: the iphone maker also is planning a long-awaited push into generative artificial intelligence. In June, Chief Executive Officer Tim Cook is expected to lay out Apple’s AI strategy at its annual Worldwide Developers Conference.

“We are making significant investments in the space,” Chief Financial Officer Luca Maestri told Bloomberg Television’s Emily Chang. “We believe we are well-positioned.” Cook said Thursday that Apple will stand out from its AI rivals by tightly integrating hardware and software, using in-house chips, and making privacy and security a priority.

AAPL shares soared as much as 7.9% in extended trading Thursday before easing back a bit. Apple had been down 10% to $173.03 this year through the close, and is now still down modestly for the year.

With most of the megatechs having already released earnings, all eyes were on the last Mag7 to report during the heart of earnings season (there is still Nvidia, but due to a calendar quirk that’s not for a month) which is also the company which until recently was the undisputed market cap world champion until it was overtaken by the mAIcrosoft juggernaut: Apple. Having failed to enjoy the same AI-driven euphoria some of its giga cap peers, Apple stock had languished for months and was in fact relegated by Goldman recently to the Meh 3 (AAPL, GOOGL, TSLA) and away from the Fab 4 (META, NVDA, MSFT, AMZN). But much of that was recovered after hours when AAPL not only reported blowout earnings but unveiled a massive, record-breaking $110 billion stock buyback program (because when your best product is the 5 pound neck brace known as the Vision Pro you have no choice but to buy your own stock since nobody else will do it for you) which sent the stock soaring after hours.

Here is what AAPL reported for the quarter ended March 31:

- EPS $1.53 vs. $1.52 y/y, and beating the estimate $1.50

- Revenue $90.75 billion, down 4.3% y/y primarily on China weakness, but beating the recently lowered estimate of $90.33 billion

- Products revenue $66.89 billion, -9.5% y/y, just missing the estimate $66.95 billion

- IPhone revenue $45.96 billion, -10% y/y, beating estimate $45.76 billion

- Mac revenue $7.45 billion, +3.9% y/y, beating the estimate $6.79 billion

- IPad revenue $5.56 billion, -17% y/y, missing estimate of $5.91 billion

- Wearables, home and accessories $7.91 billion, down 9.6% y/y, and badly missing estimate $8.29 billion now that the Vision Pro is a confirmed flop

- Service revenue $23.87 billion, +14% y/y, beating the estimate $23.28 billion

- Greater China rev. $16.37 billion, -8.1% y/y, beating the estimate $15.87 billion. This was probably the one item everyone was closely watching due to the big swing impact the recent plunge in China sales would have on the company. It ended up being not as bad as feared.

- Products revenue $66.89 billion, -9.5% y/y, just missing the estimate $66.95 billion

Going down the line:

- Total operating expenses $14.37 billion, higher than the estimate $14.33 billion

- Gross margin $42.27 billion, +0.7% y/y, higher than the estimate $42.01 billion

- Cash and cash equivalents $32.70 billion, below the estimate $36.83 billion

And so on.

Looking at a breakdown of sales by product category we find that, as expected, iphone sales dropped 10% in a quarter which most knew would be ugly for the iphone maker, but at $46bn they just barely beat expectations of $45.8 billion. The rest of the product suite was mixed with Macs surprisingly beating estimates while both iPads and wearables missed. In any case the trend is clear: while sales may not be plunging, they have certainly topped out and the only ting that is still rising is Services.

Looking at a geographic breakdown we find that while sales declined across almost every region, with the notable exception of Europe…

… the 8.1% drop in China sales was not nearly as bad as consensus expected, which fear a double digit drop was coming.

CFO Maestri said that the China concerns were overblown. “We were happy with our results in China,” he said. “The reality is different from maybe what you read at times.”

CEO Cook also pushed back on the idea that the iPhone was suffering in the country, saying that revenue from the device actually grew in mainland China. The weakness stemmed from other parts of the business, he said.

“Other products didn’t fare as well,” he said on a conference call. “And so we clearly have work there to do.”

At the same time, Bloomberg notes that Apple hasn’t shown that new product categories can reinvigorate growth. It canceled work on a self-driving car in February, eliminating a project that some had hoped could become one of its famous “next big things.”

Services were a relative bright spot, growing 14% to $23.9 billion in revenue. That topped Wall Street expectations of $23.3 billion: the category includes Apple Music, the TV+ streaming platform and iCloud subscriptions, but its revenue primarily comes from the App Store. But that business is under pressure from regulators, with Apple being forced to allow third-party marketplaces and payment services in the European Union. Depending on how Apple fares in a legal battle with the Justice Department, it may have to make changes in the US as well.

The company did push into the mixed-reality headset market this year, with the Feb. 2 debut of the Vision Pro. But that product is off to a slow start and could take years before it adds meaningfully to Apple’s revenue. Apple didn’t disclose Vision Pro sales figures on Thursday, but said that the device is generating interest among corporate customers.

But while the results were solid, and beat reduced estimates it’s what was not part of the income statement that stunned investors: the company announced a mind-blowing new stock buyback program, of $110 billion, beating the previous record set by – who else – Apple, and which itself is bigger than the market cap of Boeing (although now that all Boeing whistleblowers have died, expect BA to soar), and also bigger than both GM and Ford combined!

If that wasn’t enough, AAPL also predicted a return to growth in the current period, sparking optimism that a slowdown is easing. A lack of innovative new devices has contributed to slow sales at Apple, but the company looks to begin fixing that on May 7. That’s when it plans to unveil new iPads — the first updates to its tablet line in 1 1/2 years.

The results came as a relief to investors, who have been waiting for the iPhone maker to pull out of a long slump. Apple has posted sales declines in five of the past six quarters, hurt by a sluggish smartphone market and headwinds in China. The company had warned analysts in February that revenue in the latest period would be down about 5% from a year earlier.

In the current period, Apple expects sales to climb by a percentage in the low single digits. The company predicted that both its iPad and services business would grow by a rate in the double digits, but declined to give a forecast for the iPhone — its flagship product.

But wait there’s more: the iphone maker also is planning a long-awaited push into generative artificial intelligence. In June, Chief Executive Officer Tim Cook is expected to lay out Apple’s AI strategy at its annual Worldwide Developers Conference.

“We are making significant investments in the space,” Chief Financial Officer Luca Maestri told Bloomberg Television’s Emily Chang. “We believe we are well-positioned.” Cook said Thursday that Apple will stand out from its AI rivals by tightly integrating hardware and software, using in-house chips, and making privacy and security a priority.

AAPL shares soared as much as 7.9% in extended trading Thursday before easing back a bit. Apple had been down 10% to $173.03 this year through the close, and is now still down modestly for the year.

Loading…