Authored by Luke Broyles via BitcoinMagazine.com,

What is the “top” for an immutable money that becomes the standard for humanity? Why it’s time to get off zero...

How much bitcoin does it take to get rich and fund your lifestyle? How little bitcoin does it take to protect yourself against inevitable inflation, bank runs and fiat demise? Are you “too late” to Bitcoin? What would a 1% allocation do?

These are questions that newbies and veterans of Bitcoin alike ask themselves and each other and, oftentimes, there isn’t a clear answer.

Let’s provide a solid framework to answer that question.

THERE IS NO ‘TOP’ FOR AN IMMUTABLE MONEY STANDARD

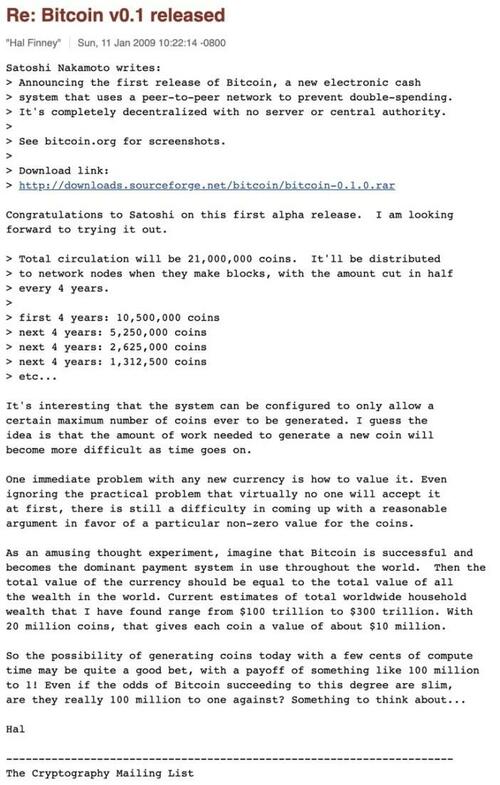

January 2009 was BTC's first price prediction. Hal Finney predicted that bitcoin could become the global-dominant payment system, or $10 million per coin (Finney’s calculation would be closer to $40 million today). But bitcoin would not surpass $1.00 until April 2011... Over two full years later.

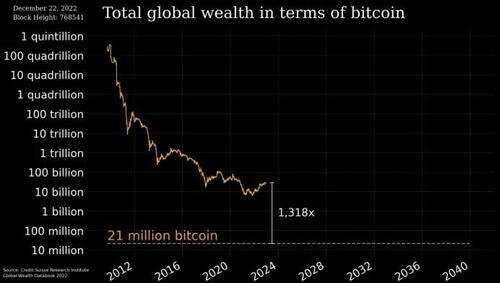

What Finney understood is that upon the invention of perfect money all global wealth would inevitably consolidate into it. Henry Ford, Nikola Tesla and others also foresaw this.

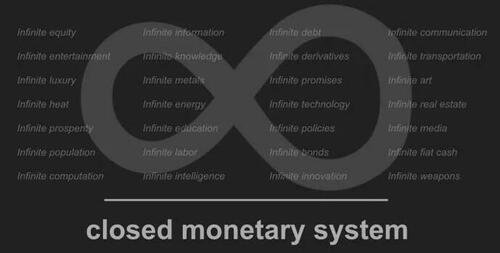

A closed (monetary) system inevitably absorbs all open (productivity) systems. Money is the technology that prices everything else within its own ledger. There is no "top" price prediction for an immutable monetary standard of the human race, the standard.

Source: Author

IT’S ABOUT PURCHASING POWER, NOT PRICE

So, a better way to think of bitcoin's value is not in price, but in purchasing power. Overlaying a share of monetary stock with a given amount of productivity (or economic value) is a better way to predict the money's value. It’s worth noting that in a finite ledger, wealth inequality as we know it today does the reverse as we expect today (a topic for another time).

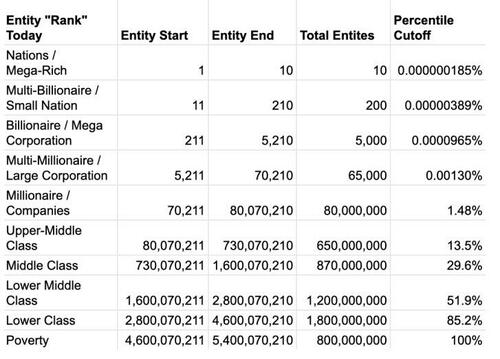

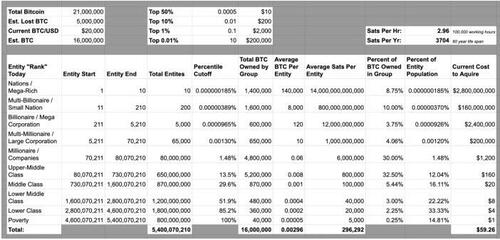

First, let's clarify "entities." We have 10 arbitrary "groups," loosely based on today's wide-ranging estimates of mega-rich entities to those in poverty.

Source: Author

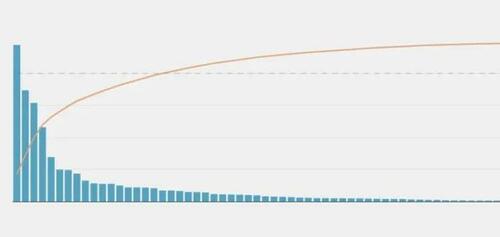

Second, we have to account for what is often attributed to the "Pareto principle": The vast majority of productivity is created by the minority of people, and the vast majority of that productivity is created within the minority of that minority.

Third, we must account for the monetary stock to fill into our matrix. It is often said there will "only be 21 million bitcoin," however this is not true. Accounting for lost bitcoin, there could easily be lower than 16 million.

When we loosely follow a Pareto distribution and today's current ranked distribution of entities, the below is what we get. Fascinating results. Michael Saylor, the U.S. government and a few select others have become Bitcoin’s 10 "mega rich" entities already.

Source: Author

Additionally, an average person today is more prosperous than a 20th century billionaire was. Therefore, if Bitcoin merely survives... as little as 800,000 sats could purchase a lifestyle in the future far more luxurious than an upper-middle class lifestyle today, since bitcoin is actually reflecting the real prosperity gains of the globe.

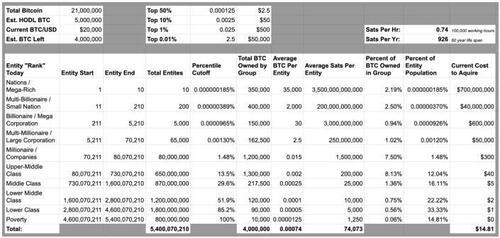

Let’s go further. There are only just over two million bitcoin left on exchanges and just under two million left to be mined. Let's take a hyper-bullish scenario and assume there are only four million BTC to be distributed, not 16 million. If we do the math here, things only get more absurd.

Source: Author

In this scenario, as little as $14.81, $100, or 75,000 sats (in the right time horizon) could be literally life changing to a person or company of the future.

What if global wealth and prosperity increases tenfold? What if the global population increases by two billion? What if another two million bitcoin are lost? What if a nation-state begins secretly stacking, and another three million bitcoin are held? What if a multi-billionaire tomorrow allocates 20% of their wealth to bitcoin, to absorb 100,000 BTC off the market? What if companies in the future employ billions of AI bots to create productivity to fight over the remaining BTC? What if just two of these scenarios occur?

What if in a few centuries energy companies do not burn coal or rely on fission, but mine asteroids, use fusion and begin construction of a Dyson swarm? Based on our model, what if these future companies have entire balance sheets of 10 to 1,000 BTC? How does one price that?

An entity selling the rights to solar real estate or trading a contract to an asteroid seems insane to us. Mock as we may, we have less in common with the future than the past.

ARE YOU TOO LATE?

So, are you too late? Absolutely not.

A closed monetary system is designed to never be too late for anyone, no matter how much or little productivity they have. When humans sell rights to the sun or other celestial bodies in the solar system, it is almost certain to be sold in exchange for bitcoin. Stop thinking you are "too late." It's absurd.

The question is: What do you do with this information? If you're a USD millionaire in 2023, you have no excuse to not buy 0.06 BTC. At $20,000 per BTC, this 0.12% allocation could save your portfolio. If Bitcoin survives, eventually this 0.12% will be more valuable than the other 99.88% of your portfolio. Even better, allocate 1% for 0.5 BTC since stock markets move 1% in a day. You can buy your "BTC insurance" with just a day’s volatility.

Not a USD millionaire? You have no excuse to not buy $100 of bitcoin (0.005 BTC as of this writing) and lock it down... just in case. You spend that much on insurance on an unlikely event, why not spend it on a likely event? Most won't, because understanding BTC is accepting many uncomfortable truths.

You'll soon realize that allocating 1% puts your other 99% at higher risk as you suck liquidity out of the fractional-reserve Ponzi.

The longer Bitcoin survives, the lower its risk and the higher its upside. It is designed to be a better savings tool as a function of time. Personally, I think my 16 million model is too bearish and the four million model is too bullish (for now).

Either way, the highest-risk allocation to bitcoin is 0%. Either bitcoin is trending toward zero, or everything else is. There is no third option.

Thanks, everyone, for your ideas. Keep sharing that Bitcoin signal, and get off zero if you are still on it.

Source: Author

Authored by Luke Broyles via BitcoinMagazine.com,

What is the “top” for an immutable money that becomes the standard for humanity? Why it’s time to get off zero…

How much bitcoin does it take to get rich and fund your lifestyle? How little bitcoin does it take to protect yourself against inevitable inflation, bank runs and fiat demise? Are you “too late” to Bitcoin? What would a 1% allocation do?

These are questions that newbies and veterans of Bitcoin alike ask themselves and each other and, oftentimes, there isn’t a clear answer.

Let’s provide a solid framework to answer that question.

THERE IS NO ‘TOP’ FOR AN IMMUTABLE MONEY STANDARD

January 2009 was BTC‘s first price prediction. Hal Finney predicted that bitcoin could become the global-dominant payment system, or $10 million per coin (Finney’s calculation would be closer to $40 million today). But bitcoin would not surpass $1.00 until April 2011… Over two full years later.

What Finney understood is that upon the invention of perfect money all global wealth would inevitably consolidate into it. Henry Ford, Nikola Tesla and others also foresaw this.

A closed (monetary) system inevitably absorbs all open (productivity) systems. Money is the technology that prices everything else within its own ledger. There is no “top” price prediction for an immutable monetary standard of the human race, the standard.

Source: Author

IT’S ABOUT PURCHASING POWER, NOT PRICE

So, a better way to think of bitcoin’s value is not in price, but in purchasing power. Overlaying a share of monetary stock with a given amount of productivity (or economic value) is a better way to predict the money’s value. It’s worth noting that in a finite ledger, wealth inequality as we know it today does the reverse as we expect today (a topic for another time).

First, let’s clarify “entities.” We have 10 arbitrary “groups,” loosely based on today’s wide-ranging estimates of mega-rich entities to those in poverty.

Source: Author

Second, we have to account for what is often attributed to the “Pareto principle“: The vast majority of productivity is created by the minority of people, and the vast majority of that productivity is created within the minority of that minority.

Third, we must account for the monetary stock to fill into our matrix. It is often said there will “only be 21 million bitcoin,” however this is not true. Accounting for lost bitcoin, there could easily be lower than 16 million.

When we loosely follow a Pareto distribution and today’s current ranked distribution of entities, the below is what we get. Fascinating results. Michael Saylor, the U.S. government and a few select others have become Bitcoin’s 10 “mega rich” entities already.

Source: Author

Additionally, an average person today is more prosperous than a 20th century billionaire was. Therefore, if Bitcoin merely survives… as little as 800,000 sats could purchase a lifestyle in the future far more luxurious than an upper-middle class lifestyle today, since bitcoin is actually reflecting the real prosperity gains of the globe.

Let’s go further. There are only just over two million bitcoin left on exchanges and just under two million left to be mined. Let’s take a hyper-bullish scenario and assume there are only four million BTC to be distributed, not 16 million. If we do the math here, things only get more absurd.

Source: Author

In this scenario, as little as $14.81, $100, or 75,000 sats (in the right time horizon) could be literally life changing to a person or company of the future.

What if global wealth and prosperity increases tenfold? What if the global population increases by two billion? What if another two million bitcoin are lost? What if a nation-state begins secretly stacking, and another three million bitcoin are held? What if a multi-billionaire tomorrow allocates 20% of their wealth to bitcoin, to absorb 100,000 BTC off the market? What if companies in the future employ billions of AI bots to create productivity to fight over the remaining BTC? What if just two of these scenarios occur?

What if in a few centuries energy companies do not burn coal or rely on fission, but mine asteroids, use fusion and begin construction of a Dyson swarm? Based on our model, what if these future companies have entire balance sheets of 10 to 1,000 BTC? How does one price that?

An entity selling the rights to solar real estate or trading a contract to an asteroid seems insane to us. Mock as we may, we have less in common with the future than the past.

ARE YOU TOO LATE?

So, are you too late? Absolutely not.

A closed monetary system is designed to never be too late for anyone, no matter how much or little productivity they have. When humans sell rights to the sun or other celestial bodies in the solar system, it is almost certain to be sold in exchange for bitcoin. Stop thinking you are “too late.” It’s absurd.

The question is: What do you do with this information? If you’re a USD millionaire in 2023, you have no excuse to not buy 0.06 BTC. At $20,000 per BTC, this 0.12% allocation could save your portfolio. If Bitcoin survives, eventually this 0.12% will be more valuable than the other 99.88% of your portfolio. Even better, allocate 1% for 0.5 BTC since stock markets move 1% in a day. You can buy your “BTC insurance” with just a day’s volatility.

Not a USD millionaire? You have no excuse to not buy $100 of bitcoin (0.005 BTC as of this writing) and lock it down… just in case. You spend that much on insurance on an unlikely event, why not spend it on a likely event? Most won’t, because understanding BTC is accepting many uncomfortable truths.

You’ll soon realize that allocating 1% puts your other 99% at higher risk as you suck liquidity out of the fractional-reserve Ponzi.

The longer Bitcoin survives, the lower its risk and the higher its upside. It is designed to be a better savings tool as a function of time. Personally, I think my 16 million model is too bearish and the four million model is too bullish (for now).

Either way, the highest-risk allocation to bitcoin is 0%. Either bitcoin is trending toward zero, or everything else is. There is no third option.

Thanks, everyone, for your ideas. Keep sharing that Bitcoin signal, and get off zero if you are still on it.

Source: Author

Loading…