Cathie Wood's ARKK fund has suffered an ugly year that was compounded by a stunning 9.5% plunge during yesterday's market rout. Yesterday marked the fourth worst performance in ARKK's history dating back to 2014, Reuters reported.

Yesterday's plunge was only bested by three declines that the ETF faced during the beginning stages of the pandemic in March 2020.

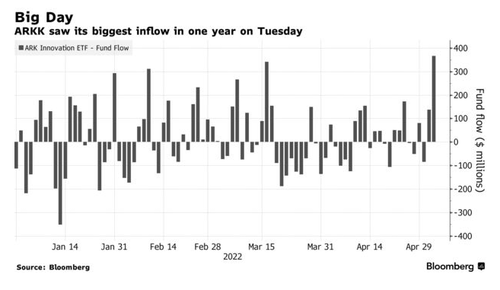

The best part about yesterday's rout was that it came days after ARKK experienced its biggest cash inflows in a year, Bloomberg reported this week. Wood's fund took in $366.7 million on Tuesday before being routed on Thursday.

On Tuesday, the stock was that the fund had gained "double" the rally in the NASDAQ and triple the rally of the S&P 500. Of course, heading into the end of the week and after yesterday's drubbing, the fund is once again approaching 52 week lows.

The report noted that investors had put $447.4 million into the fund during the beginning of the week, which had helped extend the fund's streak of three straight weeks of inflows. These inflows came after the fund's worst month in its history, when it fell 29% in April.

Athanasios Psarofagis, an ETF analyst with Bloomberg Intelligence, said: “This definitely feels like a buy the dip. The sentiment has been so bearish on ARKK and equities in general. I think investors think they are low enough to go long if even for just a short while.”

Someone get him a job with Cathie's team. After all, as Zero Hedge contributor Quoth the Raven wrote today, they seem to be the last to realize on Wall Street that the gravy train has ended.

ARKK is down 49.5% for the year.

Cathie Wood’s ARKK fund has suffered an ugly year that was compounded by a stunning 9.5% plunge during yesterday’s market rout. Yesterday marked the fourth worst performance in ARKK’s history dating back to 2014, Reuters reported.

Yesterday’s plunge was only bested by three declines that the ETF faced during the beginning stages of the pandemic in March 2020.

The best part about yesterday’s rout was that it came days after ARKK experienced its biggest cash inflows in a year, Bloomberg reported this week. Wood’s fund took in $366.7 million on Tuesday before being routed on Thursday.

On Tuesday, the stock was that the fund had gained “double” the rally in the NASDAQ and triple the rally of the S&P 500. Of course, heading into the end of the week and after yesterday’s drubbing, the fund is once again approaching 52 week lows.

The report noted that investors had put $447.4 million into the fund during the beginning of the week, which had helped extend the fund’s streak of three straight weeks of inflows. These inflows came after the fund’s worst month in its history, when it fell 29% in April.

Athanasios Psarofagis, an ETF analyst with Bloomberg Intelligence, said: “This definitely feels like a buy the dip. The sentiment has been so bearish on ARKK and equities in general. I think investors think they are low enough to go long if even for just a short while.”

Someone get him a job with Cathie’s team. After all, as Zero Hedge contributor Quoth the Raven wrote today, they seem to be the last to realize on Wall Street that the gravy train has ended.

ARKK is down 49.5% for the year.