Authored by Andrew Singer via CoinTelegraph.com,

Central bank digital currencies are becoming more politicized globally, "but in the U.S. they seem to be 'hyper-politicized'"...

It’s only since Facebook announced its Libra stablecoin back in 2019 that anyone has even talked about central bank digital currencies (CBDCs).

And then most of the discussion was within the discipline — i.e., among financial regulators, academics and payment specialists.

But last week, the CBDC conversation broke out in a big way as former United States President Donald Trump said he would “never allow” a digital dollar were he reelected president. A CBDC “would be a dangerous threat to freedom, and I will stop it from coming to America,” Trump vowed on Jan. 17 in New Hampshire.

Overnight, it seemed, CBDCs had become politicized into a partisan, Republican vs. Democrat issue.

Florida’s Republican Governor and one-time Trump primary campaign rival Ron DeSantis had earlier “preemptively banned CBDCs” in his state, while the Democratic Biden Administration had been researching a government-issued digital dollar, though it has taken no steps toward implementation.

Still, wasn’t this all a bit of a surprise?

“Partisan overtones”

Eswar Prasad, Tolani senior professor of trade policy at Cornell University and author of the book The Future of Money, told Cointelegraph:

“In the highly partisan atmosphere prevalent in the U.S., it is hardly surprising that a debate about the merits or lack thereof of a digital dollar takes on partisan overtones as well.”

CBDCs are becoming more politicized generally, with privacy among the largest of concerns, “but in the U.S. now they seem to be ‘hyper-politicized,’” Josh Lipsky, senior director of the Atlantic Council’s GeoEconomics Center, told Cointelegraph. “It’s become more political in the U.S. than in other countries.”

“If we think about CBDCs as a technical finance issue, then it is surprising,” commented David Primo, professor of political science and business administration at the University of Rochester.

“But it’s not surprising given that Trump and other politicians are defining this issue not as one of financial innovation but instead in terms of the government going too far,” Primo told Cointelegraph. In his New Hampshire speech, Trump described a central bank digital currency as a form of “tyranny.”

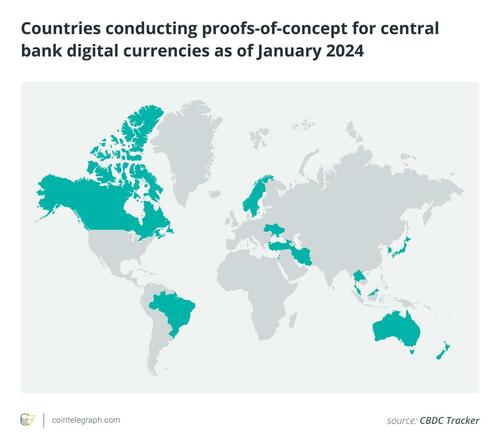

CBDCs have only been implemented in a handful of small-economy countries like the Bahamas, Jamaica and Nigeria, but they are being explored in 130 nations that collectively represent 98% of global gross domestic product, according to the Atlantic Council.

“I don’t think this is an issue that will galvanize wide swaths of voters, but I think it will resonate with Americans who are concerned with the rapid technological change we are seeing in the crypto and AI spaces right now,” added Primo.

“I don’t think it’s a coincidence Trump highlighted this issue during a speech in New Hampshire — the Live Free or Die state.”

Robust debate can be a positive way to illuminate complex and important issues. But that truism may not apply here.

“Much of this debate so far seems to be based on misconceptions and fallacies that simply feed off and validate attitudes toward government on both sides of the political divide,” said Prasad.

The consequences could be serious. Lipsky worries that the U.S. may simply quit the playing field and not even pilot-test a digital dollar. That could be a loss not only for the U.S. but for other countries as well.

CBDC opponents fear that “smart” money can be used by governments to spy on citizens’ private transactions, a form of “Big Brotherism.” They often point out that it’s no coincidence that China has been one of the first countries to embrace a state-issued digital currency.

“Some who are concerned about the development of such a ‘surveillance coin’ believe that the approach of ‘just say no’ to U.S. exploration of CBDCs will insulate Americans from the dangers of such digital money,” Jennifer Lassiter, executive director at the Digital Dollar Project, told Cointelegraph, adding:

“Sadly, however, barring the U.S. from CBDC exploration will neither hinder nor stop the global deployment of CBDCs, including in countries antagonistic to personal freedom.”

Americans and U.S. multinationals will be affected by them, for good and for ill, Lassiter continued, so it would be a big mistake for the U.S. to withdraw from CBDC exploration and innovation.

But the points being raised by Trump and others are not necessarily pure demagoguery, others suggest.

While some of the recent fears may be exaggerated, “it’s important to be clear that the last 50 years of financial policy have been a history of ever-increasing financial surveillance,” Nick Anthony, policy analyst at the Center for Monetary and Financial Alternatives at the Cato Institute, told Cointelegraph, adding:

“Unfortunately, the creation of a CBDC could very much be the capstone of this [recent surveillance] history. The more the public can understand how a CBDC fits into this history and the more the public can be part of this debate, the better.”

Prasad, who is also a senior fellow at the Brookings Institution, where he holds the New Century Chair in International Trade and Economics, is in favor of public debate but “conspiracy theorists are getting ahead of themselves in terms of how far along the U.S. is in considering or preparing for the issuance of a digital dollar.”

Among the major economies, “the U.S. seems least eager to issue a CBDC,” continued Prasad, “especially since many Fed officials themselves view it as unnecessary in view of many upgrades to the U.S. payment system that are currently underway.”

Where do cryptocurrencies figure in all this?

Since decentralized cryptocurrencies like Bitcoin are beyond the control of any central authority, some argue they should gain users to the extent that CBDCs are discredited or rejected. Is this pure fancy on the part of crypto advocates?

“There is a sort of inverse relationship between cryptocurrencies and CBDCs because governments have largely introduced CBDCs in response to the rise of cryptocurrency,” said Anthony, noting that the development of CBDCs has been accompanied by varying bans on cryptocurrency in different parts of the world.

“This strategy has even been contemplated in the United States. So to the extent the creation of a CBDC is stopped, it’s likely that cryptocurrencies have a better future.”

Others see room for a multitude of digital asset types, however. Cryptocurrencies, stablecoins and CBDCs are not isolated assets, each competing to be the sole payment mechanism, said Lassiter, but rather “complementary players” in a global financial ecosystem, each with distinct uses.

Along these lines, “I see crypto primarily as a new asset class, where there are now also ETFs [exchange-traded funds] available to invest in. CBDCs, in contrast, are a digital form of cash,” Jonas Gross, chairman of the Digital Euro Association and chief operating officer at crypto payments firm Etonec, told Cointelegraph.

“Still, the political fight against CBDCs could drive people to think about our current monetary system, which could bring more people into the crypto space.”

These are still the early days of digital assets, cautioned Atlantic Council’s Lipsky, and the relationship between crypto and CBDCs is far from clear. The two may actually be positively correlated in terms of adoption, e.g., when one goes up, the other tends to rise as well.

Indeed, something of the sort has been found among early adopters of CBDCs, like Jamaica, Lipsky added. As those nations scaled up their CBDCs, they found that cryptocurrencies, including stablecoins, also gained adherents as “It’s a signal that digital assets are safe.”

Innovations in one digital payment type “increases optionality and creates accountability,” boosting confidence in the greater public that digital money is “private, secure and trusted,” added Lassiter.

In addition, Lipsky suggested that many of the privacy concerns that people have with CBDCs can be solved with new technologies and enlightened regulations. Cryptographic tools like zero-knowledge proofs, which authenticate private information without revealing it, can preserve anonymity in many circumstances, and cryptographic techniques can also be used to design CBDCs that provide cash-like privacy up to specific thresholds — for example, $10,000.

This isn’t so different from the system already at hand in the U.S., where bank transactions of less than $10,000 have reduced reporting requirements, he added.

Prasad, for his part, sees little likelihood of crypto ever replacing state-issued currency: “The libertarian lure of decentralized cryptocurrencies such as Bitcoin serving as mediums of exchange that allow individuals and businesses to shift away from reliance on central bank money or traditional financial institutions remains a mirage.”

Moreover, the sorts of cryptocurrencies that would work well in a currency role — like stablecoins — are themselves backed by stores of fiat currencies, he said.

Only a U.S. phenomenon?

More immediately, “What will be most interesting is whether President Biden keeps CBDCs out of his campaign or officially stakes a position ahead of November [presidential elections],” noted Anthony. “Although he [Biden] previously pushed for the government to dig into CBDCs, the administration has mostly been quiet throughout the campaign.”

Elsewhere, the European Union is holding parliamentary elections in June. “I think it [ CBDCs] will also become a topic for EU elections,” Gross said. “However, we have not seen such strong political statements as compared to the U.S. yet.”

“CBDCs face an uphill battle,” political scientist Primo said, “but I’d be surprised if pilot programs were not attempted in some countries in the next decade.”

As for the U.S., despite all its fits and starts, it remains “uniquely positioned to influence the development of international standards for digital money networks, including CBDCs,” said Lassiter. These standards, contrary to some claims, “could affirmatively protect democratic values like freedom of speech and the right to privacy.”

Authored by Andrew Singer via CoinTelegraph.com,

Central bank digital currencies are becoming more politicized globally, “but in the U.S. they seem to be ‘hyper-politicized'”…

It’s only since Facebook announced its Libra stablecoin back in 2019 that anyone has even talked about central bank digital currencies (CBDCs).

And then most of the discussion was within the discipline — i.e., among financial regulators, academics and payment specialists.

But last week, the CBDC conversation broke out in a big way as former United States President Donald Trump said he would “never allow” a digital dollar were he reelected president. A CBDC “would be a dangerous threat to freedom, and I will stop it from coming to America,” Trump vowed on Jan. 17 in New Hampshire.

Overnight, it seemed, CBDCs had become politicized into a partisan, Republican vs. Democrat issue.

Florida’s Republican Governor and one-time Trump primary campaign rival Ron DeSantis had earlier “preemptively banned CBDCs” in his state, while the Democratic Biden Administration had been researching a government-issued digital dollar, though it has taken no steps toward implementation.

Still, wasn’t this all a bit of a surprise?

“Partisan overtones”

Eswar Prasad, Tolani senior professor of trade policy at Cornell University and author of the book The Future of Money, told Cointelegraph:

“In the highly partisan atmosphere prevalent in the U.S., it is hardly surprising that a debate about the merits or lack thereof of a digital dollar takes on partisan overtones as well.”

CBDCs are becoming more politicized generally, with privacy among the largest of concerns, “but in the U.S. now they seem to be ‘hyper-politicized,’” Josh Lipsky, senior director of the Atlantic Council’s GeoEconomics Center, told Cointelegraph. “It’s become more political in the U.S. than in other countries.”

“If we think about CBDCs as a technical finance issue, then it is surprising,” commented David Primo, professor of political science and business administration at the University of Rochester.

“But it’s not surprising given that Trump and other politicians are defining this issue not as one of financial innovation but instead in terms of the government going too far,” Primo told Cointelegraph. In his New Hampshire speech, Trump described a central bank digital currency as a form of “tyranny.”

CBDCs have only been implemented in a handful of small-economy countries like the Bahamas, Jamaica and Nigeria, but they are being explored in 130 nations that collectively represent 98% of global gross domestic product, according to the Atlantic Council.

“I don’t think this is an issue that will galvanize wide swaths of voters, but I think it will resonate with Americans who are concerned with the rapid technological change we are seeing in the crypto and AI spaces right now,” added Primo.

“I don’t think it’s a coincidence Trump highlighted this issue during a speech in New Hampshire — the Live Free or Die state.”

Robust debate can be a positive way to illuminate complex and important issues. But that truism may not apply here.

“Much of this debate so far seems to be based on misconceptions and fallacies that simply feed off and validate attitudes toward government on both sides of the political divide,” said Prasad.

The consequences could be serious. Lipsky worries that the U.S. may simply quit the playing field and not even pilot-test a digital dollar. That could be a loss not only for the U.S. but for other countries as well.

CBDC opponents fear that “smart” money can be used by governments to spy on citizens’ private transactions, a form of “Big Brotherism.” They often point out that it’s no coincidence that China has been one of the first countries to embrace a state-issued digital currency.

“Some who are concerned about the development of such a ‘surveillance coin’ believe that the approach of ‘just say no’ to U.S. exploration of CBDCs will insulate Americans from the dangers of such digital money,” Jennifer Lassiter, executive director at the Digital Dollar Project, told Cointelegraph, adding:

“Sadly, however, barring the U.S. from CBDC exploration will neither hinder nor stop the global deployment of CBDCs, including in countries antagonistic to personal freedom.”

Americans and U.S. multinationals will be affected by them, for good and for ill, Lassiter continued, so it would be a big mistake for the U.S. to withdraw from CBDC exploration and innovation.

But the points being raised by Trump and others are not necessarily pure demagoguery, others suggest.

While some of the recent fears may be exaggerated, “it’s important to be clear that the last 50 years of financial policy have been a history of ever-increasing financial surveillance,” Nick Anthony, policy analyst at the Center for Monetary and Financial Alternatives at the Cato Institute, told Cointelegraph, adding:

“Unfortunately, the creation of a CBDC could very much be the capstone of this [recent surveillance] history. The more the public can understand how a CBDC fits into this history and the more the public can be part of this debate, the better.”

Prasad, who is also a senior fellow at the Brookings Institution, where he holds the New Century Chair in International Trade and Economics, is in favor of public debate but “conspiracy theorists are getting ahead of themselves in terms of how far along the U.S. is in considering or preparing for the issuance of a digital dollar.”

Among the major economies, “the U.S. seems least eager to issue a CBDC,” continued Prasad, “especially since many Fed officials themselves view it as unnecessary in view of many upgrades to the U.S. payment system that are currently underway.”

Where do cryptocurrencies figure in all this?

Since decentralized cryptocurrencies like Bitcoin are beyond the control of any central authority, some argue they should gain users to the extent that CBDCs are discredited or rejected. Is this pure fancy on the part of crypto advocates?

“There is a sort of inverse relationship between cryptocurrencies and CBDCs because governments have largely introduced CBDCs in response to the rise of cryptocurrency,” said Anthony, noting that the development of CBDCs has been accompanied by varying bans on cryptocurrency in different parts of the world.

“This strategy has even been contemplated in the United States. So to the extent the creation of a CBDC is stopped, it’s likely that cryptocurrencies have a better future.”

Others see room for a multitude of digital asset types, however. Cryptocurrencies, stablecoins and CBDCs are not isolated assets, each competing to be the sole payment mechanism, said Lassiter, but rather “complementary players” in a global financial ecosystem, each with distinct uses.

Along these lines, “I see crypto primarily as a new asset class, where there are now also ETFs [exchange-traded funds] available to invest in. CBDCs, in contrast, are a digital form of cash,” Jonas Gross, chairman of the Digital Euro Association and chief operating officer at crypto payments firm Etonec, told Cointelegraph.

“Still, the political fight against CBDCs could drive people to think about our current monetary system, which could bring more people into the crypto space.”

These are still the early days of digital assets, cautioned Atlantic Council’s Lipsky, and the relationship between crypto and CBDCs is far from clear. The two may actually be positively correlated in terms of adoption, e.g., when one goes up, the other tends to rise as well.

Indeed, something of the sort has been found among early adopters of CBDCs, like Jamaica, Lipsky added. As those nations scaled up their CBDCs, they found that cryptocurrencies, including stablecoins, also gained adherents as “It’s a signal that digital assets are safe.”

Innovations in one digital payment type “increases optionality and creates accountability,” boosting confidence in the greater public that digital money is “private, secure and trusted,” added Lassiter.

In addition, Lipsky suggested that many of the privacy concerns that people have with CBDCs can be solved with new technologies and enlightened regulations. Cryptographic tools like zero-knowledge proofs, which authenticate private information without revealing it, can preserve anonymity in many circumstances, and cryptographic techniques can also be used to design CBDCs that provide cash-like privacy up to specific thresholds — for example, $10,000.

This isn’t so different from the system already at hand in the U.S., where bank transactions of less than $10,000 have reduced reporting requirements, he added.

Prasad, for his part, sees little likelihood of crypto ever replacing state-issued currency: “The libertarian lure of decentralized cryptocurrencies such as Bitcoin serving as mediums of exchange that allow individuals and businesses to shift away from reliance on central bank money or traditional financial institutions remains a mirage.”

Moreover, the sorts of cryptocurrencies that would work well in a currency role — like stablecoins — are themselves backed by stores of fiat currencies, he said.

Only a U.S. phenomenon?

More immediately, “What will be most interesting is whether President Biden keeps CBDCs out of his campaign or officially stakes a position ahead of November [presidential elections],” noted Anthony. “Although he [Biden] previously pushed for the government to dig into CBDCs, the administration has mostly been quiet throughout the campaign.”

Elsewhere, the European Union is holding parliamentary elections in June. “I think it [ CBDCs] will also become a topic for EU elections,” Gross said. “However, we have not seen such strong political statements as compared to the U.S. yet.”

“CBDCs face an uphill battle,” political scientist Primo said, “but I’d be surprised if pilot programs were not attempted in some countries in the next decade.”

As for the U.S., despite all its fits and starts, it remains “uniquely positioned to influence the development of international standards for digital money networks, including CBDCs,” said Lassiter. These standards, contrary to some claims, “could affirmatively protect democratic values like freedom of speech and the right to privacy.”

Loading…