Authored by Bill Blain via MorningPorridge.com,

“Tricks make headlines, but winners execute the basics..”

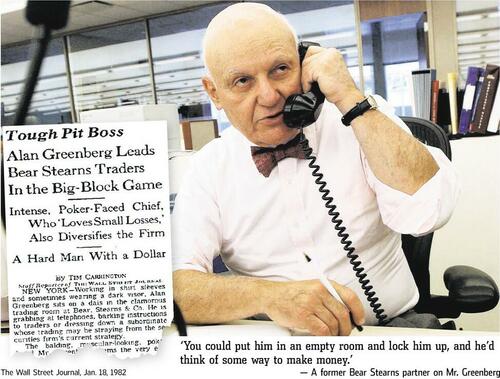

Markets remain in a major correction – but fear not. When the hurly burly is done, what goes down and survives will (eventually) come back up! As the pain bites, I recommend the wit and wisdom of Ace Greenberg, the best banking CEO ever, a man who understood the primacy of common sense.

Peloton’s numbers said it all. Great concept. Terrible Business. The most difficult thing in business is convincing someone who thinks they have a brilliant concept that it’s not.

From meme stocks, to SPACs, to profitless growth-fixated firms to disruptive tech… it’s the realisation great marketing and gab doesn’t always translate into brilliant businesses that’s hurting whole slices of the market. Such is life. Three times I’ve invested in airships. They will never replace planes, but I shall probably fall for it again because next time is always different. No. It usually is not.

Good firms – the legion of companies with solid fundamentals, the ones that don’t make the front pages of the FT and WSJ on a regular basis, the well managed ones, aware of their position on the earth and part of it, making perfect widgets and selling great products, looking after their staff and achieving positive social good – (the ones that do ESG without having to have it explained to them) – are also suffering for all the usual reasons: an inflated bubbelicious market bursting, and a declining economic outlook in the face of inflation, recession, difficult supply chains and rising global tensions.

If you are holding good and great companies you really have little to worry about. Sure, the stock price may decline as the economic picture develops, the great correction of 2022 will continue as a falling tide lowering all boats, but ultimately good companies will bounce back, they will pay dividends and they will resume on trend mean-reverted growth. These firms are the long-term holds. My portfolio is down, but it will be back up again. I am not panicking.

As I’ve pointed out many times, the trick is understanding which firms will evolve into or maintain profitable niches, and which are ultimately evolutionary dead ends…

As for Coinbase last night.. I had to stifle giggles as I scanned their statements. Sadly, it won’t be a final hurrah for Crypto. Around the world there is a huge number of desperate crypto-losers hoping and clinging to the belief the few pennies they have left in this Crypto Winter are still going to germinate into fantabulous wealth. They sincerely believe the gibberish that passes as crypto-proof. They don’t understand Greater Fool theory. They believed the invisible clothes of crypto could only be seen by really clever people, and didn’t want to look foolish. Yet, today I was surprised to discover my crypto wallet is still worth 70% of my investment – I will be smugly satisfied when its zero!

But, all the above is just noise.. What does it all really mean.. So a bit of a departure on the Morning Porridge this morning. Today, I am going to listen to someone else’s advice…

Yesterday, I was chatting with an old work chum and he showed me a photo of his dog-eared Crash of 29 by Galbraith. I went looking for mine – and its vanished. I reckon either the ex-Bank of England economist up the road or one of our local hedgies snaffled it at the Halloween, Christmas or my Birthday party.. hey-ho!

But I did find my last remaining copy of the Greatest Book on business ever written. Ace Greenberg’s Memos from the Chairman.

Ace was CEO and chairman of Bear Stearns, the greatest Little Investment Bank to ever grace the Street. I have enjoyed every moment of my not very grand career in finance, but the 10 years I spent at Bear were probably the best. (Shard, of course, comes a very close second…)

The book is a collection of genuine memos Ace sent round Bear Stearns – they are full of wisdom, humour and are highly instructive. Even though they are now 30 years old, they remain highly pertinent to what’s happening in market’s today. Perhaps the things Ace valued most was common sense and pragmatism.

Ace was a real character – and a genuine good man. Many years ago I dragged him to the IMF annual shindig in Washington. Between meetings with clients, while I was flaffing around arranging taxis, materials and schedules, he stopped me, made me sit down and decompress, and insisted on sharing his lunch with me. He gave me great advice on the clients we met. He told me not to engage with one Irish bank we met – they didn’t pass his sniff test. He was spot on right. The Irish Bank went spectacularly bust a few years later.

Ace had a gift for remembering everyone and a genuine interest and concern for his colleagues. He understood the business backwards, and was tough. He would not hesitate to pull the trigger when required, but he was absolutely fair. When he stepped back… under his utterly different successor it was only a matter of time.. which was a great shame. Bear Stearns – happy days and a great crowd of people. I raise a toast!

I reread Memos from the Chairman again last night. It’s utterly brilliant. Let me share some gems:

On being successful in markets:

-

Watch expenses

-

Work for our clients

-

Keep our feet on the ground and our heads on straight.”

“Make decisions based on common sense and avoid herd mentality.”

“Control expenses with unrelenting vigil.”

“Help all departments grow, this year’s starlet can be next year’s dog.”

“All this time I thought Merchant Banking was some esoteric, complicated British secret.”

“The bear markets will end, and it can end quickly.”

“This market will not get me down. It is just a minor challenge.”

“People who talk too much seem to have bad luck.”

On Investment Banking:

“You cannot fly with the eagles and poop like a canary.”

“It is up to all of us to fight our unrelenting enemies – complacency, over-confidence and conceit.”

“Thou will do well in commerce as long as thou does not believe thine own odour is perfume.”

“Every industry in this country is having financial problems. We paid our dues by surviving and even prospering during some tough years for Wall Street, but do not confuse luck for brains.”

“I find it amazing we never hear of a conference devoted to applying common sense to the securities industry”

On People and Markets:

“The market in stocks has taken a precipitous drip, but I am far from depressed. Why? Because we will see great opportunities in all areas, particularly personnel.”

“If somebody with an MBA applies for a job, we will not hold against them, but we are really looking for people with PSD degrees. (Poor, smart and a deep desire to get rich.)”

“Bear Stearns is not having a hiring freeze. Our experience has been the best time to hire productive people is when conditions are difficult.”

“The only thing that can stop us getting richer is stupidity.”

“Forget the chain of command. That is not the way Bear Stearns was built. If you think someone is doing something off the wall or his/her decision making stinks, go around this person, and that includes me.”

On CVs

“Remember one thing; today’s applicant could be next year’s client.”

On Work

(he recognised answering phones promptly and is critical to success)

“I conducted a study of 200 firms that disappeared from Wall Street and discovered 62.349% went bust because important people did not leave word on where they went when they left their desks…”

“A firm that has enthusiastic telephone operators starts off with a tremendous advantage over the dummies of the world.”

On trading

“If you have a problem position, discuss it with the head of desk. Absolution can be granted for losing money, but never for lying about it.”

On strategic planning:

“It is reported some prominent M&A bankers just left a firm because of a difference of opinion over strategic planning. That will never happen at Bear Stearns because we have no Strategic Planning.”

“The amount of dissension rises geometrically with the more issues you have to philosophize over.”

On Expenses

it wasn’t just spending on paperclips…

“Federal Express is not a wholly owned subsidiary of Bear Stearns… we are spending $50,000 a month with them.”

“It hurts to report I saw someone throw away a used internal envelope before it made 22 trips round the office. I can’t stand to see people burn money.”

“Electricity is not free! This will come as a surprise to 98% of the people who work at Bear Stearns. I found enough lights and machines left on to fund Bangladesh’s light bill for a year.”

“We are flexible. We should have anticipated the culture shock when a person joins us from a firm that has been losing billions. From this date forward… the personnel department will give new folks a paper bag with a box of paper clips and twenty rubber bands.”

“When the toner is low, take out the cartridge, shake it and give it another try. If we get 5% more use out our toner cartridges, it would save the company $15,000 a year.”

Bear Stearns has just bought its 10,000th Fax Machine. The Fax salesperson has just retired. He is burnt out – he is 33 years old. He has purchased Donald Trump’s yacht, and the overworked soul wants to take it easy…. There is a moral hidden somewhere…

It’s a brilliant read.. and I’m still smiling…

Authored by Bill Blain via MorningPorridge.com,

“Tricks make headlines, but winners execute the basics..”

Markets remain in a major correction – but fear not. When the hurly burly is done, what goes down and survives will (eventually) come back up! As the pain bites, I recommend the wit and wisdom of Ace Greenberg, the best banking CEO ever, a man who understood the primacy of common sense.

Peloton’s numbers said it all. Great concept. Terrible Business. The most difficult thing in business is convincing someone who thinks they have a brilliant concept that it’s not.

From meme stocks, to SPACs, to profitless growth-fixated firms to disruptive tech… it’s the realisation great marketing and gab doesn’t always translate into brilliant businesses that’s hurting whole slices of the market. Such is life. Three times I’ve invested in airships. They will never replace planes, but I shall probably fall for it again because next time is always different. No. It usually is not.

Good firms – the legion of companies with solid fundamentals, the ones that don’t make the front pages of the FT and WSJ on a regular basis, the well managed ones, aware of their position on the earth and part of it, making perfect widgets and selling great products, looking after their staff and achieving positive social good – (the ones that do ESG without having to have it explained to them) – are also suffering for all the usual reasons: an inflated bubbelicious market bursting, and a declining economic outlook in the face of inflation, recession, difficult supply chains and rising global tensions.

If you are holding good and great companies you really have little to worry about. Sure, the stock price may decline as the economic picture develops, the great correction of 2022 will continue as a falling tide lowering all boats, but ultimately good companies will bounce back, they will pay dividends and they will resume on trend mean-reverted growth. These firms are the long-term holds. My portfolio is down, but it will be back up again. I am not panicking.

As I’ve pointed out many times, the trick is understanding which firms will evolve into or maintain profitable niches, and which are ultimately evolutionary dead ends…

As for Coinbase last night.. I had to stifle giggles as I scanned their statements. Sadly, it won’t be a final hurrah for Crypto. Around the world there is a huge number of desperate crypto-losers hoping and clinging to the belief the few pennies they have left in this Crypto Winter are still going to germinate into fantabulous wealth. They sincerely believe the gibberish that passes as crypto-proof. They don’t understand Greater Fool theory. They believed the invisible clothes of crypto could only be seen by really clever people, and didn’t want to look foolish. Yet, today I was surprised to discover my crypto wallet is still worth 70% of my investment – I will be smugly satisfied when its zero!

But, all the above is just noise.. What does it all really mean.. So a bit of a departure on the Morning Porridge this morning. Today, I am going to listen to someone else’s advice…

Yesterday, I was chatting with an old work chum and he showed me a photo of his dog-eared Crash of 29 by Galbraith. I went looking for mine – and its vanished. I reckon either the ex-Bank of England economist up the road or one of our local hedgies snaffled it at the Halloween, Christmas or my Birthday party.. hey-ho!

But I did find my last remaining copy of the Greatest Book on business ever written. Ace Greenberg’s Memos from the Chairman.

Ace was CEO and chairman of Bear Stearns, the greatest Little Investment Bank to ever grace the Street. I have enjoyed every moment of my not very grand career in finance, but the 10 years I spent at Bear were probably the best. (Shard, of course, comes a very close second…)

The book is a collection of genuine memos Ace sent round Bear Stearns – they are full of wisdom, humour and are highly instructive. Even though they are now 30 years old, they remain highly pertinent to what’s happening in market’s today. Perhaps the things Ace valued most was common sense and pragmatism.

Ace was a real character – and a genuine good man. Many years ago I dragged him to the IMF annual shindig in Washington. Between meetings with clients, while I was flaffing around arranging taxis, materials and schedules, he stopped me, made me sit down and decompress, and insisted on sharing his lunch with me. He gave me great advice on the clients we met. He told me not to engage with one Irish bank we met – they didn’t pass his sniff test. He was spot on right. The Irish Bank went spectacularly bust a few years later.

Ace had a gift for remembering everyone and a genuine interest and concern for his colleagues. He understood the business backwards, and was tough. He would not hesitate to pull the trigger when required, but he was absolutely fair. When he stepped back… under his utterly different successor it was only a matter of time.. which was a great shame. Bear Stearns – happy days and a great crowd of people. I raise a toast!

I reread Memos from the Chairman again last night. It’s utterly brilliant. Let me share some gems:

On being successful in markets:

“Make decisions based on common sense and avoid herd mentality.”

“Control expenses with unrelenting vigil.”

“Help all departments grow, this year’s starlet can be next year’s dog.”

“All this time I thought Merchant Banking was some esoteric, complicated British secret.”

“The bear markets will end, and it can end quickly.”

“This market will not get me down. It is just a minor challenge.”

“People who talk too much seem to have bad luck.”

On Investment Banking:

“You cannot fly with the eagles and poop like a canary.”

“It is up to all of us to fight our unrelenting enemies – complacency, over-confidence and conceit.”

“Thou will do well in commerce as long as thou does not believe thine own odour is perfume.”

“Every industry in this country is having financial problems. We paid our dues by surviving and even prospering during some tough years for Wall Street, but do not confuse luck for brains.”

“I find it amazing we never hear of a conference devoted to applying common sense to the securities industry”

On People and Markets:

“The market in stocks has taken a precipitous drip, but I am far from depressed. Why? Because we will see great opportunities in all areas, particularly personnel.”

“If somebody with an MBA applies for a job, we will not hold against them, but we are really looking for people with PSD degrees. (Poor, smart and a deep desire to get rich.)”

“Bear Stearns is not having a hiring freeze. Our experience has been the best time to hire productive people is when conditions are difficult.”

“The only thing that can stop us getting richer is stupidity.”

“Forget the chain of command. That is not the way Bear Stearns was built. If you think someone is doing something off the wall or his/her decision making stinks, go around this person, and that includes me.”

On CVs

“Remember one thing; today’s applicant could be next year’s client.”

On Work

(he recognised answering phones promptly and is critical to success)

“I conducted a study of 200 firms that disappeared from Wall Street and discovered 62.349% went bust because important people did not leave word on where they went when they left their desks…”

“A firm that has enthusiastic telephone operators starts off with a tremendous advantage over the dummies of the world.”

On trading

“If you have a problem position, discuss it with the head of desk. Absolution can be granted for losing money, but never for lying about it.”

On strategic planning:

“It is reported some prominent M&A bankers just left a firm because of a difference of opinion over strategic planning. That will never happen at Bear Stearns because we have no Strategic Planning.”

“The amount of dissension rises geometrically with the more issues you have to philosophize over.”

On Expenses

it wasn’t just spending on paperclips…

“Federal Express is not a wholly owned subsidiary of Bear Stearns… we are spending $50,000 a month with them.”

“It hurts to report I saw someone throw away a used internal envelope before it made 22 trips round the office. I can’t stand to see people burn money.”

“Electricity is not free! This will come as a surprise to 98% of the people who work at Bear Stearns. I found enough lights and machines left on to fund Bangladesh’s light bill for a year.”

“We are flexible. We should have anticipated the culture shock when a person joins us from a firm that has been losing billions. From this date forward… the personnel department will give new folks a paper bag with a box of paper clips and twenty rubber bands.”

“When the toner is low, take out the cartridge, shake it and give it another try. If we get 5% more use out our toner cartridges, it would save the company $15,000 a year.”

Bear Stearns has just bought its 10,000th Fax Machine. The Fax salesperson has just retired. He is burnt out – he is 33 years old. He has purchased Donald Trump’s yacht, and the overworked soul wants to take it easy…. There is a moral hidden somewhere…

It’s a brilliant read.. and I’m still smiling…