Mitsubishi has officially made it way out of the Chinese auto market and now other Japanese automakers are considering doing the same.

According to research by MarkLines cited by Nikkei this week, Japanese car manufacturers such as Toyota, Honda, and Nissan are lagging in the Chinese market this year. In the first three quarters of 2023, the trio's combined new vehicle sales were 1.29 million, a 26% year-on-year decrease. Both Toyota and Nissan experienced declines in the ballpark of 30%.

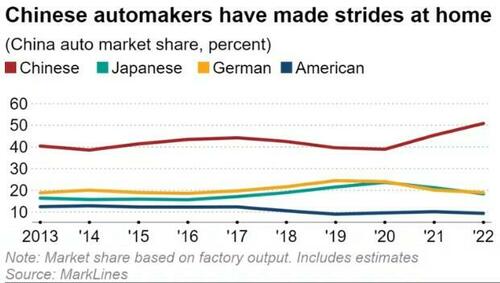

The rise in China's EV adoption and the dominance of local brands like BYD and Great Wall Motor are challenging Japanese automakers. Electric vehicle sales in China soared 80% to 5.36 million last year, capturing about 20% of the new car market.

Japanese companies, traditionally strong in gas-fueled cars, are falling behind in the fast-paced EV sector led by Chinese firms.

Facing challenges, Japanese automakers are reorganizing their Chinese operations. Mazda plans to cut its dealership network by about 10% from 2022 levels, while Toyota terminated contracts for roughly 1,000 workers at a joint venture.

Honda and Nissan have reduced local production, with Nissan's output reportedly at half its peak. Estimates suggest Toyota, Nissan, and Honda have a combined 40% excess capacity in China, based on current sales forecasts.

Nikkei writes that:

"Japanese automakers' market share in the Association of Southeast Asian Nations region this year came to 73% as of Oct. 19, down four percentage points from 2019, according to MarkLines and other data sources."

Mitsubishi, meanwhile, is expecting to take a 24.3 billion yen ($162 million) loss from pulling out of the country in the FY that ends next March.

Recall, we noted weeks ago that Mitsubishi was calling it quits in China. The company had been suffering from "sluggish sales", a September report said, noting that other Japanese automakers are also reassessing their viability in the Asian country.

GAC Mitsubishi Motors shuttered its manufacturing operations in Hunan province indefinitely in late September, marking the end of Mitsubishi's sole factory in China. GAC, which holds a 50% share in the joint venture, plans to repurpose the Hunan facility for electric vehicle (EV) production while aiming to retain some level of its workforce, the report says.

Mitsubishi Motors and Mitsubishi Corp., owning 30% and 20% stakes respectively, would pull their investments, although GAC Mitsubishi will continue to exist as a business entity, we wrote.

Nikkei noted that in 2022, Mitsubishi's car sales in China plummeted by 60% to 38,550 vehicles. An attempt to revive sales with the launch of the hybrid Outlander SUV last autumn failed to meet expectations. Mitsubishi now plans to reallocate resources to Southeast Asia and Oceania, areas responsible for about one-third of the company's consolidated sales.

Meanwhile, the electric vehicle market in China is booming, with a report from the China Association of Automobile Manufacturers indicating an 80% surge in EV sales in 2022 to 5.36 million units. Mitsubishi has lagged in this segment, relying on GAC for EV supplies in China.

Mitsubishi has officially made it way out of the Chinese auto market and now other Japanese automakers are considering doing the same.

According to research by MarkLines cited by Nikkei this week, Japanese car manufacturers such as Toyota, Honda, and Nissan are lagging in the Chinese market this year. In the first three quarters of 2023, the trio’s combined new vehicle sales were 1.29 million, a 26% year-on-year decrease. Both Toyota and Nissan experienced declines in the ballpark of 30%.

The rise in China’s EV adoption and the dominance of local brands like BYD and Great Wall Motor are challenging Japanese automakers. Electric vehicle sales in China soared 80% to 5.36 million last year, capturing about 20% of the new car market.

Japanese companies, traditionally strong in gas-fueled cars, are falling behind in the fast-paced EV sector led by Chinese firms.

Facing challenges, Japanese automakers are reorganizing their Chinese operations. Mazda plans to cut its dealership network by about 10% from 2022 levels, while Toyota terminated contracts for roughly 1,000 workers at a joint venture.

Honda and Nissan have reduced local production, with Nissan’s output reportedly at half its peak. Estimates suggest Toyota, Nissan, and Honda have a combined 40% excess capacity in China, based on current sales forecasts.

Nikkei writes that:

“Japanese automakers’ market share in the Association of Southeast Asian Nations region this year came to 73% as of Oct. 19, down four percentage points from 2019, according to MarkLines and other data sources.”

Mitsubishi, meanwhile, is expecting to take a 24.3 billion yen ($162 million) loss from pulling out of the country in the FY that ends next March.

Recall, we noted weeks ago that Mitsubishi was calling it quits in China. The company had been suffering from “sluggish sales”, a September report said, noting that other Japanese automakers are also reassessing their viability in the Asian country.

GAC Mitsubishi Motors shuttered its manufacturing operations in Hunan province indefinitely in late September, marking the end of Mitsubishi’s sole factory in China. GAC, which holds a 50% share in the joint venture, plans to repurpose the Hunan facility for electric vehicle (EV) production while aiming to retain some level of its workforce, the report says.

Mitsubishi Motors and Mitsubishi Corp., owning 30% and 20% stakes respectively, would pull their investments, although GAC Mitsubishi will continue to exist as a business entity, we wrote.

Nikkei noted that in 2022, Mitsubishi’s car sales in China plummeted by 60% to 38,550 vehicles. An attempt to revive sales with the launch of the hybrid Outlander SUV last autumn failed to meet expectations. Mitsubishi now plans to reallocate resources to Southeast Asia and Oceania, areas responsible for about one-third of the company’s consolidated sales.

Meanwhile, the electric vehicle market in China is booming, with a report from the China Association of Automobile Manufacturers indicating an 80% surge in EV sales in 2022 to 5.36 million units. Mitsubishi has lagged in this segment, relying on GAC for EV supplies in China.

Loading…