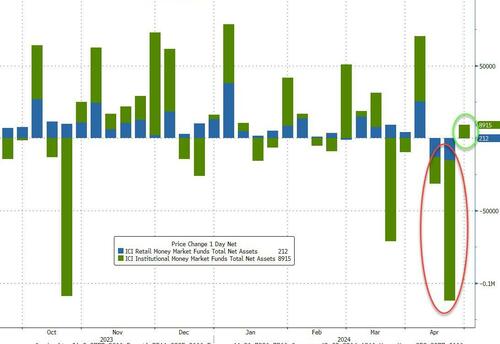

After the prior week's almost unprecedented outflows, total money market fund assets rose last week (admittedly by a modest $9.1BN), but remain below the $6TN level ($5.97TN) as tax-season draws roll off...

Source: Bloomberg

The flows into money-market fund assets through April 24 mainly on the back of inflows by institutional investors, which had led the tax-related decline the prior week. Institutions added $8.9 billion in money-market fund exposure.

Source: Bloomberg

In a breakdown for the week to April 24, government funds - which invest primarily in securities like Treasury bills, repurchase agreements and agency debt - saw assets rise to $4.84 trillion, a $3.97 billion increase.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, meanwhile, saw assets rise to $1.02 trillion, a $3.15 billion increase.

Still, cash is expected to continue piling into money funds as long as the Federal Reserve keeps rates on hold - and this week has seen rate-cut expectations tumble further...

Source: Bloomberg

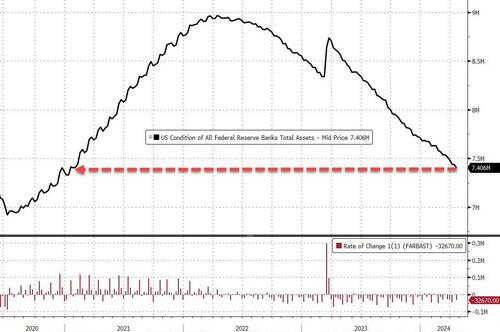

The Fed balance sheet continued to shrink, falling $32.8BN to its lowest since Jan 2021...

Source: Bloomberg

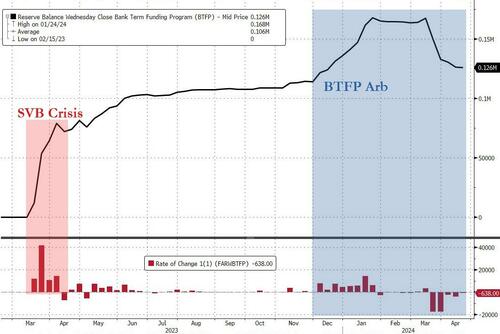

As The Fed starts discussing tapering QT, usage of The Fed's bank bailout facility (now expired but these are 12 month term loans) continued to decline (though only by a tiny $638MM), basically erasing all the late-period arb-driven inflows, leaving a huge $126BN hole in bank balance sheets still being filled by this...

Source: Bloomberg

This means the 'real' crisis money that banks used to save their souls is yet to really unwind from this bailout fund (and rates are considerably higher now than they were a year ago when the balance sheet holes were stuff with fake Fed paper - i.e. the losses are bigger).

Finally, we note that bank reserves at The Fed plunged last week and while US equity market cap has bounced a little in the last two days, we suspect the trend down (and a painful recoupling) remains a threat...

Source: Bloomberg

While there may be no rate-cuts anytime soon... will The Fed taper QT in a big enough manner to avoid that recoupling?

After the prior week’s almost unprecedented outflows, total money market fund assets rose last week (admittedly by a modest $9.1BN), but remain below the $6TN level ($5.97TN) as tax-season draws roll off…

Source: Bloomberg

The flows into money-market fund assets through April 24 mainly on the back of inflows by institutional investors, which had led the tax-related decline the prior week. Institutions added $8.9 billion in money-market fund exposure.

Source: Bloomberg

In a breakdown for the week to April 24, government funds – which invest primarily in securities like Treasury bills, repurchase agreements and agency debt – saw assets rise to $4.84 trillion, a $3.97 billion increase.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, meanwhile, saw assets rise to $1.02 trillion, a $3.15 billion increase.

Still, cash is expected to continue piling into money funds as long as the Federal Reserve keeps rates on hold – and this week has seen rate-cut expectations tumble further…

Source: Bloomberg

The Fed balance sheet continued to shrink, falling $32.8BN to its lowest since Jan 2021…

Source: Bloomberg

As The Fed starts discussing tapering QT, usage of The Fed’s bank bailout facility (now expired but these are 12 month term loans) continued to decline (though only by a tiny $638MM), basically erasing all the late-period arb-driven inflows, leaving a huge $126BN hole in bank balance sheets still being filled by this…

Source: Bloomberg

This means the ‘real’ crisis money that banks used to save their souls is yet to really unwind from this bailout fund (and rates are considerably higher now than they were a year ago when the balance sheet holes were stuff with fake Fed paper – i.e. the losses are bigger).

Finally, we note that bank reserves at The Fed plunged last week and while US equity market cap has bounced a little in the last two days, we suspect the trend down (and a painful recoupling) remains a threat…

Source: Bloomberg

While there may be no rate-cuts anytime soon… will The Fed taper QT in a big enough manner to avoid that recoupling?

Loading…