Authored by Simon White, Bloomberg macro strategist,

There are fertile conditions for volatile markets this week as a raft of labor data is released at the same time as liquidity sees a sizable drop versus last month’s buoyant conditions. With positioning in bonds now very long, yields are at risk of rising, triggering a selloff in stocks.

Focus returns to the US labor market this week as JOLTS, ADP, Challenger layoffs, ISM services employment and payrolls are released.

The jobs market is slowing but the question remains: will it deteriorate fast enough to prompt the Federal Reserve to act even sooner than rates markets are expecting?

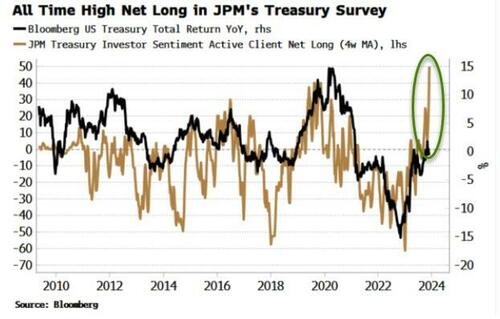

This comes at the same time as a non-negligible drop in liquidity and skewed positioning in bonds. The JPMorgan Treasury Survey of active clients is registering an all-time high in net longs.

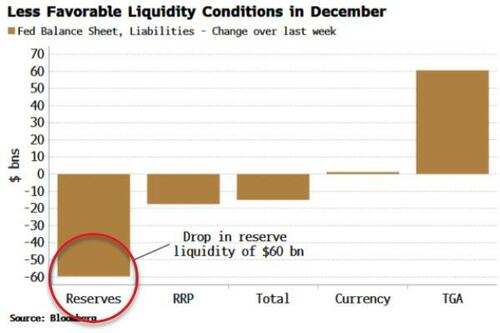

Liquidity was very supportive for assets last month, with Fed reserves rising almost $200 billion.

The combination of money market funds drawing down on the reverse repo facility and the Treasury drawing down on its account at the Fed (the TGA) led to a jump in reserves despite ongoing quantitative tightening.

Just one thing matters: in November, central banks added $350BN in liquidity, the third largest increase since March pic.twitter.com/xjThXLOQam

— zerohedge (@zerohedge) December 4, 2023

But this last week has not been so favorable. The TGA has risen by ~$60 billion, absorbing the same amount of reserves, with the RRP – only falling marginally – therefore not mitigating the TGA’s rise.

In the labor market, indicators with a longer lead (6-12 months) expect payrolls’ annual growth to continue to fall. However, shorter-term leading indicators, e.g. unemployment claims, have recently inflected lower, which would not be consistent with a jobs market that is about to worsen at an accelerating rate.

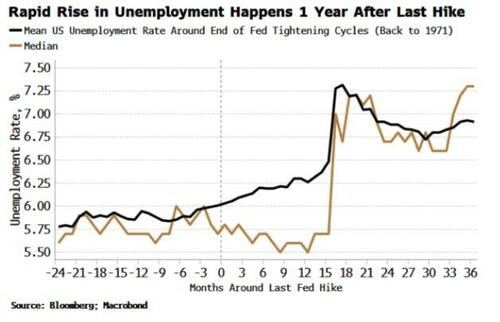

This agrees with what has happened in previous cycles. The median and mean unemployment rate around the end of Fed tightening cycles does not accelerate higher until about a year after the central bank’s last rate hike.

Nonetheless, monthly data is volatile (especially payrolls), and there is every chance of a negative surprise. With liquidity less supportive versus last month, that opens up the likelihood of more volatile markets.

Further, if long positioning in bonds is as extreme as the JPM survey indicates, even weak data could trigger profit taking and thus higher yields, prompting overbought stocks to sell off.

Authored by Simon White, Bloomberg macro strategist,

There are fertile conditions for volatile markets this week as a raft of labor data is released at the same time as liquidity sees a sizable drop versus last month’s buoyant conditions. With positioning in bonds now very long, yields are at risk of rising, triggering a selloff in stocks.

Focus returns to the US labor market this week as JOLTS, ADP, Challenger layoffs, ISM services employment and payrolls are released.

The jobs market is slowing but the question remains: will it deteriorate fast enough to prompt the Federal Reserve to act even sooner than rates markets are expecting?

This comes at the same time as a non-negligible drop in liquidity and skewed positioning in bonds. The JPMorgan Treasury Survey of active clients is registering an all-time high in net longs.

Liquidity was very supportive for assets last month, with Fed reserves rising almost $200 billion.

The combination of money market funds drawing down on the reverse repo facility and the Treasury drawing down on its account at the Fed (the TGA) led to a jump in reserves despite ongoing quantitative tightening.

Just one thing matters: in November, central banks added $350BN in liquidity, the third largest increase since March pic.twitter.com/xjThXLOQam

— zerohedge (@zerohedge) December 4, 2023

But this last week has not been so favorable. The TGA has risen by ~$60 billion, absorbing the same amount of reserves, with the RRP – only falling marginally – therefore not mitigating the TGA’s rise.

In the labor market, indicators with a longer lead (6-12 months) expect payrolls’ annual growth to continue to fall. However, shorter-term leading indicators, e.g. unemployment claims, have recently inflected lower, which would not be consistent with a jobs market that is about to worsen at an accelerating rate.

This agrees with what has happened in previous cycles. The median and mean unemployment rate around the end of Fed tightening cycles does not accelerate higher until about a year after the central bank’s last rate hike.

Nonetheless, monthly data is volatile (especially payrolls), and there is every chance of a negative surprise. With liquidity less supportive versus last month, that opens up the likelihood of more volatile markets.

Further, if long positioning in bonds is as extreme as the JPM survey indicates, even weak data could trigger profit taking and thus higher yields, prompting overbought stocks to sell off.

Loading…