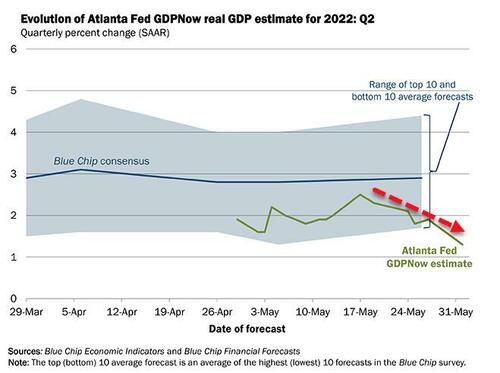

Amid a wall of relatively hawkish Fed Speak today (all pronouncing the economy's 'underlying strength'), this morning's Manufacturing survey data raised the threat level for stagflation and prompted The Atlanta Fed to slash its forecast for Q2 GDP growth from +1.9% to +1.3%... getting ever closer to recession (after Q1's contraction).

As The Atlanta Fed writes, the GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is 1.3 percent on June 1, down from 1.9 percent on May 27.

After this morning's Manufacturing ISM Report On Business from the Institute for Supply Management, and this morning’s construction spending report from the US Census Bureau, the nowcasts of second-quarter real personal consumption expenditures growth and real gross private domestic investment growth declined from 4.7 percent and -6.4 percent, respectively, to 4.4 percent and -8.2 percent, respectively.

Which fits with JHamie Dimon's 'downgrade' of the economy from "storm clouds" to "hurricane"...

"That hurricane is right out there down the road coming our way," he added.

"We just don't know if it's a minor one or Superstorm Sandy. You have to brace yourself."

This makes some sense given the recent collapse in macro data relative to expectations...

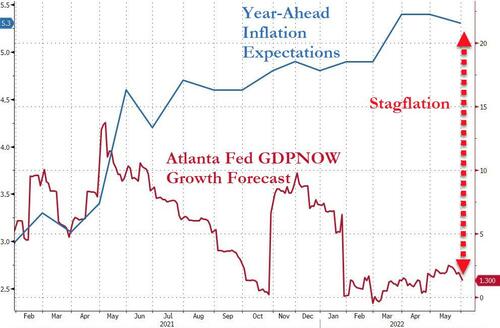

And longer-term, the trend towards stagflation could not be clearer...

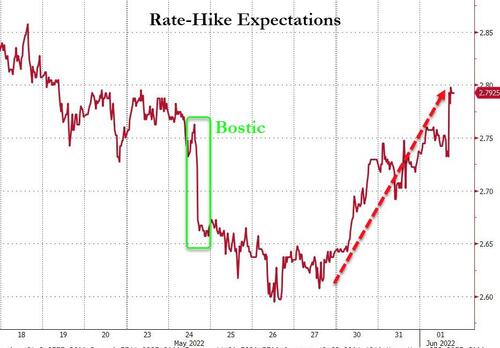

And thus increasingly problematic for The Fed, as the jawboning is driving rate-hike expectations higher once again...

Meaning The Fed is hiking rates into a recession.

Amid a wall of relatively hawkish Fed Speak today (all pronouncing the economy’s ‘underlying strength’), this morning’s Manufacturing survey data raised the threat level for stagflation and prompted The Atlanta Fed to slash its forecast for Q2 GDP growth from +1.9% to +1.3%… getting ever closer to recession (after Q1’s contraction).

As The Atlanta Fed writes, the GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is 1.3 percent on June 1, down from 1.9 percent on May 27.

After this morning’s Manufacturing ISM Report On Business from the Institute for Supply Management, and this morning’s construction spending report from the US Census Bureau, the nowcasts of second-quarter real personal consumption expenditures growth and real gross private domestic investment growth declined from 4.7 percent and -6.4 percent, respectively, to 4.4 percent and -8.2 percent, respectively.

Which fits with JHamie Dimon’s ‘downgrade’ of the economy from “storm clouds” to “hurricane”…

“That hurricane is right out there down the road coming our way,” he added.

“We just don’t know if it’s a minor one or Superstorm Sandy. You have to brace yourself.”

This makes some sense given the recent collapse in macro data relative to expectations…

And longer-term, the trend towards stagflation could not be clearer…

And thus increasingly problematic for The Fed, as the jawboning is driving rate-hike expectations higher once again…

Meaning The Fed is hiking rates into a recession.