Curious why stocks are soaring today ahead of an expected 75bps rate-hike by The Fed (further tightening financial conditions as QT starts shrinking the Fed's balance sheet)?

The answer comes courtesy of the Atlanta Fed which just confirmed the economy is in technical recession.

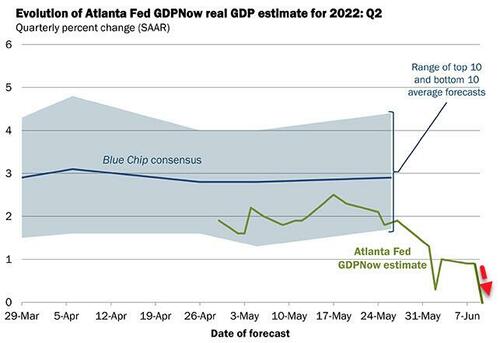

After a week of rampant jawboning to adjust the market's expectation for The Fed's actions later today (after last Friday's unexpected resurgence in CPI), the continued erosion in economic data (most notably retail sales this morning) has prompted The Atlanta Fed to slash its forecast for Q2 GDP growth from +0.9% to 0.0%, meaning the US is now right on the verge of a technical recession (after Q1's contraction).

Retail Sales control group 0.0%, Exp. 0.3%, down from 0.5%

— zerohedge (@zerohedge) June 15, 2022

This may be enough for negative Q2 GDP

According to the Atlanta Fed's GDPNow model estimate for real GDP, growth in the second quarter of 2022 has been cut to just 0.0%, down from +0.9% on June 6, down from 1.3% on June 1, and down from 1.9% on May 27.

As the AtlantaFed notes, "After recent releases from the US Bureau of Labor Statistics, the US Census Bureau, and the US Department of the Treasury's Bureau of the Fiscal Service, the nowcasts of second-quarter real personal consumption expenditures growth, second-quarter real gross private domestic investment growth, and second-quarter real government spending growth decreased from 3.7 percent to 2.6 percent, -8.5 percent to -9.2 percent, and 1.3 percent to 0.9 percent, respectively."

In short: the US consumer is getting tapped out, just as we have been warning repeatedly.

Which also fits with Jamie Dimon's recent "downgrade" of the economy from "storm clouds" to "hurricane"... and also makes some sense given the recent collapse in macro data relative to expectations...

And longer-term, the trend towards stagflation could not be clearer...

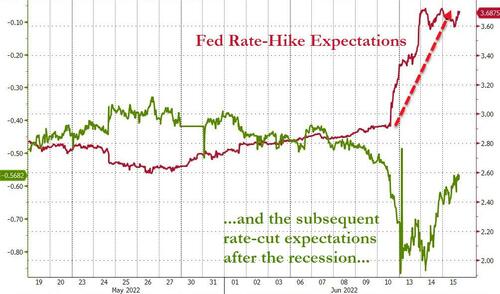

And thus increasingly problematic for The Fed, as the jawboning is driving rate-hike expectations higher once again

Meaning The Fed is now hiking rates into a recession... and the market is already pricing in 2-3 rate-cuts to address that recession.

Curious why stocks are soaring today ahead of an expected 75bps rate-hike by The Fed (further tightening financial conditions as QT starts shrinking the Fed’s balance sheet)?

The answer comes courtesy of the Atlanta Fed which just confirmed the economy is in technical recession.

After a week of rampant jawboning to adjust the market’s expectation for The Fed’s actions later today (after last Friday’s unexpected resurgence in CPI), the continued erosion in economic data (most notably retail sales this morning) has prompted The Atlanta Fed to slash its forecast for Q2 GDP growth from +0.9% to 0.0%, meaning the US is now right on the verge of a technical recession (after Q1’s contraction).

Retail Sales control group 0.0%, Exp. 0.3%, down from 0.5%

This may be enough for negative Q2 GDP

— zerohedge (@zerohedge) June 15, 2022

According to the Atlanta Fed’s GDPNow model estimate for real GDP, growth in the second quarter of 2022 has been cut to just 0.0%, down from +0.9% on June 6, down from 1.3% on June 1, and down from 1.9% on May 27.

As the AtlantaFed notes, “After recent releases from the US Bureau of Labor Statistics, the US Census Bureau, and the US Department of the Treasury’s Bureau of the Fiscal Service, the nowcasts of second-quarter real personal consumption expenditures growth, second-quarter real gross private domestic investment growth, and second-quarter real government spending growth decreased from 3.7 percent to 2.6 percent, -8.5 percent to -9.2 percent, and 1.3 percent to 0.9 percent, respectively.”

In short: the US consumer is getting tapped out, just as we have been warning repeatedly.

Which also fits with Jamie Dimon’s recent “downgrade” of the economy from “storm clouds” to “hurricane”… and also makes some sense given the recent collapse in macro data relative to expectations…

And longer-term, the trend towards stagflation could not be clearer…

And thus increasingly problematic for The Fed, as the jawboning is driving rate-hike expectations higher once again

Meaning The Fed is now hiking rates into a recession… and the market is already pricing in 2-3 rate-cuts to address that recession.